RICHMOND, Va. — Usually, April 15 is the filing deadline hanging over the heads of U.S. taxpayers. But this year, Americans have been granted a slight reprieve: They have until April 18 — this Tuesday — to submit their federal income taxes.

By law, individual tax returns are typically due on April 15. But when that falls on a weekend or holiday, as it does this year, the deadline is automatically extended.

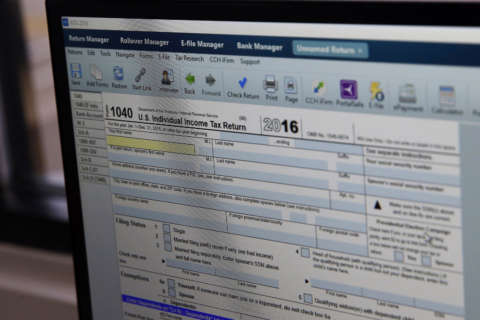

The Internal Revenue Service offers a number of tips for people still working on filing their 2016 federal taxes. These tips can help taxpayers avoid errors and ensure that refunds are received as quickly as possible.

Last-minute filers who still need more time have the option to request a tax-filing extension to avoid late-filing penalties. While this gives taxpayers more time to file their federal taxes, it does not give them more time to pay what they owe.

State taxes are still due as scheduled on May 1. The Virginia Department of Taxation has online advice for filing state returns.

In 2014, the most recent year for which the IRS has provided data, Virginians filed nearly 3.9 million individual federal tax returns. The total amount of income reported was about $284 billion — or approximately $73,000 per return.

In Virginia, the average income per return ranged from less than $35,000 in Petersburg and Emporia to more than $130,000 in Falls Church and Goochland County.