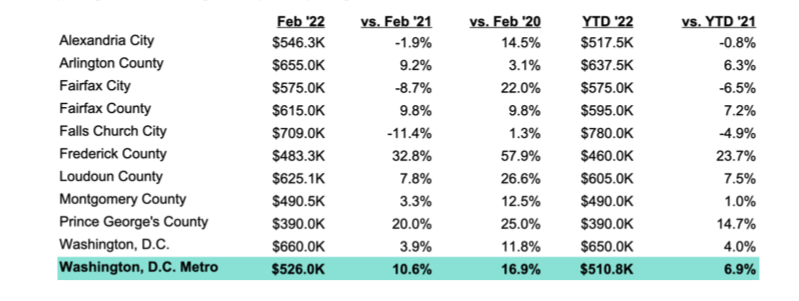

The median price of a home that sold in the D.C. metro area in February was $526,000, up 10.6% from February 2021 and near an all-time high, but prices in two of our nearest big city neighbors are considerably less.

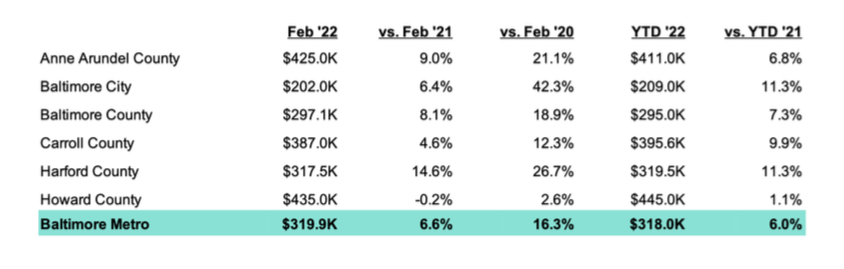

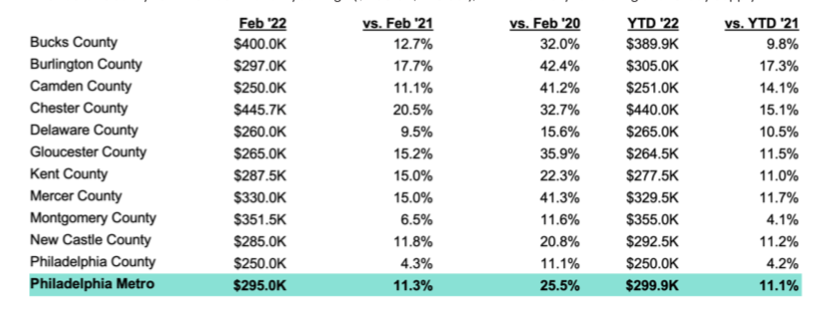

In the Baltimore metro, the median selling price last month was $319,000, or 39% less than the D.C. area. And in the Philly metro, the median selling price of $295,000 was 44% below the D.C. region, according to listing service Bright MLS.

All three are large metros, and are roughly in the same area of the country. Local economies tend to drive housing markets, but D.C. is different.

“Here in D.C. we have an economy that is built around professional and technical services and the federal government, and we just have a population with higher incomes. The economic picture is just a little bit different here, which has been the primary reason prices have always been higher here,” said Lisa Sturtevant, chief economist at Virginia Realtors and an economist adviser for listing service Bright MLS.

Baltimore and Philadelphia have much more of a manufacturing history in their economies, so there are many moderate-wage manufacturing jobs. They also have very strong service sector economies, she said.

Both metros are constrained by the same thing holding back sales in the D.C. region: A lack of sellers.

Total active listings on the market in the Baltimore area last month were down 12.3% from a year earlier, and 64.3% below February 2020. In Philadelphia, the number of homes for sale was down 34% from a year earlier, and down 63.3% from two years ago.

As a result, there were fewer sales. Closed sales in Philadelphia so far this year are down 6.3% from last year, and down 8.9% in the Baltimore region. Inventory remained fairly steady in both D.C. and Philadelphia compared to the previous month, but the number of listings in Baltimore fell another 5.7%. The number of property showings by real estate agents was down about 8% from a year ago in Baltimore and about 9% in Philadelphia.

The three housing markets aren’t that different, but, particularly for the District itself, there is a distinct difference.

“There are some similarities. We have a lot of rowhouses and moderate density housing in both of these cities. But as you know, in the District there is a height limit, so there is a limit to how high those buildings can go. In Baltimore and Philadelphia, we are seeing more high-rise construction as new product comes online,” Sturtevant said.

What is for sale in Baltimore and Philadelphia does sell quickly, averaging less than two weeks on the market in both metros.

Homes that sold in the D.C. metro in February were on the market an average of just seven days, though closed sales were down 14.2% from a year earlier.

Homes sold the fastest last month in Virginia’s Loudoun County and Fairfax City, at an average of five days, and Fairfax County, at an average six days.

Below are sales prices in the Baltimore, Philadelphia and D.C. metro areas in February, Data provided by MarketStats by Showing Time, based on listing activity from Bright MLS:

Baltimore metro area:

Philadelphia metro area:

D.C. metro area: