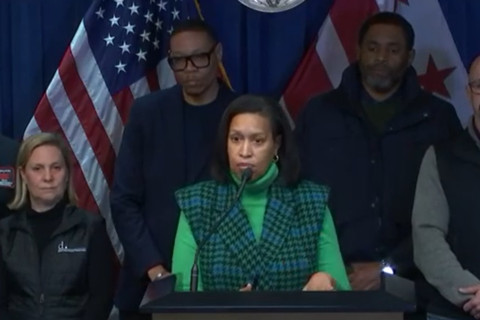

D.C. Mayor Muriel Bowser showed up in Ward 7 on Monday to talk about one of only two certainties in life — and thankfully, this time it wasn’t death.

With this week being the start of tax season, her message to incentivize people to file their taxes was a simple one: Not filing taxes can cost you.

“I am not a tax expert, but I do know too many D.C. residents who believe they don’t need to file a tax return, then leave money that they’re owed on the table because they’re not then applying for the Earned Income Tax Credit,” Bowser said.

“This is money back for people who work and for people who have low or moderate income. Generally individuals and families making less than $60,000 and you don’t have to have kids.”

Bowser said it’s as simple as being in the eligible income range and applying. There is both a federal and a city EITC, which, when combined, can put as much as around $10,000 back in people’s pockets.

Last year, some 55,000 city residents claimed the federal EITC, and 1,357 people were able to claim both. Combined, they got back about $3.4 million.

That’s not the only underutilized tax credit and rebate Bowser was promoting. The mayor also took the time to remind residents that senior citizens at certain income thresholds are eligible for 50% off their property taxes. It’s for residents who are 65 and older and certain income brackets.

“I think everybody knows, although every time I mention this, there’s somebody who qualifies who’s not getting it,” said Bowser. “But again, you must apply.”

City residents who have children enrolled in D.C. child care centers are also eligible for a $1,000 child care tax credit per child.

The mayor also warned about working with companies that offer to pay your refund right away in exchange for “an onerous fee,” and said the city will be teaming up with AARP to help seniors file their taxes free of charge in select D.C. libraries.

In the 2022 filing year, 3,669 people were eligible and received the free tax prep services offered by a trio of nonprofits, saving them $1.1 million in tax preparation fees. A city spokesman said that on average, filers can expect to pay more than $300 to a tax preparer for an itemized tax return.