This story has been updated.

In a reversal by the Department of the Treasury, Secretary Steven Mnuchin said Wednesday that those who receive Social Security benefits and are not typically required to file tax returns will not need to file an abbreviated tax return to receive their coronavirus stimulus check.

The payments will be automatically deposited into their bank accounts.

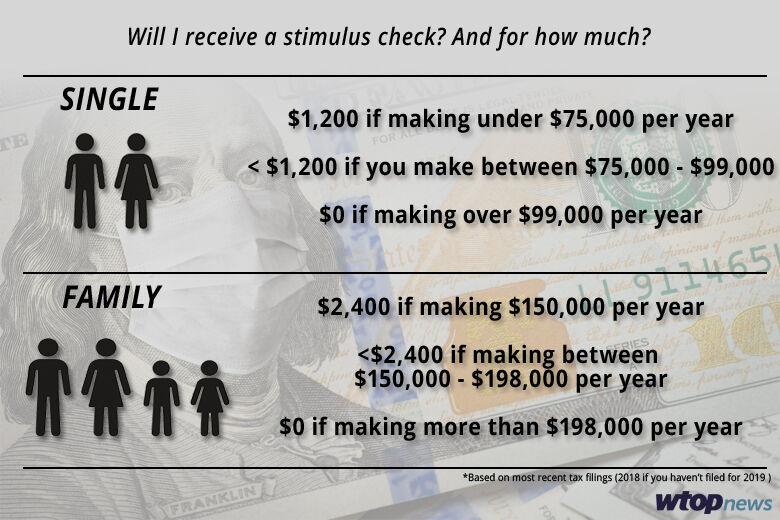

For the rest who qualify for the relief check, how much you get is based on your adjusted gross income in your 2019 tax filings — or 2018 filings if you haven’t filed yet.

So how do you know how much you may be getting?

Individuals who make $75,000 a year or less, and heads of households who make $112,500 or less, all qualify for the full amount of $1,200.

Married couples who file their taxes jointly who make $150,000 or less qualify for all of the $2,400.

But what if your income is higher than those amounts?

Once you hit those limits, your check would be reduced by 5% of the total amount you earn above those limits. (The stimulus checks phase out entirely for single filers with incomes of $99,000 or higher and $198,000 or higher for married couples filing jointly).

If you really want to do the math, here’s an equation for figuring out how much you might be getting: Take the total amount you earn over $75,000 (or $150,000 for married couples filing jointly) and multiply it by 0.05. Then subtract that amount from 1,200.

Here’s a quick rundown on what stimulus checks will look like with a variety of incomes.

For single earners:

- If you make $75,000 a year or less, your check will be $1,200

- If you make $80,000 a year, your check will be about $950

- If you make $85,000 a year, your check will be about $700

- If you make $90,000 a year, your check will be about $450

- If you make $95,000 a year, your check will be about $200

For the heads of households

- If you make $112,500 a year or less, your check will be $1,200

- If you make $117,500 a year your check will be $950

- If you make $122,500 a year your check will be $700

- If you make $127,500 a year your check will be $450

- If you make $132,500 a year your check will be $200

For married couples who file taxes jointly:

- If your household makes $150,000 a year or less, your check will be $2,400

- If your household makes $160,000 a year, your check will be about $1,900

- If your household makes $170,000 a year, your check will be about $1,400

- If your household makes $180,000 a year, your check will be about $900

- If your household makes $190,000 a year, your check will be about $400

The bill also provides an extra $500 for every child under 17 claimed by each filer, regardless of how much they are making. If you have children, use the previous equation and then add $500 for each child you claim on your taxes to get the amount you will receive in your stimulus check.

President Donald Trump signed an unprecedented $2.2 trillion economic rescue package into law last week after swift and near-unanimous action by Congress to support businesses, rush resources to overburdened health care providers and help struggling families during the deepening coronavirus epidemic.

- Sign up for news alerts from WTOP

- Closings and delays

- As coronavirus spreads, organizations across the region seek volunteers

- Traffic and transit changes in DC, Md. and Va. during coronavirus response

- Coronavirus test results in DC, Maryland and Virginia

- Coronavirus FAQ: What you need to know

WTOP’s Abigail Constantino and The Associated Press contributed to this report.