This video is no longer available.

This article is part of WTOP’s monthlong series, “Money Matters,” where we explore tips for saving, budgeting and making your money work for you. Check for new articles all month, right here on WTOP.com.

On a rainy day at Hayfield Secondary School in Virginia, a group of students took turns standing up and sitting down.

Some would stand if they preferred Skittles over Jolly Ranchers or sit if they liked Reese’s Peanut Butter Cups over Snickers. But what did these all have to do with each other, teacher Sharon Paul asked.

The answer was that some of the sweets were owned by The Hershey Company while the others were owned by Mars, Inc. A majority of the students said they’d rather invest in Hershey, as it’s more of a household name, over the Virginia-based Mars.

But, Paul explained, investing in Mars isn’t possible because it’s a privately owned company. The realization elicited a groan of understanding from the students.

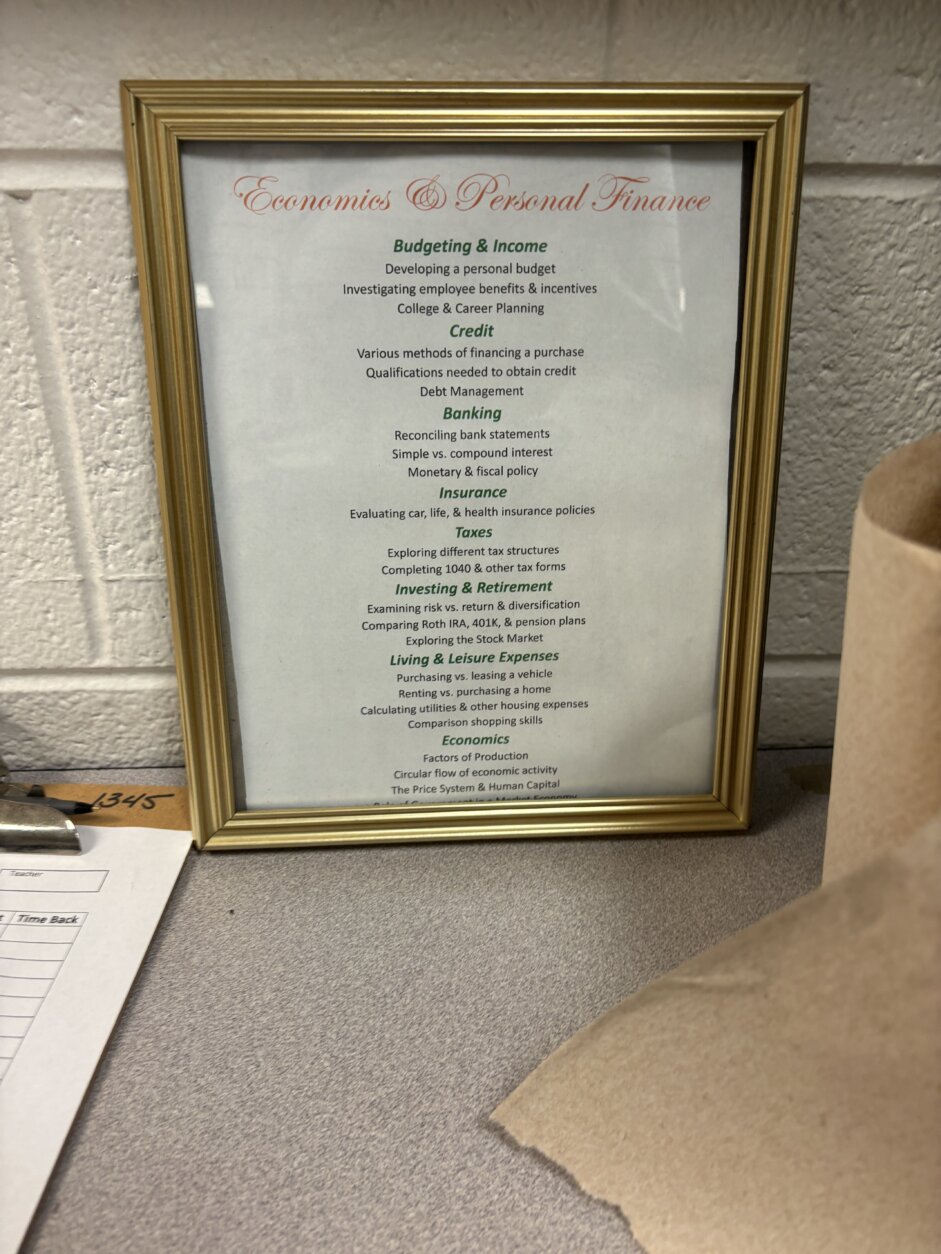

The students in Paul’s economics and personal finance honors class learn about everything from banking and budgeting to investing toward retirement and how to plan for college and a future career, before capping it off with a final project that ties the topics all together.

Since 2011, Virginia high school students are required to take an economics and personal finance course in order to graduate. The Commonwealth’s General Assembly passed the legislation with the goal of introducing the next generation of consumers, employees and responsible citizens to the market economy.

It’s seems that Virginia’s decision is paying off.

According to Champlain College’s national report card on states’ efforts to improve financial literacy, Virginia reported a Grade A rating from 2017 to 2023. Fairfax County and the broader Northern Virginia region have a high concentration of diverse and well-established financial literacy initiatives, catering to various age groups and needs.

In the 12 years she’s been teaching the course at Hayfield, Paul said she likes to assign projects with a story behind them to motivate her students.

“They have a real-life project where the first thing they do … is a vision board for their future self,” Paul said. “Then, they take a look at a budget.”

Paul said her favorite topics to teach are college preparedness and compounding interest, emphasizing how important it is to start investing and saving early on in life.

“You need time in order for long-term investing to actually be the most beneficial,” she said.

