Peer-to-peer payment platforms, such as Venmo, Zelle and PayPal, have become hugely popular.

A recent LendingTree survey found that 84% of consumers have used a “P2P” service, and 44% of those who do, use them at least once a week.

The apps are a fast and convenient way to send money to family, or to split the dinner bill with friends.

But they don’t have much fraud protection, according to LendingTree. A surprisingly high number of P2P users — 23% in the survey — say they have accidentally sent money to the wrong person.

How does that happen?

“If you have a relatively common name, then there are probably an awful lot of people using that service who have that same name,” said Matt Schulz, chief credit analyst at LendingTree. “If there is not an image associated with the account, or you haven’t been told exactly what the account name is, it is not that hard to send to the wrong person.”

P2P platforms also do not have the protections standard credit card transactions do, and 15% of P2P users have been victims of scams. That jumps to 22% among those who use P2P services several times a week.

“Unlike with a credit card where it is really just one phone call it takes to get some sort of fraudulent activity removed, you are likely liable for that money that you lost,” Schulz said.

Balances left in P2P accounts are also not insured by the FDIC, like traditional bank accounts are, but 49% of P2P users surveyed wrongly believe their money is protected.

Despite a willingness to use them, only 11% of those users surveyed believe P2P services are the most secure. Among consumers who say they don’t use a P2P app, 18% say security concerns are why they don’t.

LendingTree’s full survey results of P2P users, which included about 1,200 consumers, is online.

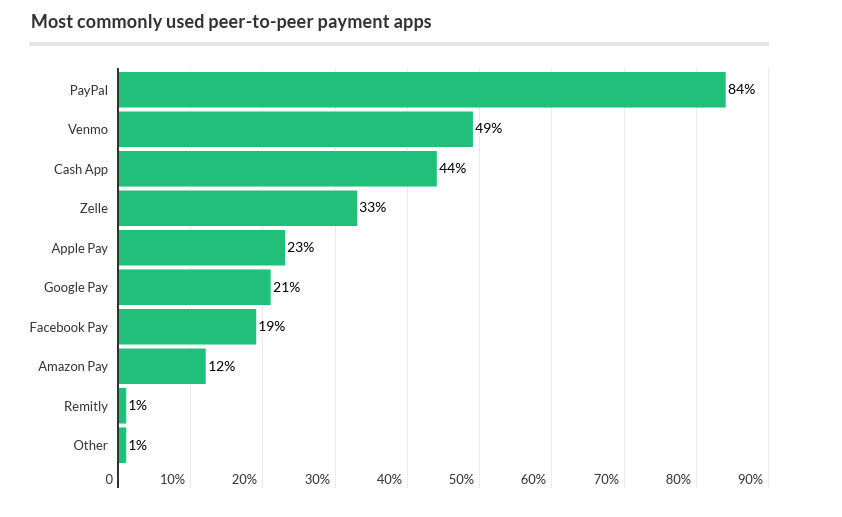

Below are the most commonly users P2P apps, courtesy LendingTree. Respondents could select multiple answers: