Investors remain formidable competitors for house hunters across the country. They accounted for 19.4% of all homes that were purchased in the second quarter. But the D.C. metro is not a particular favorite.

In the second quarter, investors accounted for just 8.1% of all sales in the D.C. region, second lowest behind Providence, Rhode Island.

“It is hard to make a profit in D.C. because homes are already so expensive,” said Daryl Fairweather, chief economist at real estate firm Redfin, which provided second quarter investment buyer data.

Investors prefer markets they see as up-and-coming, even still buying in some markets where prices have seen the largest pandemic-era increases.

“Places like Phoenix and Austin and really the whole Southwest have been really attractive to investors. Florida as well. They tend to have lower-priced homes so investors can buy more and spread their risks,” Fairweather said.

Investors accounted for 31.9% of all residential sales in Jacksonville, Florida last month, and 31.5% of sales in Las Vegas.

An investor buyer could be an institutional buyer that owns many residential properties, or it could be an individual or family that owns just one or two rentals. There is no single reason for choosing to buy residential real estate as an investment.

“Investors might buy to rent out the home. They may buy to renovate and flip the home. They may buy just to hold the home and hope it goes up in value, although that is not as common. They may Airbnb out the home. There are a lot of things you can do as an investor,” said Fairweather.

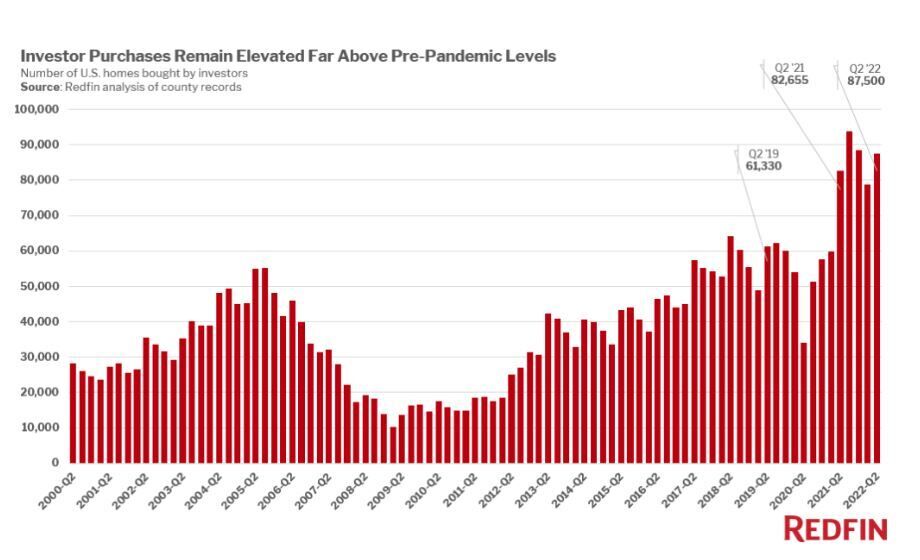

Investors are buying far more homes than before the pandemic. Redfin reports investor sales were up 11% from the first quarter, and up 5.9% from a year earlier. In dollar terms, investors paid a record $60.1 billion for residential real estate in the second quarter, more than $5 billion more than a year earlier.

Investors favor single-family homes, buying 65,000 of them in the second quarter, up 8.5% from a year earlier. But the 14,000 condos investors purchased was up 40% from the second quarter of 2021.

Below is a historical chart of investor share of residential real estate purchases nationwide: