D.C.-based Mediterranean fast-casual restaurant chain CAVA has made its plans to go public official, filing for an initial public offering with the Securities and Exchange Commission.

CAVA’s latest filing does not list a timeline for the offering, a per-share price or the amount of stock it will offer. It will trade on the New York Stock Exchange under the ticker symbol “CAVA.”

CAVA was founded in 2006 by three Maryland friends: Dimitri Moshovitis, Tex Xenohristos and Ike Grigoropoulos. It opened its first restaurant in 2006 in Rockville, and has grown from 22 locations at the end of fiscal 2016 to 263 locations in 22 states thus far, including two dozen in the D.C. region.

The company now has 7,400 employees.

It also owns Zoes Kitchen, which it acquired in 2018 for $300 million, and is in the process of converting some of those restaurants to CAVA. To date, it has converted 145 Zoes locations. Since the Zoes acquisition, it has also opened 51 new CAVA locations.

Its filing shows the company’s revenue reached $564 million in 2022, with $59 million in annual losses. It had restaurant sales growth in fiscal 2022 of 14.2%.

“The broad appeal of our food combined with favorable industry trends drive our vast opportunity for continued growth,” the filing said.

The new capital will fund further expansion for CAVA.

CAVA received a total of $20 million under the CARES Act and Paycheck Protection Program, which was used for retaining employees after the onset of the COVID-19 pandemic. The loan was forgiven in June 2021.

The filing also shows CAVA’s largest investors include T. Rowe Price, Swan Hospitality and Revolution Growth.

CAVA is moving its D.C. headquarters from Chinatown to City Ridge, the mixed-use, Wegmans-anchored redevelopment of the former Fannie Mae headquarters at 3900 Wisconsin Ave. NW.

Outside of its restaurant operations, CAVA sells hummus spread, tzatziki sauces and other products in thousands of grocery stores. Two years ago, it invested $30 million in a new processing and packaging facility near Staunton, Virginia.

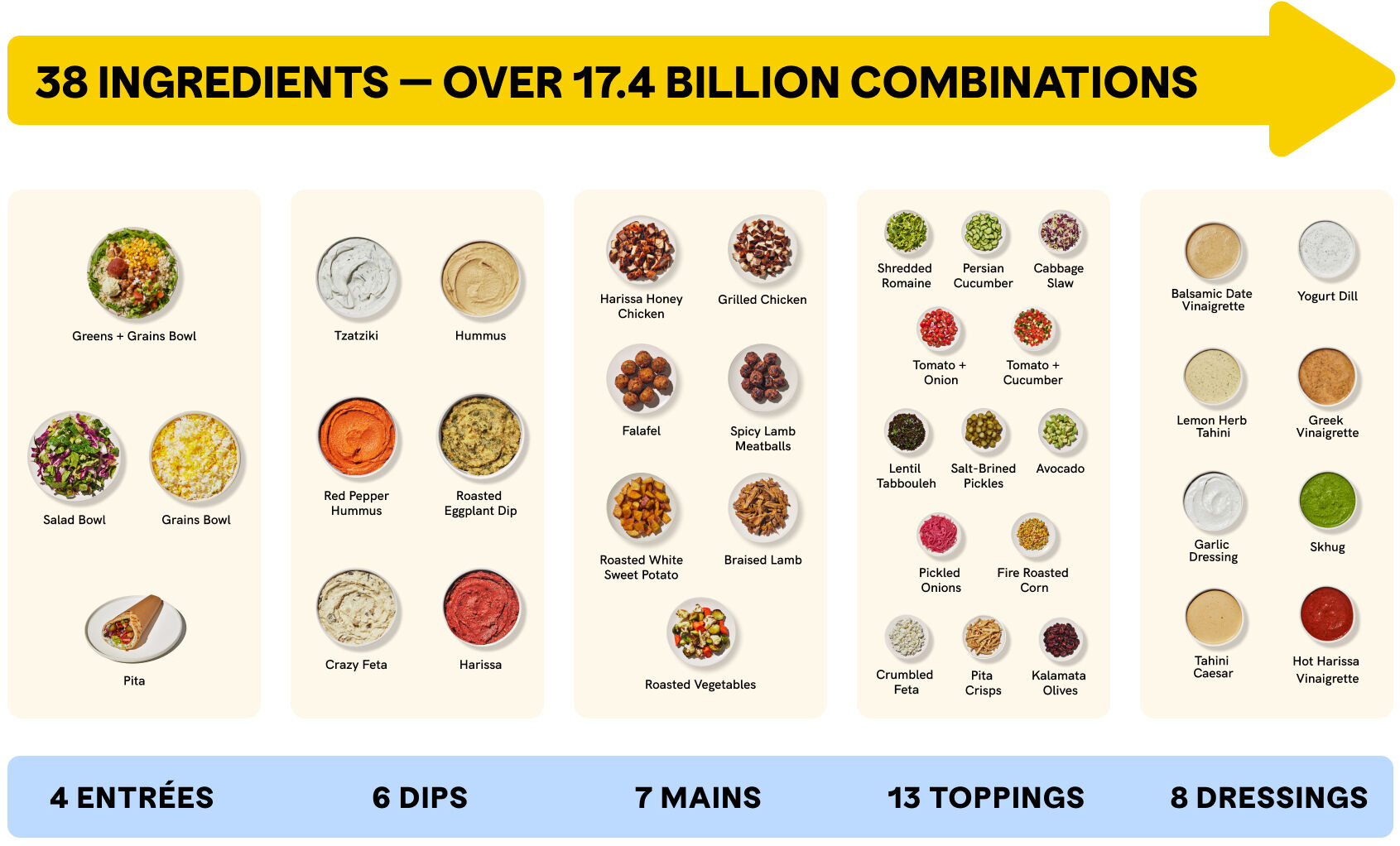

Fun fact: CAVA’s filing says its menu includes 38 ingredients that can be mixed and matched by customers for more than 17.4 billion combinations.