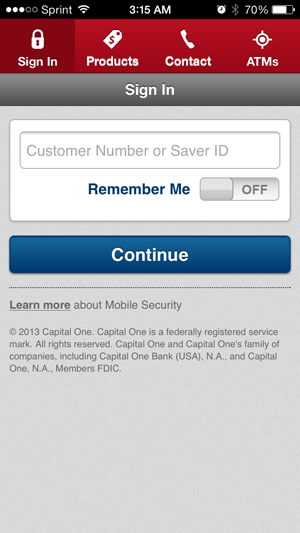

WASHINGTON — Mobile banking makes monitoring your finances convenient – but a surprising number of people aren’t cashing in on the expedient option, according to a new survey.

Only 2 percent of bank customers consider mobile banking to be their primary banking method, according to a survey from RateWatch, a premier banking data and analytics service owned by TheStreet, Inc.

Sixy-two percent of bank customers consider “at the branch” to be their primary banking method, compared to 29 percent who consider “online” to be their primary banking method.

Scott Gamm, a reporter for TheStreet.com, says it is surprising that mobile and online banking — both of which have been big pushes by banks — are not used more.

“It was pretty surprising given the convenience of mobile banking, but as we progress further into the mobile space … we should see those numbers pop up a little bit,” he says.

“We were pretty surprised to see how few people were taking advantage of mobile banking.”

Brick-and-mortar banks may appeal to a majority of customers because they offer services that mobile and online can’t. Services, such as opening an account, taking out a loan or getting a cashier’s check, can only be done at branch locations.

“People still want the convenience of being able to stop by their local branch and be able to take care of some of the more complex services, whereas the apps are used for checking account balances and paying bills – those sorts of things,” he says.

With more and more online breaches being reported, many people may be fearful that their banking information is susceptible to hackers, Gamm says.

Still, the fears have not slowed down younger generations of banking customers, he adds.

“People certainly have concerns over doing substantial financial tasks over an app or a website,” Gamm says.

“But largely, I think we are seeing a generational shift where the younger consumers out there are more open to adding the smartphone to their financial life, and where the other generations are just not as used to this and they are going to stick to the more traditional methods.”

In the end, Gamm says, the best banking method for any customer is one that keep them abreast of their finances and accounts.

Follow @WTOP on Twitter and WTOP on Facebook.