Small businesses and their employees would get new federal assistance to share payroll costs, to help the firms keep running and save jobs during the coronavirus pandemic, under legislation proposed Thursday.

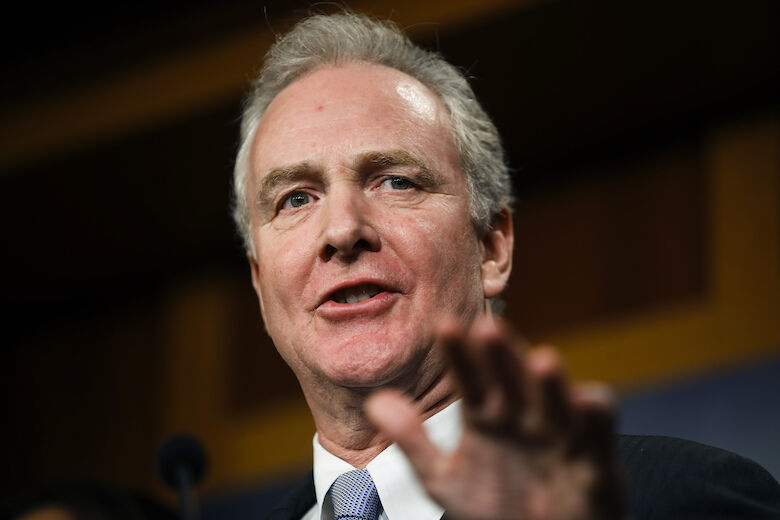

Sen. Chris Van Hollen, D-Md., is the lead sponsor of the legislation, which would build on small business programs already approved by Congress. Though hundreds of billions of dollars have gone out under the Small Business Administration’s Paycheck Protection Program, Van Hollen said that program and its requirements don’t work for many small businesses.

The “Rebuilding Main Street Act” would allow employers to share payroll costs with the federal government. The proposal encourages work sharing, a program that was supported in the original CARES Act, but which Van Hollen said has been “chronically underutilized.”

Van Hollen said the legislation could help businesses “weather the storm” as Maryland and other states gradually reopen their economies.

- Sign up for news alerts from WTOP

- ‘Our numbers are not there’: Northern Va. leaders praise delay of Phase I

- ‘We need to be careful’: Montgomery Co. keeping coronavirus restrictions in place

- Prince George’s County stay-at-home order extended through June 1

- Coronavirus: Calvert Co. extends local state of emergency 30 days

- 36 million have sought US unemployment aid since virus hit

- Hogan: Maryland to relax stay-home order starting May 15

- Coronavirus test results in DC, Maryland and Virginia

- Coronavirus FAQ: What you need to know

“Work sharing enables employers to avoid layoffs by instead reducing the hours of their employees’ work,” Van Hollen said, noting that employees would receive prorated unemployment insurance benefits.

Van Hollen said employees would still be able to receive the extra $600 Congress approved for unemployment benefits in the coming months. But the idea is to make sure those employees can come back to their employers and resume earning more money once they begin working their regular hours again.

Businesses could also receive a grant for fixed costs, such as mortgages, during the economic crisis.

“This a good fit, we believe, for small businesses and other employers who have fixed costs and are going to have phased reopenings,” Van Hollen.

The legislation includes incentives for businesses to take advantage of the program, he said.

During a conference call, Amanda Ballantyne, executive director of the Main Street Alliance, said this approach would help businesses as they try to adjust to the new economic reality.

She noted, for example, that restaurants have had to alter their operations with takeout delivery and other services.

“Many businesses right now are attempting to pivot,” Ballantyne said. “They’ve done layoffs; they’re just trying to keep the doors open.”

Ballantyne said the legislation would help provide small businesses with the capital they need to change their operations during what will likely be a very gradual reopening that stretches their resources.

Sens. Jeff Merkley, D-Ore., and Chris Murphy, D-Conn., are co-sponsoring the bill with Van Hollen.

Several proposals are being floated to help small businesses ahead of consideration of new legislation by Congress.

The House plans to return Friday to vote on a massive relief package totaling more than $3 trillion. It would extend the additional $600 unemployment benefit, now scheduled to end in July, to January 2021.

Though the House is expected to approve the proposal, Republicans have made it clear that the legislation will not go anywhere in the GOP-controlled Senate.

The next major piece of legislation to deal with the pandemic is expected to take much longer to develop before it is taken up by the full Congress.