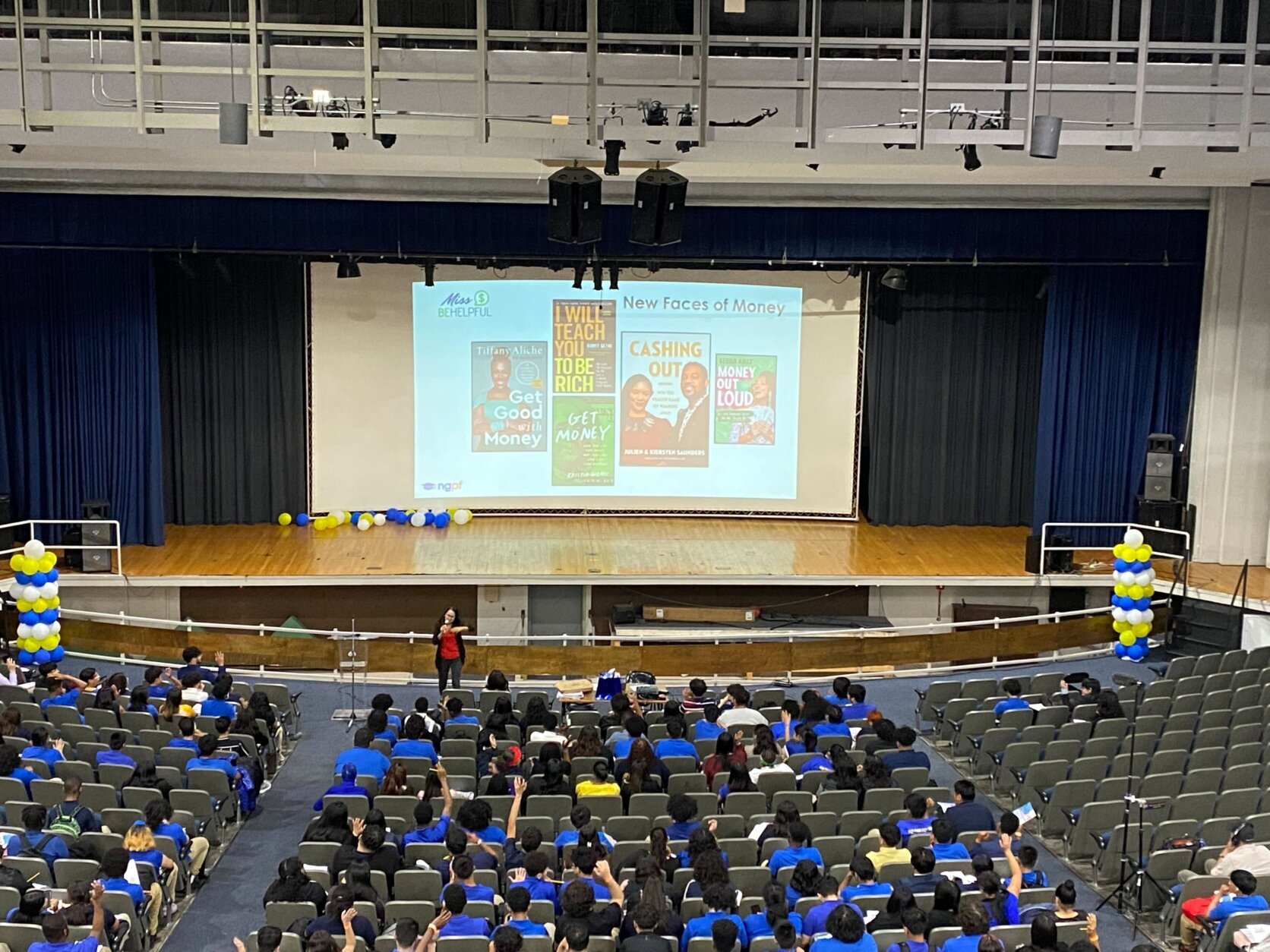

Students who have taken part in a financial literacy program at High Point High School in Beltsville, Maryland, closed out Financial Literacy Month in April with a talk from Yanely Espinal about the money management lessons she learned the hard way in life.

They’re lessons that numerous Americans can relate to: a new credit card led to poor decisions and lots of credit card debt; and before she knew it, Espinal was tens of thousands of dollars in debt.

“I didn’t make a financial choice; I made an emotional choice,” Espinal said.

The students who listened, and later asked questions, are all working to avoid that through the financial literacy class they’ve been taking this year. By this time next year, it’ll be a requirement to graduate from Prince George’s County Public Schools.

“I realized that I’ve been doing a lot of mistakes with how I was spending my money,” said Lyssa Jean, a senior at High Point. “I wasn’t really focused on what I should get and what I really needed to get. I was only considering what I wanted at the moment.”

Sophomores Jonathan Moreno and Hailey Pavon had similar things to say about how they handled money now, compared to before they took the class.

For Pavon, any cash she got for birthdays or other reasons would quickly disappear.

“And then the next week I’d actually need it … and I was like ‘dang’ … because I don’t have money and I don’t want to ask my parents because I’m too ashamed because they just gave me this money yesterday,” Pavon said. “Now that I’m saving up I can rely on myself more.”

“Before financial literacy I didn’t know how to manage money, I didn’t really know how important money was,” said Moreno. “You learn a lot about how to manage money.”

He added that he regrets not saving the money he would get for birthdays when he was younger. But now, that’s not an issue anymore.

“We really feel like this is the most important class any student is going to take before they got out in the real world,” said Susan Bistransin, who taught a financial literacy class for years at Parkdale High School and helped push the school board to make it a countywide requirement. She’s now the financial education and empowerment coordinator for financial literacy.

“As I visit different schools … the students love it,” she added. “They’re very engaged, they realize that this is really important and they’re asking very, very important questions.”