A recent trip to visit three local universities helped tie together all the concepts her students have been learning about — from college to a career, to making an income, to personal financing for retirement and other major life decisions.

Students who are required to take personal finance courses are more likely to plan ahead for college with a knowledge of the financial resources available to them, according to a study by the National Endowment for Financial Education.

Tonish Jones, a junior at Hayfield, said the class has particularly helped him prepare to apply for college with scholarships and loans in mind.

“My favorite thing is probably the assignments,” he said. “The assignments are mostly hands-on … where they’re simulations as if you’re doing it at that time, like tax forms.”

‘I wish I had this when I was in high school’

Paul said she’s an advocate for more states to follow Virginia’s goal of teaching young people to be financially literate.

A spokesperson with the District’s school system confirmed to WTOP it has offered courses through its Career and Technical Education program “for many years.” However, it is not a graduation requirement for high school students.

Maryland requires students to take some financial literacy instruction. In Prince George’s County, for example, students must complete at least half a credit of financial literacy instruction to graduate high school.

Maryland and the District earned a B and an F, respectively, on the 2024 Nation’s Report Card of Financial Literacy, which rates states based on finance courses that teach students how to make money, invest, save for retirement and give charitable donations.

“Every single year at back-to-school night, parents are saying, ‘I wish I had this when I was in high school. I’m so glad my child is having it.’ So therefore, I know that this was needed, and I’m glad that Virginia is one of those states that has made it a requirement,” she said.

Paul recalled a former student returning to her classroom to tell her how much the course meant to her after she graduated.

“She said that she feels this class helped her because she first realized what she wants to do and what she doesn’t want to do,” Paul said. “And one of the things she realized is that she does not want student loan debt.”

The student went on to Northern Virginia Community College and told Paul “how grateful she was because she feels better financially that she’s not going to that four-year right away because there wasn’t the money to do so.”

Paul said she recommends parents have the often uncomfortable conversations about money, including credit scores and reports, retirement accounts, college funds and pensions.

“Sometimes, I … have them text a parent to start the conversation and also have materials for certain topics that say these are some talking points that, as a family, you can have to further … a deeper understanding of the course,” she said. “Because they’re not going to get a deep understanding by, I would say, just doing the regular textbook work.”

Vanessa Bruce Smith, a 10th grade student, said her favorite thing about the class is Paul.

“She’s so engaging. At first, I used to think she might be a little too hyper in the morning, but you come into the class, and you’re sat; she just comes in and brings all the energy. All of a sudden, you have that energy back. She really brings that enthusiasm to the class,” she said.

“I’m just grateful for the opportunity to teach this course, and the opportunity that every single day I’m bringing a life skill to the kids,” Paul added. “I really love this course; I just can’t tell you how much I love it.”

It starts with money

On top of the personal finance curriculum offered in Virginia’s public high schools, other local organizations have been designed to help students of all ages learn about financial literacy.

At the Junior Achievement Finance Park Fairfax, you might find a 12-year-old with a mortgage and car payments, or an eighth grader with two children in day care and student loans they need to pay off.

They’re actually regular middle school students playing out real-life scenarios that teach them how to budget and save for certain life experiences.

Numerous Fairfax County schools partner with Junior Achievement of Greater Washington, a local nonprofit that prides itself on delivering a practical experience to financial literacy that will build a thriving community of prepared adults.

Students who visit these hands-on, experiential learning programs will be given an education level, career, family size and bills to simulate how to best invest, save and budget for everyday life necessities and experiences.

The goal is to give students the opportunity to learn what it really takes to navigate a complex economy and prepare for future success.

“As an educator, I think financial literacy, in an experiential way, provides another level of understanding and significance, and it brings it to life from a textbook,” said Junior Achievement of Greater Washington President and CEO Monica Goldson. “We could have taught all the skills … in isolation, but when we do it in the context of a real-world scenario, it causes them to internalize it, understand it more and remember it.”

Partner schools that implement Junior Achievement programs can take their students to the “Finance Park” locations as field trips or a free extracurricular activity.

“It allows them to understand all the pieces of financial experience that their parents are currently going through,” Goldson said.

The Finance Park programs are offered in three school districts around the D.C. region — Fairfax County in Virginia and Prince George’s and Montgomery counties in Maryland. The organization hopes to work with D.C. Public Schools soon.

‘Why am I learning this?’

Goldson said making financial literacy a required course in a school’s curriculum shows students that learning about finances is “a priority.”

“When you integrate it into either your curriculum or you make it a required course, you’re already sending a message to your community that you value this,” Goldson said.

After aging out of the Finance Park program, students have the opportunity to continue their financial literacy education at Junior Achievement’s three-dimensional education high schools, or “3DE” schools. In the D.C. area, those educational tracks are only available at Ballou High School in the District and Potomac High School in Prince George’s County.

Alongside normal curriculum, 3DE high school students are presented with a “case challenge” from a large corporate organization every year and research the real-world problems they might be facing.

“All of that helps with the age-old question of: ‘Why am I learning this?’ That presentation, that case challenge, is woven into the content that they have to learn each and every day,” Goldson said.

Before taking on the position of CEO of Junior Achievement in December, Goldson was the chief executive officer for Prince George’s County Public Schools and the vice president of the Maryland State Board of Education.

“Having led a school district that had financial literacy as a graduation requirement, we had a lot more students who were engaged in what scholarships look like,” she added.

After graduating from a 3DE school, students can be connected to higher education scholarships and JA’s business partners for internship opportunities.

The national Junior Achievement USA organization serves thousands of classrooms in all 50 states. This year, Junior Achievement of Greater Washington hopes to serve over 44,000 local students with its programs.

Get breaking news and daily headlines delivered to your email inbox by signing up here.

© 2025 WTOP. All Rights Reserved. This website is not intended for users located within the European Economic Area.