EDITOR’S NOTE: The housing bubble before the recession drove prices up at the Delmarva beaches. Then prices sank. It’s been nine years since the end of the recession. So have the beach communities recovered? In the series, Beach Real Estate Guide, WTOP’s Colleen Kelleher brings you advice on buying, selling and renting at the Delaware and Maryland beaches.

DELMARVA BEACHES — The words “normal” or “stable” may sound bland, but for anyone looking to buy beach property in Delaware or Maryland, that’s what you want to hear your real estate agent say nine years after the end of the Great Recession.

“I consider this to be a normal market,” said real estate broker Allison Stine of The Allison Stine Team at Long & Foster. Stine sells properties in Delaware, including in Bethany Beach and Rehoboth.

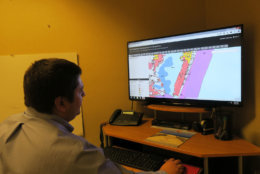

“At the moment we’re up 15 percent in year-over-year pricing, which I keep saying is not an insignificant number. We’re starting to see the inventory heading down and the prices heading up,” said Stine as she reviews data in Long & Foster’s Bethany office.

Real estate agents in Ocean City, Maryland, agree with her assessment.

“I would say the prices are probably around 2003-2004 prices because we had an abnormal price increase in the 2004 to 2007 era, and now prices are back probably where they should be,” said Long & Foster real estate agent Steve Mastbrook, who sells in Ocean City and in Delaware.

Because there aren’t lots of properties on the market, “people are not able to be as choosy as they used to be,” said Joe Wilson, an agent with Condominium Realty, Ltd. in Ocean City.

Long & Foster closely tracks real estate trends in the beach markets. Click on each link for specific monthly data:

Stine said she expects the beach market will continue to tighten and prices will rise because the feeder markets, the markets from which new buyers come — like D.C. and Wilmington, Delaware — are seeing multiple offers on properties, and they are only on the market a few days.

Making a six- or seven-figure investment in a beach property requires a good bit of thought. WTOP interviewed real estate agents in Delaware and Maryland to get some tips on buying a vacation home at the beach. Agents outline a few things that are specific to coastal properties and Delmarva.

1. KNOW WHAT YOU WANT IN A PROPERTY

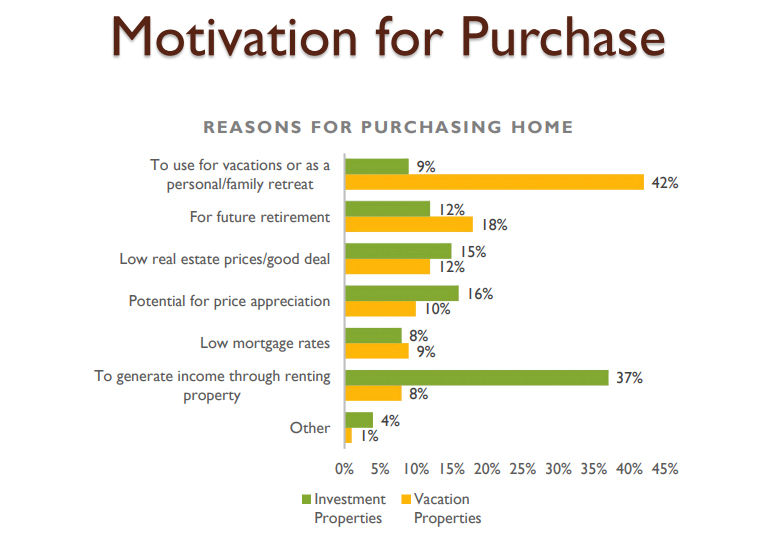

Why are you buying a beach property? Is it to create family memories? Is it to relax and get away from the everyday stress of urban life? Is it as a future retirement home?

Buyers Mike and Natalie McEwan have two young children. They wanted to keep making memories and to relax.

Mike McEwan said “quality of life” and having a “stress-free” way to come to the beach on weekends, during the summer and in the offseason mattered as they searched for an Ocean City property last summer.

