WASHINGTON — A recent report from LendingTree notes Americans are on pace to amass a record $4 trillion in consumer debt this year, and that doesn’t count mortgages.

And credit card debt alone in Washington is among the highest in the nation.

Bankrate.com ranks the Washington metro as the fifth highest for average credit card debt.

The good news is Washington also ranks high for the ability to absorb that debt. The D.C. area has the second highest median, after-tax income.

Even so, the money Washington consumers, and consumers nationwide, are saving is alarming low, despite a current economy that should be supportive of consumers socking more away.

“It’s really weird because the economy is doing better, so what’s going on?” Tyler Tepper at Bankrate told WTOP.

“I think a lot of it has to do with home prices. Home prices are going up, and people are feeling wealthier and feeling they can spend more money, so they’re saving less and spending more, and so their credit card obligations are going up,” Tepper said.

And he said that has created a false sense of security.

“This is one of the longest-running economic expansions in history. Eventually it is going to come to an end. That can put your job in jeopardy. And you need to be secure in case that happens,” he said.

Household incomes in Washington range from families who are barely getting by to those who have more than they need to spend, but, the typical Washington household has, with discipline, the ability to build an emergency savings account fairly quickly.

Bankrate calculates, taking into account average costs for necessary living expenses, debt payments, insurances and taxes, and the median after tax household income, the typical Washington area family of four can theoretically save up to $13,636 of its $78,893 annual take-home pay in one year. That equates to roughly 42 percent of the $32,629 needed to cover expenses for six months in case of emergency.

Washington households also have potential savings hindrances.

The area has the seventh highest mortgage and interest expenses, ranks seventh highest for homeowner insurance, third highest for health insurance and fifth highest for groceries.

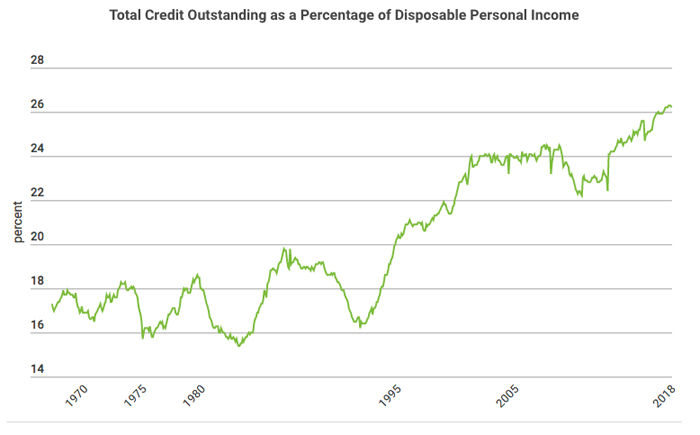

Nationwide, LendingTree said the percentage of total non-housing debt for the average American family has climbed to record 26 percent of disposable personal income, and nonmortgage debt is growing at more than 7 percent annually.

LendingTree’s chart, below, shows five decades of nonmortgage household debt growth in the U.S.