WASHINGTON — The credit card industry is extremely competitive right now, and credit card companies have never been more accommodating to their best customers.

And if you’d like a lower rate, more reasonable annual fee or a late fee waived, now is the time to ask.

A Creditcards.com report says 89 percent of cardholders who ask for a higher credit limit now get it, and about 80 percent are successful in getting their annual fee either waived or reduced.

If you get dinged with a late fee, ask about that, too: Creditcards.com says 87 percent of cardholders who ask for a late fee waiver get it. But don’t expect to get that courtesy very often.

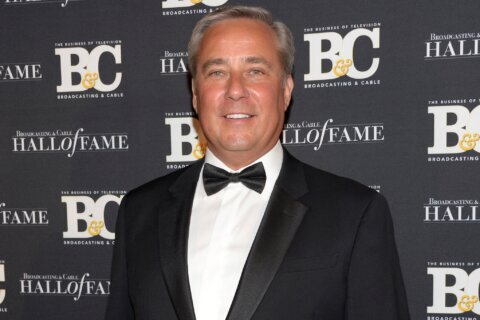

“You certainly wouldn’t get a late fee waived every time you ask for it, and certainly not if it’s your third or fourth time in the last couple of years,” Creditcards.com’s Matt Shultz told WTOP.

“But if it’s something that only happens every few years, then you probably won’t have any problem,” he said.

Credit cards are about the only consumer loan, revolving or otherwise, right now that have high interest rates, but 69 percent of cardholders who ask for a lower one are getting it.

But banks and credit card companies won’t always be this flexible. In fact, this bend-over-backwards approach to keeping customers may already be waning.

“Credit card debt is increasing; interest rates are rising; delinquency rates are starting to grow. So now is a really good time to take advantage of the fact that banks are being this accommodating,” Shultz said.

The study shows that no more than one in four cardholders ever bother to make any requests for lower rates, higher limits or annual fee adjustments.