D.C. wants to make 20,000 additional Black Washingtonians homeowners by 2030.

The announcement Monday included the release of the Black Homeownership Strike Force’s final report of recommendations for the use of a $10 million Black Homeownership Fund in the city’s Fiscal Year 2023 budget.

The Strike Force made 10 recommendations covering issues such as increasing the supply of homes affordable at various price points, streamlining zoning and permitting for homeownership projects and helping families transfer homes to future generations.

There’s a gap of about 15% between the number of Black (34%) and white (49%) homeowners in the city.

Mayor Muriel Bowser said she likes all of the recommendations: “They are all practical, needed things.”

The number one recommendation is to help existing homeowners leave property to their heirs.

“How does a family make a plan to transfer their property upon the owner’s death? Do they need legal services, for example, to help with that? Is there assistance needed to help with that?,” Bowser said. “Our budgeting process for next year is starting now. So all of these recommendations will start in our budget discussion.”

The recommendations also focus on preservation with assistance programs to help homeowners to maintain their homes.

“How are we helping existing home owners keep up with their maintenance and repair costs, so that they can stay in their homes and have a valuable property to pass on to their heirs?,” Bowser said.

You can see the entire report and the Strike Force’s 10 recommendations on the city’s website.

At the event, John Falcicchio, D.C.’s deputy mayor for planning and economic development, said people need to know that there is assistance available.

“If you are a current homeowner and you need some assistance, or you’re a prospective homeowner, go to frontdoor.dc.gov,” he said.

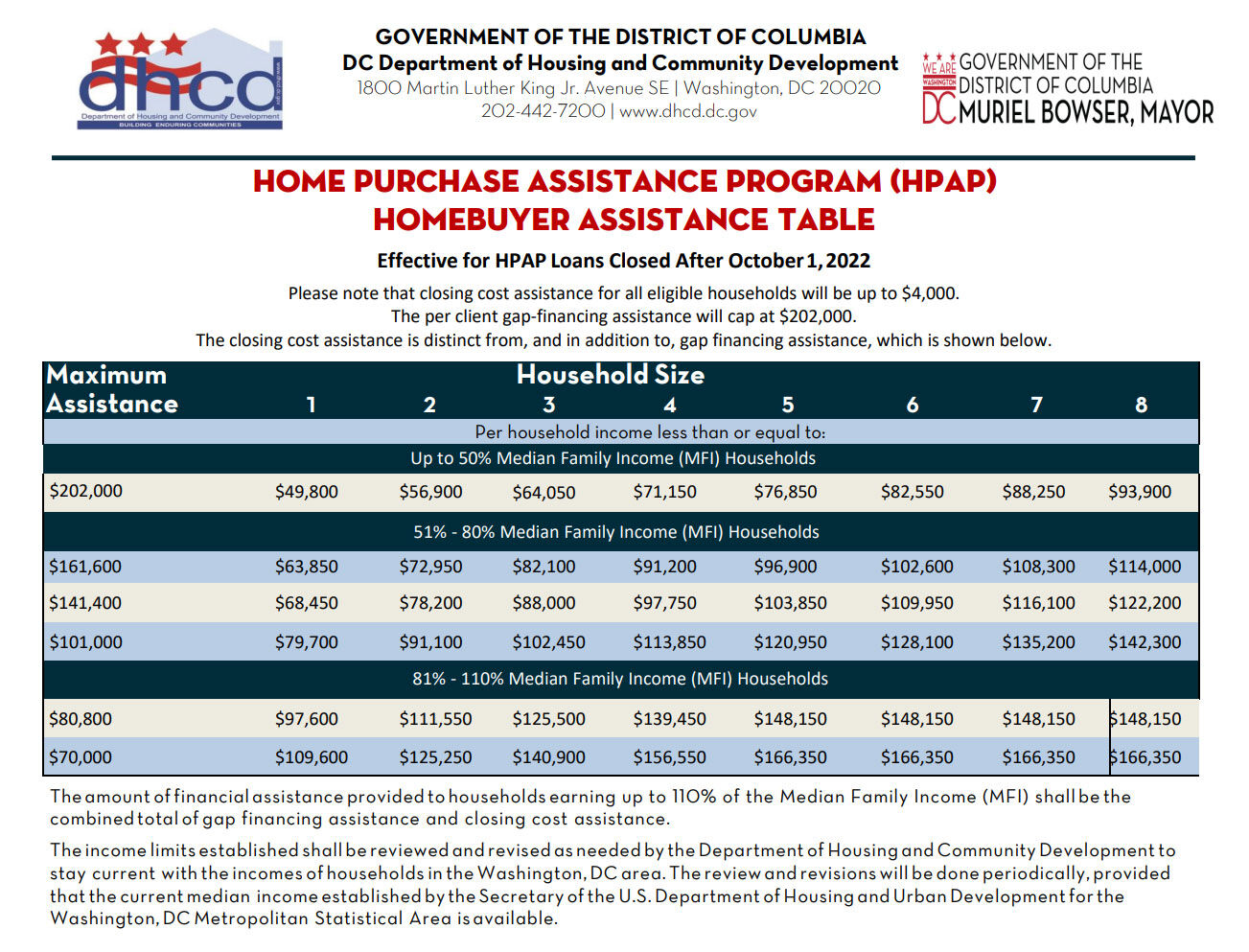

People can get loans of up to $202,000 in financing assistance and up to an additional $4,000 in closing cost assistance in the form of loans. Loan deferment periods are determined by income and household size.

Programs also include the employee assistance program for D.C. government employees and the city’s housing choice voucher.

Citing an example of how the city is working to create opportunities for home ownership, Falcicchio said 27 of the 88 of the new townhomes currently under construction on the campus of St. Elizabeth’s are income restricted to be more easily affordable.

One town home priced at 50% of the area median income will have a reduced price of $250,000. With D.C.’s Home Purchase Assistance Program and Employee Assistance Program assistance, that household gets $129,000 of assistance. Their mortgage amount then is $147,000. Their mortgage payment is estimated to be about $750 a month.

“This is to own a brand new townhome on the campus of St. Elizabeth’s that is going to look no different from the townhomes next door that are market rate that sell upwards of $600,000,” he said.

“If you think that you couldn’t buy a house before, today’s the day that you go to frontdoor.dc.gov,” Falcicchio said.

Click to expand: