After hours of debate and numerous amendments, the Prince George’s County Council has put together its plan for what it calls “rent stabilization.”

The deal reached this week meets many of the demands raised by progressive advocates, leading the apartment industry to warn it will backfire in the long run. But the 10-0 preliminary vote this week, a culmination of lots of discussion and compromise among the council, made clear that this will be what passes into law when the final vote on the matter comes next month.

The sudden resignation of At-large Council member Mel Franklin — who would have been the sixth vote on the original plan circulated among the council — meant nothing would pass without more progressive buy-in. That included meeting demands for lower caps for age-restricted/senior housing.

“I just want to thank my colleagues,” said Council member Krystal Oriadha, who pushed for many of the changes adopted by the council. “This has been two years and change in the making. I know it’s been a rough ride, lots of varying opinions. But I’m proud that we’re passing permanent stabilization.”

The new law will apply to multifamily housing built before the turn of the century. It caps the rent hikes on those units at 3% plus the Consumer Price Index (inflation rate), with a maximum of 6% allowed. Landlords can also bank some of that — meaning if they only increase rent by 4% one year, for instance, then they can take that 2% and apply it the following year instead. Apartment buildings limited to seniors will have even lower caps than that.

Other amendments prevent landlords from introducing new fees in the middle of the lease. And if a tenant moves out of an apartment, there will be limits to how much more they can charge the next tenant who moves in.

Any type of housing finished after Jan. 1, 2000, will be exempt from the new restrictions, and progressives had to compromise on efforts aimed at rolling that date up a year on an annual basis. Landlords who own single family homes are also exempted.

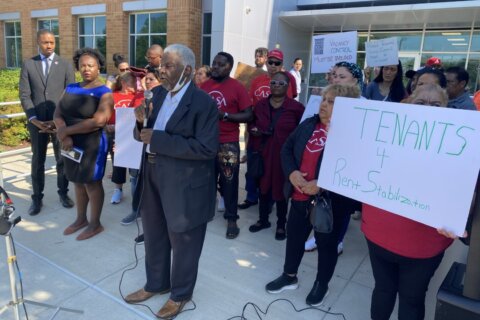

“We’re living in a day and time where we need to make certain changes,” said Bishop Clyde Hargraves, who spoke in favor of more progressive measures backed by Oriadha. “To make certain changes, we have to be honest about our approach for the future — for not only ourselves but for our children, and our children’s children.”

But in recent weeks, the apartment industry has been warning that the proposals of today will backfire on the region’s need for housing tomorrow. Earlier this month, the Apartment and Office Building Association released a study saying numerous apartment buildings in the region are nearing foreclosure after millions of dollars in back rent built up during the pandemic never got paid. And the group has long argued that private investment in new construction is looking elsewhere amid concerns that profits will be too elusive.

“I build new housing and it’s making it completely difficult to finance new projects right now,” said Josh Wooldridge with the NRP Group, one of the country’s largest builders of apartments, during an interview with WTOP before the council took up the issue last week.

“We go all over the world to try to attract investors here to the D.C. area, and even more specifically, to Prince George’s County. When we pass bills like this, folks have a lot of options. They can look at Charlotte and Raleigh, Nashville, Florida and Texas, and we’re just not competitive with those types of places and so investors are kind of voting with their feet and they’re choosing to go to those other markets.”

Wooldridge also said the only big projects that have gotten off the ground in Prince George’s County are being built with some form of public subsidy. And he warned that millions of dollars in recordation tax revenue is also being lost, at least in part because sales and transactions of apartment complexes have slipped.

“I think that we could have protected a lot of vulnerable renters with $50 million had we left the capital markets alone,” Wooldridge said.

Get breaking news and daily headlines delivered to your email inbox by signing up here.

© 2024 WTOP. All Rights Reserved. This website is not intended for users located within the European Economic Area.