This content was republished with permission from WTOP’s news partners at Maryland Matters. Sign up for Maryland Matters’ free email subscription today.

A looming federal government shutdown could destabilize Maryland’s budget outlook.

Minor decreases in projected revenues announced Thursday by the Board of Revenue Estimates represent a mostly flat budget picture compared to March projections.

State fiscal officers warned that inflation and a shutdown, if House Republicans cannot agree on a plan to fund the federal government for the fiscal year that begins on Sunday, pose a potential risk to the state’s revenue picture.

Robert Rehrmann, director of the Bureau of Revenue Estimates, said the new forecast represents “only minor adjustments, and we are largely consistent with our forecast” and that it includes modest growth rates.

“Unfortunately, we are still in a situation where we do have elevated risks, not only from recession, but from this potential federal government shutdown,” Rehrmann said.

A federal shutdown could have dire impacts on the finances of both residents and state government.

“The impact will very much depend on the type of shutdown, its duration and if there’s significant spending cuts, as far as any agreement to end the shutdown,” said Rehrmann.

Overall, Maryland may feel the pinch more acutely than many states.

More than 160,000 federal jobs — not including federal contractors — are based in Maryland. The total is equal to more than 4% of all jobs in the state.

“At the March board meeting, I noted that revenue forecasts indicated a flashing yellow light for Maryland’s economy,” said Comptroller Brooke Lierman (D), chair of the Board of Revenue Estimates. “I think that remains true now. As we just heard, from unknown trends associated with a post-COVID economic recovery to deeply concerning implications of a looming federal government shutdown, the warning lights are still flashing. Any full or partial shutdown could mean delayed paychecks for federal employees and contractors, federally supported researchers, service providers and others who contribute to Maryland’s employment and income tax base. We could see a slow down in state tax receipts and reduced economic activity statewide as well.”

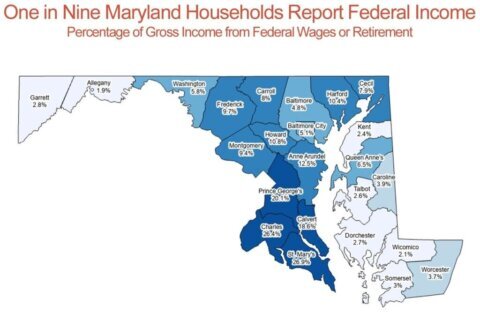

One in nine households benefited from either a federal paycheck or federal retirement income, according to the Office of the Comptroller.

“Despite Republican extremists’ refusal to govern, the Moore-Miller Administration is taking steps to ensure that state government will continue to operate, that households in need continue to receive assistance, and that hospitals and other institutions that provide essential services can continue to function,” said David Turner, a spokesperson for Gov. Wes Moore (D).

“In the near-term, we plan to use a portion of our state cash reserves to bridge fund services that rely on federal support — but only for a limited period of time and only if we maintain confidence that the federal government will reimburse the State after the shutdown,” Turner said. “State agencies are ready to employ contingency plans to ensure continued operations.”

Included in that effort is a plan to offer no-interest loans to affected individuals through a coming Federal Government Shutdown Employment Assistance Loan program. The loans, offered through the state Department of Labor, would have to be repaid at the conclusion of the shutdown.

Senior administration officials told reporters Thursday morning that the state is prepared to use $1 billion of its $5 billion in cash on hand as part of a strategy to ease — perhaps temporarily — the impact of the shutdown.

But they said that cash could be expended in less than a month.

Two shutdowns, one for 16 days in 2016 and a 35-day partial shutdown in 2018-2019, had little impact on the state, according to Rehrmann.

Budget sequestration during a fight over the federal debt limit in 2013 “had significant impacts on the Maryland economy,” causing a slowing of state tax withholdings and economic output that took years to recover, he said.

In three counties — St. Mary’s, Charles, and Prince George’s — more than 20% of gross income from salaries or retirement income comes from the federal government.

In Calvert, Anne Arundel, Howard and Harford Counties, federal paychecks and retirement payments make up more than 10% of gross income.

Total wages and retirement income from federal sources equals $31 billion or 10.5% of all income earned in Maryland, according to the Office of the Comptroller.

“Most urgent at this current moment is that we’re just days away from the potential federal government shutdown, that as you can see from the dips that we saw during sequestration, could have a devastating impact on the state,” said Lierman. “And so, I certainly reiterate my admonition and urge House Republicans to come together and put the nation at the forefront of their thinking. There are families, there are businesses who are depending on them to do their job and to ensure that we do not have a shutdown and that we continue to fund the federal government services.”

The three-member board unanimously approved what amounted to only minor changes to revenue estimates for the current budget year.

The board also provided the first look at fiscal 2025, which begins next July 1.

In the current year, analysts now project revenues of nearly $24.6 billion — a decrease of roughly $14.1 million from the March estimate.

Growth in nearly every revenue category was offset by a projected $301 million decrease in personal income taxes and more than $46 million in projected interest on investments.

State revenue is projected to grow by less than 1% compared to the previous year.

In fiscal 2025, analysts project that personal income tax collections will rebound as corporate taxes decline. The state is projected to collect nearly $25.1 billion — a roughly 2% increase compared to the current budget year.

“These low growth rates do not keep pace with growth in expenditures and the structural deficit that we face,” said state Budget Secretary Helene Grady, a member of the Board of Revenue Estimates. “The administration has been clear from day one that the factors that drove our state’s cash surplus by the fall of 2022…like many states around the country, were external to Maryland and would not be sustained.”

Maryland’s budget is projected to grow by roughly 5% in the coming year, according to the Department of Legislative Services.

“To put today’s forecast in context of budget planning, the forecast makes the structural deficit a little worse than projected by DLS over the summer,” Grady said.

“As we prepare to introduce our next budget for fiscal year 2025, come January, the administration’s work is cut out for us,” she said. “We will continue to be selective, disciplined and intentional with our investment decisions.”

In June, the Department of Legislative Services projected the fiscal 2025 budget will start with a $418 million deficit — a $650 million decrease compared to the January estimate.

Senate Republicans called for reducing spending in order to prevent tax increases.

“Today’s announcement by the Board of Revenue Estimates confirms what we already knew — a surplus this current fiscal year, with significant challenges in the coming years,” said Sen. Paul Corderman (R-Washington), a member of the Budget and Taxation Committee. “Our economy is changing and the influx of Federal COVID dollars is over. We must reign-in overspending now, or else all Marylanders will see tax and fee increases in the very near future.”