U.S. consumers continue to move away from carrying cash, but cash is certainly not dead yet.

In fact, when it comes to small purchases, 49% of U.S. adults say cash is their preferred payment method for anything under $10, a new poll from CreditCards.com finds. Thirty-five percent pay with debit cards and 16% with credit cards.

CreditCards.com’s online poll done by YouGov Plc surveyed 2,544 adults between July 17 and July 19.

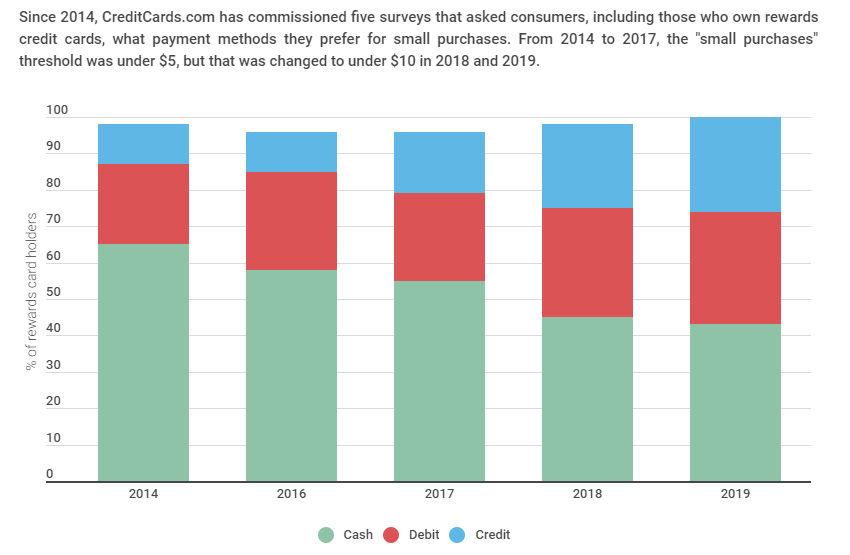

CreditCards.com said even among rewards credit cardholders, 43% say cash is their go-to payment method, while 31% favor debt and a mere 26% prefer credit.

One of the top reasons for preferring to use cash for small purchases? It can be faster.

“That’s surprising to me, because I find that fumbling with dollar bills and coins to be more difficult than using a credit card,” CreditCards.com’s Ted Rossman told WTOP.

“But I think people are referring to how long it takes to process a chip card transaction. You have to put it in the machine and wait maybe 15 seconds,” he said.

Contactless tap and pay and mobile pay are much faster, but, while more than half of in-person card transactions in the U.K. and Canada are with those newer methods, they account for less than 1% of card transactions in the U.S.

That will change.

“Major card issuers have made a big commitment this year to deliver contactless cards to their customers, so I think the more people are concerned about speed, the more they should be looking at either mobile payments or contactless cards,” Rossman said.

Mobile payments are also typically even more secure than chip-enabled credit cards because they usually require biometric authentication, such as a fingerprint or face scan.