WASHINGTON — Virginia has blocked the idea of a uniform, dedicated regional sales tax that would pay for Metro’s long-deferred needs.

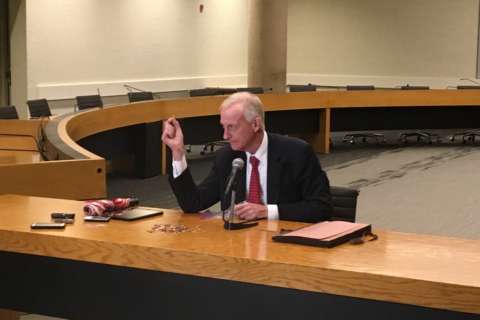

Sen. George Barker, a Democrat who represents parts of Alexandria, Fairfax County and Prince William County, told the state’s Senate Finance Committee Thursday that he and other Virginia representatives on a key regional body have convinced Maryland leaders that Maryland, Virginia, D.C., and local governments in Virginia should be allowed to figure out their own ways to provide dedicated funding for Metro.

“The consensus that we are reaching right now is that each jurisdiction will figure out its way to meet its share of this, so it won’t be a regionally imposed type of thing; it won’t be a state-, necessarily, imposed type of thing,” Barker said.

“We’ve been adamant on that, and been successful in terms of our meetings so far. I’m still working a little bit with people in D.C. on that, but Maryland is fully on board [with the idea] that in Virginia we need to be able to design our own strategy to do that.”

Barker is part of the Metropolitan Washington Council of Governments’ Metro Strategy Group, which expects to issue its recommendations this fall on how to pay for Metro’s needs. Their report on the D.C. region’s agreement on what to ask Richmond and Annapolis to approve is scheduled to be released after a report by former U.S. Transportation Secretary Ray LaHood is issued in November. LaHood hopes his report will list regional consensus on this and other Metro issues, such as governance and costs.

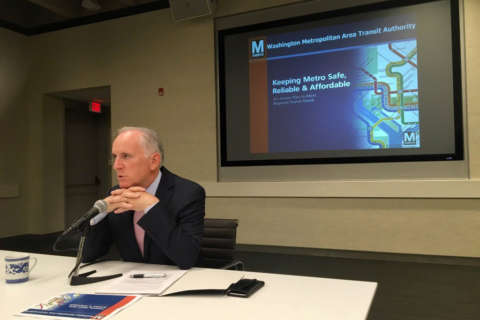

General Manager Paul Wiedefeld has asked for $500 million per year in dedicated funding in addition to the money that goes to the system today. If the cost is distributed based on existing funding formulas, Virginia jurisdictions would be responsible for about $150 million of that.

A Council of Governments technical panel last month recommended providing about $650 million in annual dedicated funding for Metro through a 1 percent sales tax in all jurisdictions served by the transit agency.

“$150 million is not chump change, but it’s not something that’s impossible to meet, particularly if we’re able to work out ways, from both the state and local perspective, to share in that,” Barker said.

“So I think it’s a doable proposition, and I think we’ve basically nixed the regional sales tax thing, which I think was a bad idea, and I think [we’re] working on things that are much more constructive from a Virginia perspective … a shared approach from the state and localities, with localities having a major stake in this.”

Under the outline described by Barker, each local government — Arlington, Alexandria, Fairfax County, Fairfax City, Loudoun and Falls Church — could take a different approach to finding additional funding for Metro.

Barker said the technical panel, made up of top staffers from the region’s largest jurisdictions “screwed up” by recommending the uniform sales tax across the entire region without the involvement of political leaders.

“Flat-out screwed up, in that they decided rather than just providing information to the COG board to be able to move forward on it, they … made a recommendation for a regional sales tax of 1 percent to be imposed across suburban Maryland, Northern Virginia and D.C.

“I think that was a huge mistake in this process, because it jumped the gun and didn’t provide for the discussion and the debate on that, and I think that also it was a very bad recommendation from a lot of political standpoints,” Barker said.

He described the proposed sales tax as a potential state bailout of the Metro system that would allow local governments to avoid providing their own additional funding. In Virginia, unlike Maryland, the local jurisdictions bear the burden of Metro costs.

The localities are not allowed to impose any new taxes of their own without the explicit permission of the General Assembly.