They grew up with a soundtrack that may have included disco or punk and can probably name at least one of the 1980s Brat Pack actors. They are the oldest members of Generation X, and they will turn 60 in 2025.

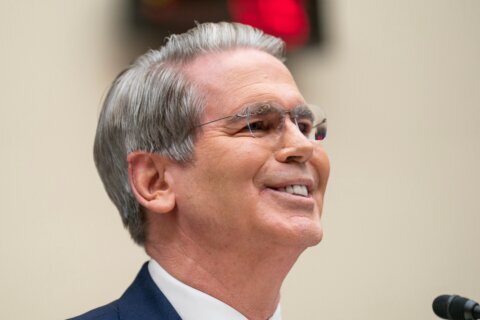

“There’s a wide range of people in Generation X,” says Daniel Razvi, senior partner and lead tax attorney for Higher Ground Legal, a nationwide law firm specializing in wills, trusts and taxes.

Generally defined as those born between 1965 and 1980, Gen X includes people of varying incomes and wealth. However, all face the same three retirement pitfalls, according to Razvi: risk, fees and taxes.

To avoid these stumbling blocks, here’s what Gen X should know about retirement:

— Budgeting is still important.

— Retirement funds can be tapped at age 59 1/2.

— Taxes can go up in retirement.

— Social Security can begin at age 62.

— Medicare won’t cover all health care costs.

— Investment strategies may need to evolve.

— Estate plans are a priority.

Budgeting Is Still Important

A workable budget becomes even more important during retirement than in your working years. Financial planners say they see their Gen X clients struggle with this.

“They’ve been getting a paycheck for the last 40 years, and they just don’t know what they spend,” says Zach Ungerott, associate partner with Hightower Wealth Advisors in St. Louis.

As Generation X members prepare for retirement, they must prepare for hard decisions.

“They really need to look at their spending,” says Jonathan Dane, founder and chief investment officer for Defiant Capital Group in Pittsburgh. They may find they are unable to maintain their current lifestyle in retirement. Given current housing prices and mortgage rates, moving in retirement might be off the table too, Dane says.

[READ: My Budget Is $2K per Month: Where Can I Retire?]

Retirement Funds Can Be Tapped at Age 59 1/2

With pensions few and far between nowadays, Generation X has mostly been responsible for saving for retirement themselves, Ungerott notes. For many of them, workplace retirement plans, such as 401(k) accounts, will be their primary source of funding.

Beginning at 59 1/2, Gen X can start taking penalty-free withdrawals from tax-advantaged retirement accounts such as 401(k) accounts and IRAs. However, knowing when to begin distributions and how much to withdraw can be challenging.

“You don’t know what that money means in terms of monthly income,” Razvi says.

If you take too much too quickly, you could run out of cash before your retirement is over. Working with an experienced financial professional is one way to determine the right withdrawal strategy.

Taxes Can Go Up in Retirement

Conventional wisdom says that retirees have less income and pay less taxes after leaving the workforce, but that may not be true for Gen X.

“The big problem is that a lot of them are going to be faced with a lot of taxes in retirement,” Dane says.

That’s because many Gen X workers have placed their savings in tax-deferred traditional 401(k) accounts and IRAs. These accounts offer a tax deduction for contributions, but withdrawals are subject to regular income tax.

Razvi calls it the “biggest scam in the IRS code today,” noting that no one knows what the tax rates will be like once they reach retirement. “It’s like you’ve signed a business partnership agreement, and the partner decides how much they own,” he says.

To minimize taxes in retirement, “The easiest thing for (Gen X) to do is to stop putting money into tax-deferred retirement accounts,” Dane suggests.

Using a Roth account ensures withdrawals in retirement are tax-free. Money that is currently in traditional retirement accounts can be converted to Roth accounts, with workers paying taxes on that money at today’s low tax rates.

[When You Need to Pay Taxes on Social Security]

Social Security Can Begin at Age 62

At 60, Gen Xers who are unmarried widows and widowers may be able to begin claiming Social Security survivor benefits. However, for most members of this generation, 62 is the earliest age to begin receiving a monthly Social Security payment.

While claiming benefits at age 62 is a popular choice, there are drawbacks. Starting Social Security early could mean your monthly benefit is permanently reduced by as much as a third. And if you are still working and exceed certain income thresholds, your benefits could be further docked.

The full retirement age for those born in 1960 or later is 67. At that age, you’ll receive your full Social Security retirement benefits without any reduction. However, if you wait until age 70, you’ll get an 8% boost in your benefit for each year between 67 and 70. There is currently no benefit to waiting to claim after age 70.

Medicare Won’t Cover All Health Care Costs

Even though Gen X doesn’t reach full retirement age until 67, they can begin Medicare at 65. This government health care program provides comprehensive coverage but has limits.

Medicare beneficiaries typically have deductible, co-pay and coinsurance requirements. Plus, the program excludes some services. Most notably, Medicare won’t pay for ongoing long-term care costs, such as those incurred in assisted living, memory care and nursing homes. For that, people must have separate coverage, such as a long-term care insurance policy or life insurance with a long-term care rider.

“Health savings accounts are always a nice piece to add to your retirement planning strategy,” Ungerott says.

Workers with a qualified high-deductible health insurance plan can save money tax-free for medical expenses in these accounts. Not to be confused with a workplace flexible spending account, money in a health savings account rolls over year to year. There is a tax deduction for contributions, and money grows tax-free and can be withdrawn tax-free when used for qualified health care expenses.

Investment Strategies May Need To Change

The stock market may scare some people, but that may not be the case for members of Generation X.

“I think this is a generation that has made their wealth in the stock market,” Dane says. As a result, they may be inclined to leave their retirement savings there. “It’s not necessarily a mistake if it’s done right,” according to Dane.

Doing it right may mean moving some money to more conservative investments and diversifying with other funds that can provide protection in a market downturn.

“You don’t know when these bad years are coming,” Razvi says. He recommends a volatility buffer strategy in which some money is moved from the market to stable assets such as certificates of deposit, Treasurys or annuities. Then, during down years, retirees can pull from these funds rather than withdrawing from the market and locking in losses there.

In addition to reconsidering their investments as they enter retirement, Gen X should be aware of the fees they pay. One percent annual fees on a $100,000 balance reduces portfolio value by nearly $30,000 over a 20-year period as compared to 0.25% annual fees, according to the Securities and Exchange Commission.

[Should Retirees Still Plan for 95?]

Estate Plans Are a Priority Now

Many members of Gen X have created wills and other estate planning documents but often fail to update them as they age.

As Generation X prepares for retirement, now is the time to reconsider whether those early plans still reflect your wishes. You may have new assets or heirs, such as a new spouse, children or grandchildren.

In addition to refreshing your will, be sure all beneficiary and transfer on death designations on individual accounts are updated. That way, when the time comes, your money and belongings will go exactly to whom you intended.

More from U.S. News

Is My Social Security Safe From Debt Collectors?

Here’s What Gen X Should Know About Retirement originally appeared on usnews.com