WASHINGTON — To avoid even worse traffic in coming years, Virginia needs to raise taxes to pay for basic transit maintenance beyond major needs for Metro, a final report submitted to the General Assembly on Monday concludes.

The Transit Capital Revenue Advisory Board report includes some tweaks from a draft this June, including explicit acknowledgment that a projected average state funding gap of $130 million per year between 2020 and 2027, around $1 billion, likely underestimates full statewide transit capital funding needs to keep up with population growth.

A number of experts said Virginia’s true need for basic bus or rail car overhauls and replacement and other capital projects is closer to $2 billion, or around $200 million per year.

A big additional cost is Metro.

While the initial review factored in Metro’s previous maintenance schedule, an update from the agency to address its dire needs increased spending plans by about $1 billion over five years.

As part of Metro General Manager Paul Wiedefeld’s plans, the agency would need new dedicated funding.

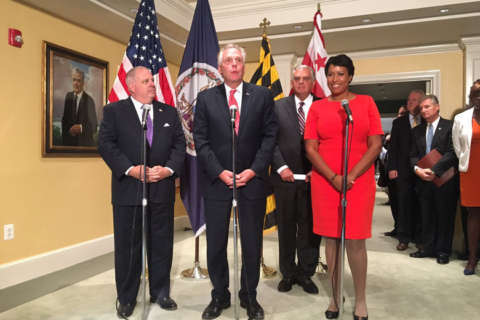

However, at a regional summit Monday, Virginia Gov. Terry McAuliffe, Maryland Gov. Larry Hogan and D.C. Mayor Muriel Bowser did not agree on details of how any such funding would be set up.

Metro, Alexandria’s DASH Bus, Virginia Railway Express, Fairfax Connector, Arlington’s ART Bus and the Potomac and Rappahannock Transportation Commission (PRTC) are the agencies with the largest capital needs in Northern Virginia.

Without additional funding, PRTC in the Prince William County and Manassas areas could face double the expected costs for bus replacements and mid-life overhauls.

“If these vehicles are not replaced resulting in a reduction in service, an additional 5,000 person trips per day will be added to the congested I-95 and I-66 corridors,” the report said.

New taxes

The advisory board recommends the General Assembly adopt one of four packages of tax increases to cover a $130 million annual funding gap.

- Option 1:

Raise statewide deed and mortgage recordation tax from $0.25/$100 to $0.30/$100 with the increase dedicated to transit capital; dedicate a portion of priority transportation fund revenue to transit capital; increase the real estate transfer tax from $0.05/$100 to $0.10/$100 with increase dedicated to transit capital.

Option 1 would provide an estimated $127 million/year now through fiscal 2027.

- Option 2a:

Raise the statewide sales tax rate for non-food purchases from an effective 5.3 percent to 5.4 percent with the increase dedicated to transit capital funding.

Option 2a would provide an estimated $157 million/year through fiscal 2027.

- Option 2b:

Raise the statewide gas sales tax by 0.9 percent.

Option 2b would provide an estimated $154 million/year through fiscal 2027.

- Option 3:

Raise the statewide deed and mortgage recordation tax and the real estate transfer tax each by $0.02/$100 and dedicate a portion of priority transportation fund revenue to transit capital (combined $67 million/year in state money); Add additional regional taxes in Northern Virginia ($50 million) and Hampton Roads ($25 million.)

Option 3 would provide an estimated $138 million/year through fiscal 2027.

In Northern Virginia, options include putting a floor on the gas sales tax as many regional elected leaders have asked for for several years and increasing the regional gas sales tax by from 2.1 percent to 3.3 percent or raising the general regional sales tax from 0.7 percent to 0.85 percent.

- Option 4:

Raise statewide deed and mortgage recordation tax by $0.03/$100 and the real estate transfer tax by $0.04/$100; dedicate a portion of priority transportation fund revenue to transit capital; Add additional regional taxes in Northern Virginia ($25 million) and Hampton Roads ($17 million.)

The advisory board established by law was made up of seven representatives of state government, local governments and state transit agency leaders. They recommend the majority of new funding to replace expiring sources come from statewide rather than regional sources.

“Without question, a long-term and sustainable investment in transit capital is critical for Virginia’s economic vitality,” the report concludes.

More traffic

Consultants hired as part of the advisory board’s research since 2016 concluded reduced funding would push significant costs onto local governments which could lead to significant service cuts, hurting Virginia’s economy, reducing access to jobs and significantly adding traffic.

“Perhaps even more significant than these economic impacts are the resulting costs to the transportation system, such as travel times for commuters and on the quality of life for those using Virginia roads and transit,” the research concluded.

The most significant traffic increases would be in Northern Virginia, where drivers would also spend more on gas and wear and tear on their vehicles and the number of crashes would likely rise.

In 2020, longer commutes from transit cuts could take up $78.7 million worth of Virginian’s time alone, with a net economic and productivity impact of $410 million statewide.

“The Revenue Advisory Board strongly feels that the future success of transit agencies throughout the Commonwealth is dependent upon action by the General Assembly to resolve the loss of the Capital Project Revenue bond revenues,” the report finds. “Millions of individuals yearly rely upon public transportation as the preferred or sole mode of transportation. Without strong and reliable transit agencies, the Commonwealth’s citizens, tourism industry, and economy will suffer tremendously,” the report finds.