All of the pieces for a strong seller’s market remain in place in the Washington, D.C.-area’s housing market — low inventory, active buyers and rising prices. Even with those trends expected to continue through spring, one forecast still sees home values beginning to decline heading into 2021.

CoreLogic said the median price of a home that sold in the Washington region in April was up 1.3% from March, and up a healthy 5.47% from a year ago.

But its new Home Price Index Report now forecasts the median home value in the region will be down 1.2% year-over-year by April 2021.

Nationwide, CoreLogic predicts home prices will decline in 2021 for the first time in nine years.

The significant lack of homes for sale is driving the market right now.

Nationally, the inventory of entry-level homes was down an average of 25% in April. In the D.C. region, inventory is down double digits, with active listings down more than 30% in the District and in Virginia’s Arlington County, according to recent Long & Foster data.

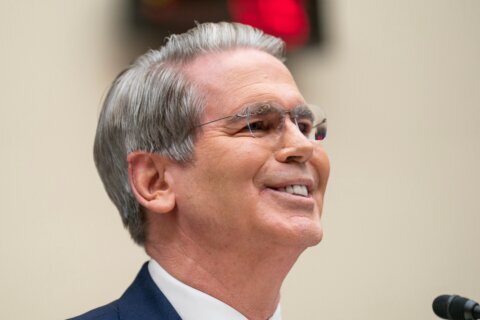

“The very low inventory of homes for sale, coupled with homebuyers’ spur of record-low mortgage rates, will likely continue to support home price growth during the spring,” said Frank Nothaft, CoreLogic chief economist.

“If unemployment remains elevated in early 2021, then we can expect home prices to soften. Our forecast has home prices down in 12 months across 41 states.”

Some markets could see a bigger decline in home values.

CoreLogic said in overvalued markets, such as Las Vegas and Miami where the local tourism economy took a hit due to the coronavirus pandemic, home prices are expected to decline by 7.2% and 4.4% respectively, by April 2021.

Still, CoreLogic expects tight supply and pent-up demand — particularly among millennials — will support a bounce back in the housing market’s sales and home prices over the median term.

“The next 12 to 18 months are going to be very tough times for the broader economy,” Nothaft said.

“As employment and economic activity begin to pick up, as it will surely do, we expect housing to be a driver in a national economy.”