In the almost three decades since 401(k) defined contribution plans were established, they have become the primary retirement funding tool for individuals.

The initial purpose of the savings vehicle was to supplement a defined benefit pension plan. Over the years, however, defined contribution plans have come to replace pension plans as corporations continue to freeze and/or terminate their existing plans. Consequently, 401(k)s often are the only corporate-sponsored retirement plans available for many workers, especially younger employees.

As of 2018, there was an estimated $5.2 trillion invested in 401(k) plans, according to the Investment Company Institute. While there are many benefits to these retirement savings plans, they do have some drawbacks. Weaknesses include the high fees that can make it costly for the plan sponsor (typically the employer) to offer, and fees that reduce participants’ investment returns. It is noteworthy that high fees generally have more of an impact on smaller plans than larger ones.

In order to understand the impact that fees have on the employer and participant, we first need to understand what these fees are and the services received for them:

Plan expenses cover a broad range of services that generally fall under three categories:

- Investment management fees: These are expenses that provide compensation to fund managers. Most often, they are embedded in mutual funds and come directly out of the performance of the funds. They vary by asset class and strategy (i.e., passive versus active). Additionally, management fees can include revenue sharing arrangements used to compensate other service providers, which we will discuss later.

- Record-keeping fees: These cover services provided by the record-keeper who manages the “back office” administrative functions of the plan, such as posting employee contributions and overseeing the compliance and reporting functions required of all plans.

- Advisory fees: These compensate financial advisers who perform due diligence and advise plan sponsors on the selection of the investments for the plans. These advisers also periodically monitor the investments to measure whether or not they are performing competitively. Financial advisers may also offer investment and planning advice to the participants.

How fees are paid makes a big difference

Defined contribution plan fees can be paid in two primary ways. The method that is most beneficial to plan participants is for the plan sponsor to pay the record-keeping and advisory fees. Investment management fees are paid by participants and deducted from the performance of the funds.

The other, less beneficial, method is for participants to indirectly pay for those services. This is accomplished through revenue sharing arrangements with fund managers. Most mutual funds come in several share classes that vary in the amount of the investment management fees charged. If the plan sponsor chooses not to compensate service providers directly, then they would need to choose a share class with higher management fees. The fund manager then shares some of those fees to compensate the record-keeper and financial advisers for their services. This payment method reduces the performance for plan participants, as more of their financial gains go toward management fees.

Let’s illustrate how this works:

If the plan sponsor is paying the fees, it would choose the least expensive share class — typically, the institutional class. If it is not paying the fees, it would select a share class that may include a revenue-sharing component, thus adding an additional 0.15% to 0.30% of fees to the fund. This additional expense is shared with the record-keeper and/or the adviser to pay for their services, and reduces the performance of the fund.

Record-keeping fees

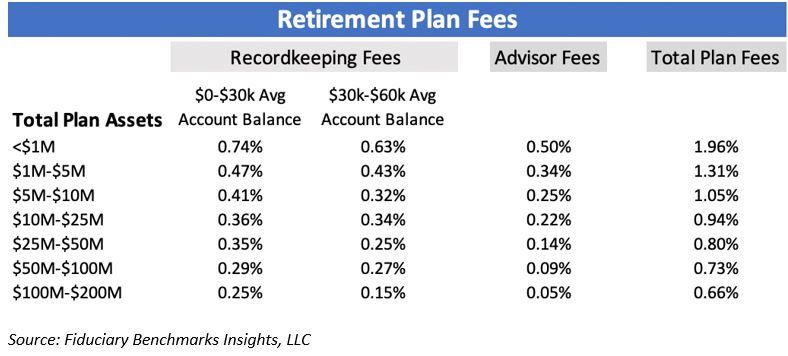

Record-keeping fees are determined by the total plan assets, the number of plan participants, and the average account balance. Below is a table of average fees charged for record-keeping by average account balance and total assets in the plan.

Adviser fees

Adviser fees also depend on total plan assets, but they may also vary by the services provided. The table below shows typical average fees by plan size.

Total plan fees — smaller companies pay more

Total plan fees are difficult to compare because of the large differential in investment fees that can exist based on share class, asset class, and whether fund managers use active or passive strategies. A representative schedule of total plan fees is shown below.

As you can see, fees for smaller plans can be onerous whether borne by the employer or the participant. They can pose a financial obstacle to a potential plan sponsor, or, where the sponsor is not paying the fees, reduce gains by participants

Since a majority of defined contribution plans have $10 million or less in assets, the higher fees of these smaller plans are a significant drag on millions of Americans and their attempt to grow their retirement savings.

A potential remedy — multiple employer retirement plans

A potential remedy for smaller employers is to participate in multiple employer retirement plans or MEPs. An MEP is a retirement plan adopted by two or more employers that are unrelated for income tax purposes. While MEPs have been available for years, current tax law presents obstacles unless the plan sponsors have some commonality, such as being members of a trade association. When unrelated sponsors create an MEP, each participant is required to maintain nondiscrimination rules on an employer-by-employer basis. If just one of the participants does not comply with these rules, the tax status of the plan may be jeopardized

Fortunately, Congress is now paying attention to this issue. In early April, the House Ways and Means Committee unanimously passed the Secure Act, allowing employers to band together and create MEPs and offer a tax credit to sponsors that set up plans with automatic enrollment. The Senate also is considering a similar bill. The encouraging aspect is that the act has widespread support from members of both parties.

This legislation, if passed, could be a major step in encouraging and enabling small employers to offer cost-effective retirement plans while reducing the expenses that act as a drag on the retirement savings for millions of employees.

Tim Jester, CAIA®, AIF, is the Director of Institutional Advisory Practice and a senior investment adviser at The Colony Group.