If you’re not feeling particularly cheery about holiday shopping this year, you’re far from alone, according to a new survey.

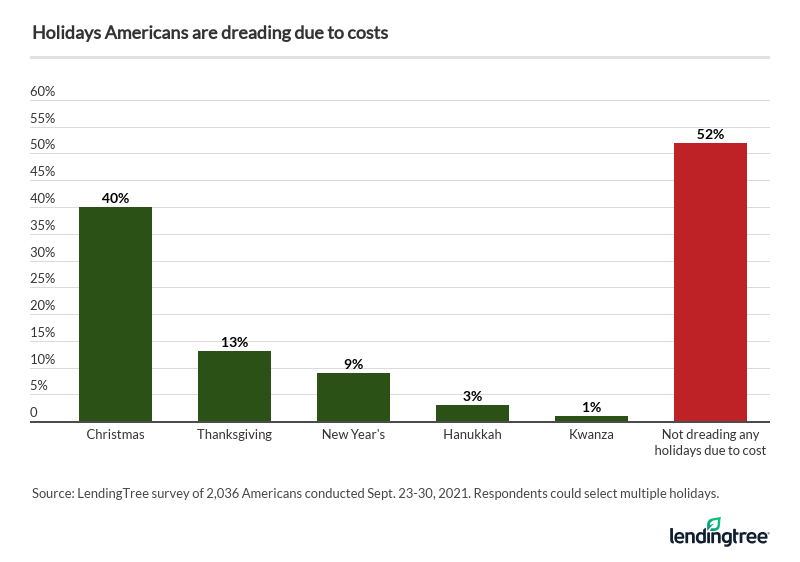

Nearly half of American consumers are dreading it, LendingTree said after polling more than 2,000 people. And the big reasons come down to how much they think they’ll need to spend on presents and festivities, as well as the pressure to purchase gifts.

Worse, about a quarter of Americans said they’re losing sleep because they’re stressing out about holiday spending, according to the survey.

“There’s a lot of stuff that’s bringing on this feeling of dread. Really, the biggest issue is just the cost of things,” Matt Schulz, chief credit analyst at LendingTree, told WTOP’s Dimitri Sotis. “Life is so expensive in 2021. And it seems like it’s getting more expensive every day. And the holidays are always pricey. But this year in particular, people definitely seem to be a little worried and are dreading these holidays.”

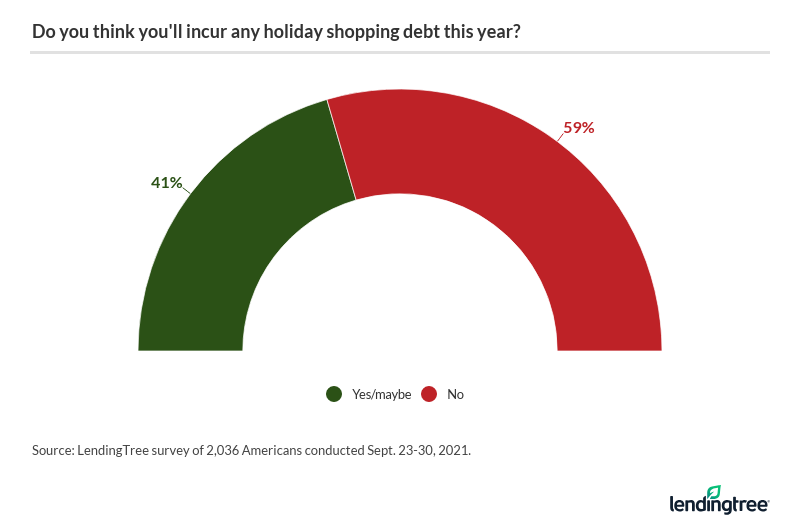

And according to Schulz, about one in seven or one in eight consumers are still paying off last year’s holiday bills.

“That’s an awful lot of people who are still wrestling with a lot of debt. To still be paying off those bills a year later is definitely troubling,” he said.

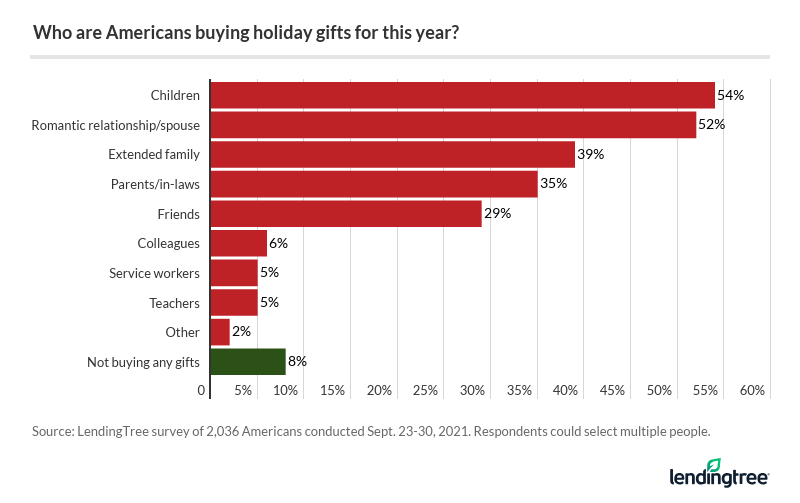

There’s also the pressure to buy gifts. Gen Z and millennials are feeling that pressure more than most, Schulz said.

“It shouldn’t be all that surprising, especially with millennials. They may be starting their families and they have kids who are getting on them to get them the newest coolest thing for Christmas or whatever holiday,” he said.

“And there’s no question that gift-giving pressure is real. Any parent can tell you that. And it’s also one of those things where people want to do these holidays right, in order to make up a little bit for just how crummy the last couple of years have been.”

On average, Schulz said Americans are spending a little less than $800 on gifts this holiday season. But for folks with kids under 18, that number is going to be more like $1,100, which is a hefty price tag.

According to Schulz, there are a couple of ways to have a happy holiday season while avoiding debt.

“The best way to avoid debt is just to be thoughtful and planful, because impulse buying is a big part of what wrecks people’s budgets,” Schulz said. “And if you — instead of just going in browsing to that brick-and-mortar store or to that website — if you go in knowing specifically what you want to get, and how much you want to spend, it completely changes the feel of that trip. And you’re a whole lot more likely to get out of there on budget and without too much impulse buying.”

You can also get creative: offer to take photos, do chores or something else your loved ones will appreciate.

“It’s not necessarily about how much you spend, but it can just be about the thoughts and the ability to kind of do things a little more inexpensively during these kind of weird economic times,” Schulz said.

He added that times have been tough, and that people shouldn’t be afraid to tell their families they need to dial everything back for this holiday season.

“We’ve all been through these last two years, we all know that things have been a little difficult and a little weird, so it may make for some awkward conversation around the dinner table, but being open, being honest, is your best way to go,” Schulz said.

WTOP’s Dimitri Sotis contributed to this report.