“We definitely knew what neighborhood we wanted to be in because we’ve been coming down here for 10-plus years and we’ve rented very close to here,” McEwan said as he sat in his bayside condo near Northside Park. The condo is located three blocks from the beach.

Knowing the type of home and location will help narrow the search.

“Some people want to be on the bayside because they want to have a boat. Some people want to be on the oceanside because they don’t want to cross Coastal Highway with their kids to get to the beach,” said Wilson about Ocean City buyers.

But not all buyers know what they really want.

Both Long & Foster’s Stine and Grace Masten, broker/owner of Sea Grace at North Beach, realtors in Ocean City, say you need to be able to explain to an agent how the property will be used.

“The most important question that we can ask as realtors is: ‘What do you want to do with your property? What do you want to accomplish? Do you want to just come down on the weekends? Are you coming down in the offseason? Do you want to make some rental income for a couple of weeks to pay your condo fees and your taxes? Or do you want to purchase as a full investment where you rent it out continuously?'” Masten said.

New owners, Masten said, often change their minds about how they will use their condos.

“I think their intention when they first purchase is to use it themselves a lot. Then the realize after the second year, baseball games come up at school, or they’re traveling somewhere else. So the first two years, it’s their honeymoon period. Then after that, they go, ‘Maybe I should consider renting a couple weeks. What harm would that be?'”

She said once they get the taste of the rental income, some buyers then think about buying another property “because it’s a good investment.”

Whether you will use your beach property as a rental property is important, Stine said.

“You can travel 2 1/2 miles from the beach to a resort-type neighborhood. Let’s say like a Bare Trap Dunes that has golf and tennis and pool and clubhouse and restaurant and pro shop, and you can buy a condo, a townhome, a single-family home. They will all be great rental properties if you decided you wanted to get some rental income. You could step 10 feet outside the neighborhood, in a random home, in a random neighborhood, and probably not do any rental income,” Stine said.

2. EXPECT A ‘WOW’ MOMENT BUT BE REALISTIC

Most buyers experience a “wow” moment where they fall in love with a property.

When buyers get caught up in the “wow” moment — seeing the seagulls flying overhead and hearing the ocean waves in the background — Masten said she makes sure she tempers the moment with a little reality.

“I tell my clients, ‘You can get emotionally attached to this, however, let’s look at the numbers.’ If the numbers aren’t making sense, let’s back away. Let’s move in a different direction because I don’t want you to be that seller who comes to me 10 years down the road and say, ‘I can’t afford this.’ Or five years down the road. ‘I can’t afford this. What do I have to do?'” Masten said.

