For the first time in four months, the average rate on a 30-year fixed-rate mortgage fell below 5% this week.

Freddie Mac reports 30-year fixed-rates averaged 4.99% this week, falling sharply from an average of 5.3% last week. As recently as June, 30-year rates were averaging almost 6%.

A year ago, 30-year rates averaged 2.77%.

“Mortgage rates remained volatile due to the tug of war between inflationary pressures and a clear slowdown in economic growth,” said Sam Khater, Freddie Mac’s chief economist.

“The high uncertainty surrounding inflation and other factors will likely cause rates to remain variable, especially as the Federal Reserve attempts to navigate the current economic environment.”

A 15-year fixed-rate mortgage averaged 4.26% this week, down from 4.58% last week. A 15-year fix averaged 2.1% a year ago.

With rates the highest they’ve been in years, adjustable-rate mortgages have regained some popularity with buyers. The average rate on a five-year adjustable-rate mortgage was 4.25% this week. A year ago, five-year adjustable rates averaged 2.4%.

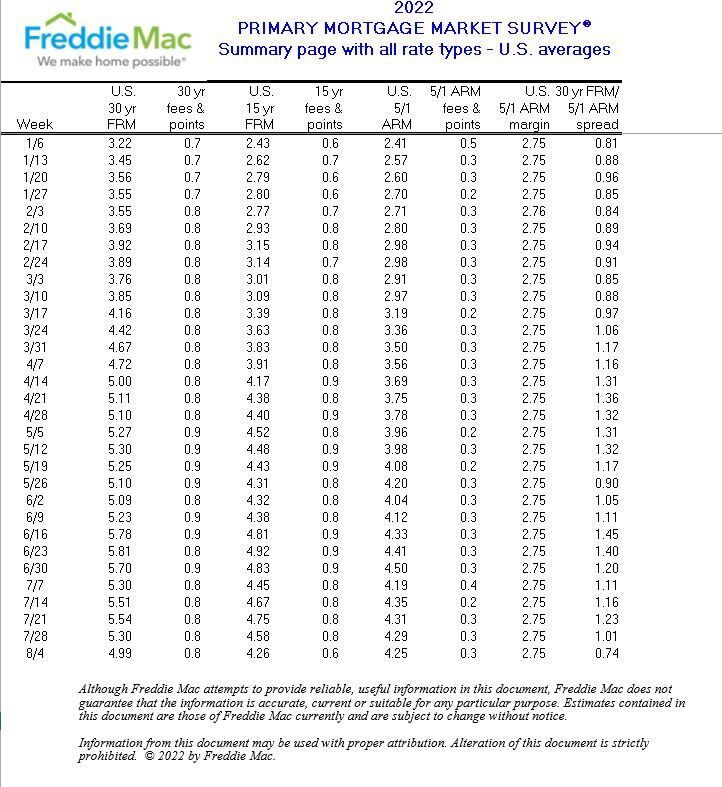

Below is a list of weekly mortgage rate averages so far in 2022: