Over 50% of renters in D.C. use more than half their paychecks on rent and utilities, according to a new analysis from United Planning Organization, a nonprofit community development group that said it helps D.C. residents lift themselves out of poverty.

The report found more than 44,000 renter households were spending their income this way in 2022, compared to 36,000 in 2010.

Many of the homes that allocate a significant portion of their incomes toward housing make less than $50,000 annually, the report said.

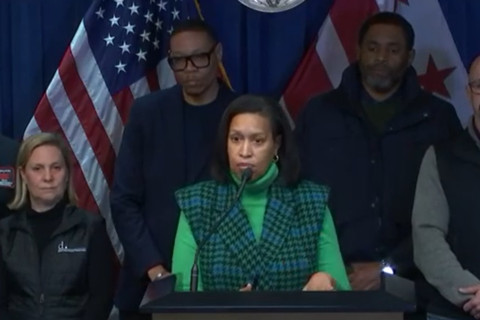

“There is such a high number and an increasing number of people who are paying over half of their income to housing,” said Andrea Thomas, UPO’s president and CEO, adding that this then leads to disparities in terms of food access, health needs and education.

Broadly, the report suggests D.C. isn’t doing enough to create affordable housing for people suffering the most from expensive rents across the city.

For one, Thomas said the city isn’t spending enough on rental assistance. Research suggests that there would need to be at least 1,000 low-rent subsidy vouchers to stabilize low-income families in D.C.

However, “right now, at 400 low-rent subsidy vouchers per year, we are woefully behind what’s needed,” she said.

D.C., according to the analysis, isn’t using the Housing Production Trust Fund to offer enough affordable housing. The report did credit the city for investing in affordable housing for residents experiencing homelessness.

In a statement responding to the report, the Office of the Deputy Mayor for Planning and Economic Development said D.C. is 67% of the way toward reaching Mayor Muriel Bowser’s goal of creating 12,000 new affordable houses by 2025.

“Mayor Bowser has not only continued to invest historic amounts to produce more affordable housing in DC, but also leveraged new tools to ensure we deliver housing units that serve residents most in need,” the agency said. “We’re proud DC continues to lead our region in creating affordable housing, and we remain focused on doing everything we can to ensure more Washingtonians can continue to afford to live in the District.”

Meanwhile, Thomas said the challenge of creating affordable housing isn’t unique to D.C., but pointed out that there are consequences for people with lower incomes paying higher rent prices.

And while there are rent affordability challenges across the city, according to the report, such challenges are concentrated east of the Anacostia River.

“We know that when people have to make hard decisions around housing and health care needs, they may choose to keep a roof over their heads, as opposed to buying medicines and other things,” Thomas said. “There is the mental impact and the depression that comes along, constantly having to deal with the fear of what we used to call ‘being outdoors, not having a place to stay or couch surfing.'”

Renters in D.C., Thomas said, “should be able to live, work and play in the same area and not have to be far away from their jobs.”