The District has announced that it is increasing the financial assistance it offers low- and moderate-income residents who want to buy a home.

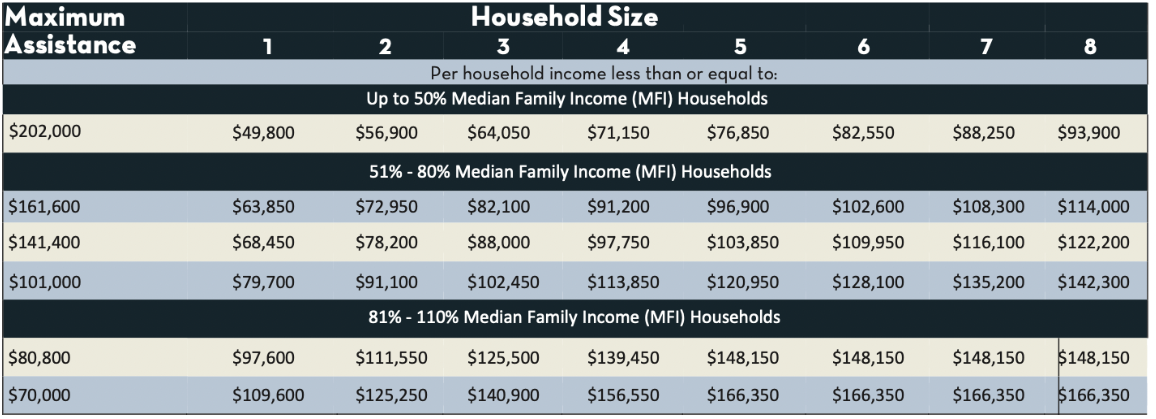

In October, the Home Purchase Assistance Program will go from offering eligible families up to $80,000 to offering up to $202,000.

“Homeownership is the way we will close racial gaps in our city,” Mayor Muriel Bowser said during a news conference announcing the rise in financial help.

According to the District, households making up to 50% of D.C.’s median family income will qualify for the full $202,000, with a lower amount available to families who make more. The money comes in the form of an interest-free loan, and can be used not only to get a smaller mortgage, but also for closing costs.

“For most people, especially most Washingtonians, the way they build generational wealth is through buying a home and passing that home on from generation to generation,” Bowser said.

Marcus Branch, a D.C. firefighter who has been trying to buy a home for years, was able to take advantage of the program.

“It’s been a struggle for me,” he said, “but with that program, it made my longtime dream … be able to come to reality.”

According to the program’s website, those eligible need to be the head of the household, have good credit, have not recently owned a home, and must use the home as their primary residence.

Payments on the loans are also deferred for the first five years, according to the District, and the total is due immediately if the home is sold or refinanced, or the property is no longer a primary residence.

“There was a time not long ago when the Black community, in particular, was not allowed to purchase homes,” said D.C. Council member at-large Anita Bonds. “And so I’m focusing on ownership because I want you to have that piece of dirt, whether you are Black or whatever.”

The District also announced that on Sept. 30, the emergency foreclosure moratorium ends in the District, which means foreclosure proceedings can resume against homeowners who are behind on the mortgages. The District said for some residents, assistance to prevent a foreclosure can come from D.C.’s Homeowner Assistance Fund.