WASHINGTON — The math looks simple: leverage money from a new tax hike to build new schools now, and pay for them over the next few decades.

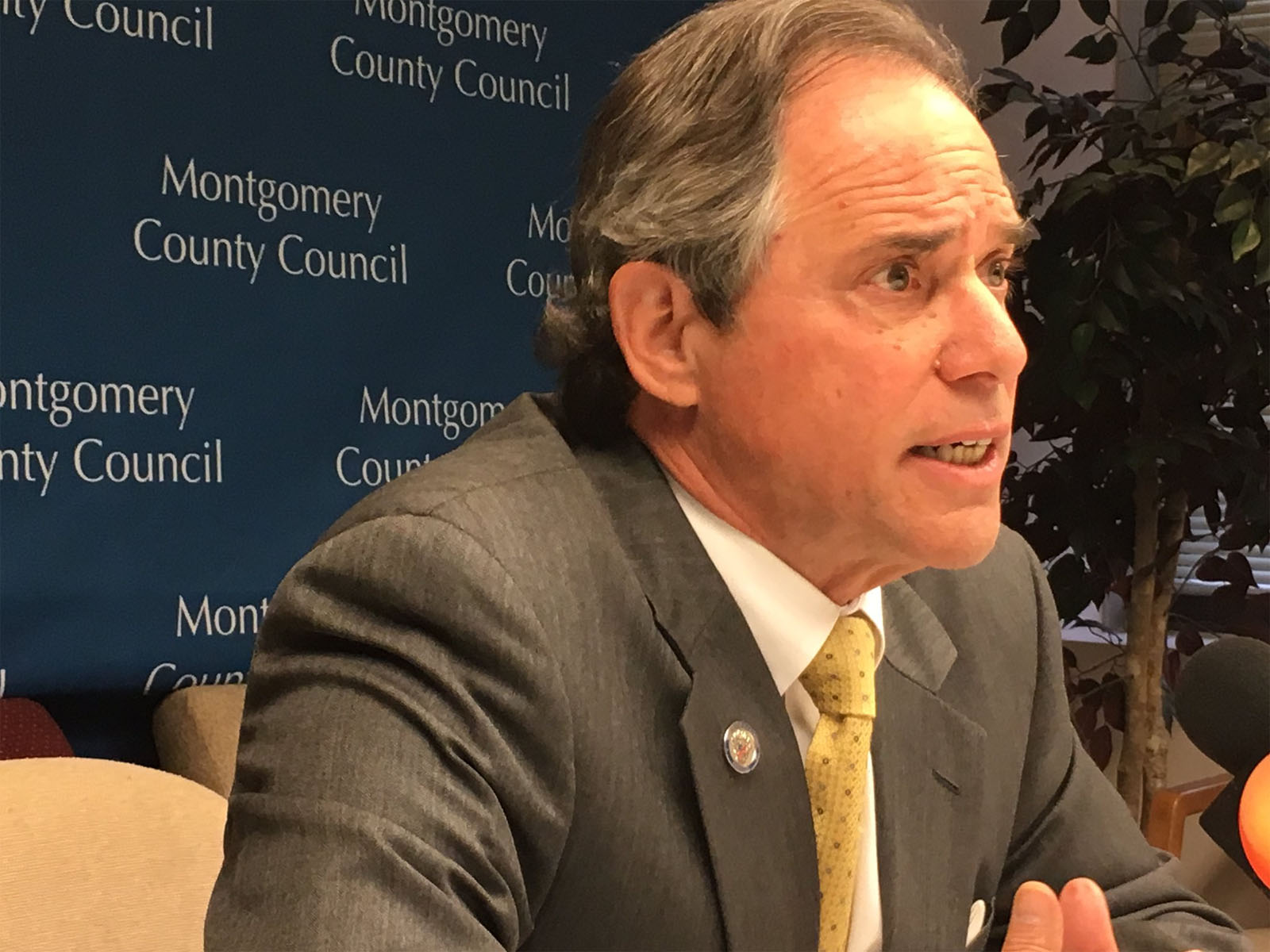

Montgomery County Council President Roger Berliner is proposing to finance the construction of new schools with bonds that would be guaranteed by some of the money coming in from an increase in the recordation tax — the tax that homebuyers pay to file their sales paperwork with the county.

“It is my proposal that we would bond $30 million of this revenue,” Berliner told reporters at his Monday briefing.

Last year’s increase in the tax means as much as $70 million in new funds to the county treasury.

Using $30 million a year for five years, he said, the county would be able to effectively double its money, borrowing up to $300 million.

“This is a separate set of dollars that are dedicated for this purpose,” he said — meaning the bonds would not count against the county’s overall bond rating.

He hopes to bring the proposal to the full County Council by the fall — once the school district has some up with a priority list of new schools.

Berliner said it makes sense to pay out long-term for a school building that will be used for many years.

“These projects are 20-, 30-, 40-year projects. They should be paid for over 20 or 30 years,” he said.

Berliner noted that enrollment in Montgomery County schools is growing by as many as 3,000 students a year.

The recordation tax is one of the most expensive line items when buying a home. Montgomery County’s tax is now $3.45 for every $500 of the purchase price. For example, such a tax on a $400,000 home would be $2,760.

Montgomery County expects to generate nearly $62 million in recordation tax revenue in fiscal 2018, and more than $74 million by 2022.