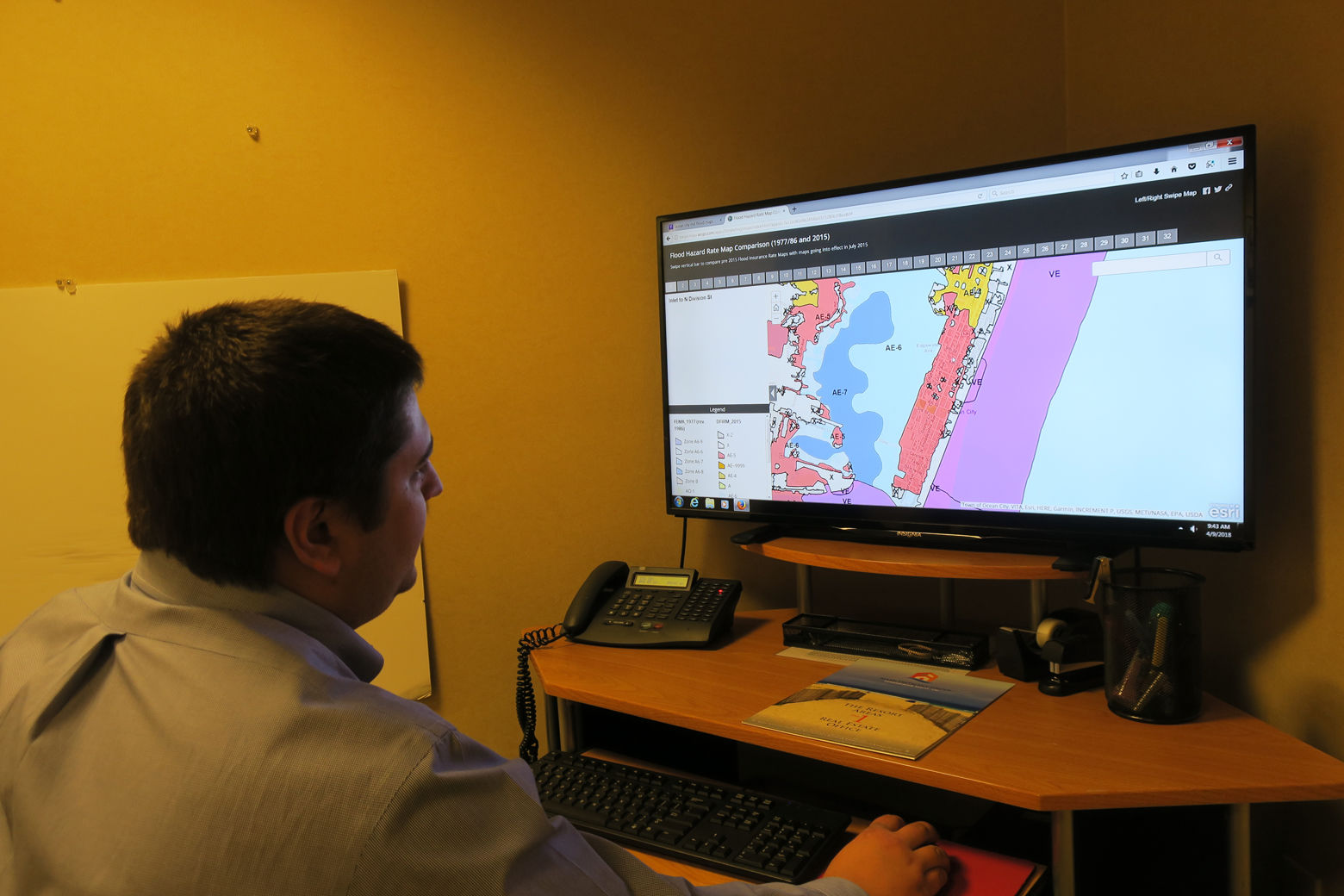

3. REALIZE YOU MAY NEED FLOOD INSURANCE

One cost that can pack a big whammy in coastal towns is flood insurance. It’s a cost that is continually rising.

Bryan Baker, Long & Foster regional insurance manager, recommends buyers talk with their lenders or their insurance agents early in the process to see what type of flood zone the property is in.

“As of now, there is no contingency to allow someone to get out of a property contract simply because it’s in a flood zone,” Baker said.

“If somebody qualifies for financing and there are no other contract contingencies, they’re kind of locked into the contract, regardless or not of whether they want flood insurance.”

Baker cautions buyers to not make assumptions by using online mapping tools to determine a property’s flood zone. The online data may be wrong and it could cost them money.

“The challenge is with high-risk flood zones. I have personally seen policies range anywhere from $500 a year to up to $7,000 or $8,000 a year. It just depends on the home, the replacement value, the age, obviously, the actual flood zone that it is in,” Baker said.

Older properties, Baker said, could see flood insurance costs rise 15 to 18 percent a year.

“If you do not have a mortgage, you are not compelled to purchase flood insurance,” said real estate broker Stine, who also has investment and rental properties. “You can buy it as an option, which I always did because I’ve seen floods. There’s nor’easters. They’re a little bit scarier than hurricanes.”

Flood insurance, for some six- and seven-figure buyers in high-risk areas, may not be a big deal.

“For the most part, my clients who could afford the mortgages in those locations, they don’t really care about the flood insurance. It’s the cost of having an oceanfront home or a bay front home,” Stine said.

4. PLAN TO ANSWER THE SAME LOAN QUESTIONS OVER AND OVER

While the process of getting a loan hasn’t changed much since the mortgage crisis, what has changed is the amount of documentation required. Expect to be asked a lot more questions about your financial wealth.

Dewey Beach Mayor T.J. Redefer is a broker with Rehoboth Bay Realty.

“The process is painful,” Redefer said, describing the undertaking involved with loan documentation.

“They literally want to know how many sheets of toilet paper you use in the morning. I am just teasing. No, they don’t. But they do need to get to the bottom of how they can make sure you can afford this house today, where they didn’t in the past. It is a more difficult process to go through,” Redefer said.

The documentation process is among the biggest complaints Stine gets about any transaction.

“The loan application itself hasn’t changed much over the years, to me,” Stine said. “It’s just the supporting documentation. They ask for your income. They verify your income. They verify your income one more time before you go to closing. They just seem to be asking for the same things over and over again.”

- 7 tips for buying beach real estate in Del., Md.

- Selling beach property? 8 ways to get the best price

- Tips for beach rentals through VRBO, Airbnb

- What’s the best beach for the money?

5. UNDERSTAND TRANSFER TAXES

While property taxes are lower in Delaware, buying property in the First State will cost you more at the outset. The state’s realty transfer tax, which is based on the purchase price, is higher than the realty transfer tax in Maryland.

Transfer taxes are part of closing costs and add thousands to the property’s bottom line cost.

Delaware increased its transfer tax to 4 percent in 2017. It had been 3 percent. Buyers and sellers split the cost of the tax that pays for state and local services.

“The transfer tax is one of the reasons why the property taxes are able to stay so low because every time a house transfers, the state and the county collect a transfer tax — 2 1/2 percent to the state and 1 1/2 percent to the county or a municipality, depending on where you are,” said Stine.

Buyers and sellers split the cost of transfer and recordation taxes for Ocean City, Worcester County and Maryland. The tax is 1.66 percent of the property’s cost.

“Take a typical $300,000 home. If you were buying in Ocean City, you would be paying $2,500. It would be $6,000 in Delaware,” said Mastbrook.

6. FIND OUT IF THERE IS A GROUND LEASE

You may not own the land below your home, if you buy in parts of Sussex County, where the Delaware beaches are located. You may pay a land lease.

“There are ground leases throughout the county,” Stine said. “Dewey Beach has ground leases in Rehoboth by the Sea. Sea Colony has ground leases. There’s a little community in Bethany called Bethany Proper, which is real beautiful, affordable townhomes but they’re on ground leases.”

Land rent is based on the value of the land and can cost tens of thousands of dollars a year for some properties.

Paying to lease the land where your home sits can be a sensitive issue. Some buyers dismiss it immediately, Stine said.

At Sea Colony in Bethany, where there are 2,200 condominiums, the cost of the ground lease, which is in addition to condominium fees and recreation fees, can be up to $2,000 a year. A lease can be purchased for 12 ½ times its price. In a resale, it has a value of $25,000.

In Dewey Beach, land rent started in the 1950s when Redefer’s grandfather and his grandfather’s father-in-law worked with a developer to build those rustic, knotty pine cottages in the north end of the 2-mile-long town.

But for a buyer who can see beyond the emotional aspect of making a purchase, Redefer said it may be cheaper than the debt load on a huge mortgage or less expensive than taxes the buyer paid in other states.

“The perfect buyer in Dewey Beach is a million-dollar buyer that went to Rehoboth and was very disappointed in what that would get them, five blocks back, kind of looks like a mobile home but it’s a modular home. That million-dollar price range is going to be quite a distance from the beach, and they’re disappointed,” Redefer said.

“And they come to Dewey Beach, and they say, ‘So I can have that whole cottage for $300,000 or $400,000?’ Yeah, you will have land rent, and the land rent is substantial, but it is much cheaper than the debt load you would have had on a $1 million purchase in Rehoboth or Bethany or any of the other towns. For a lot of people, it’s the most affordable way to get to the beach.”

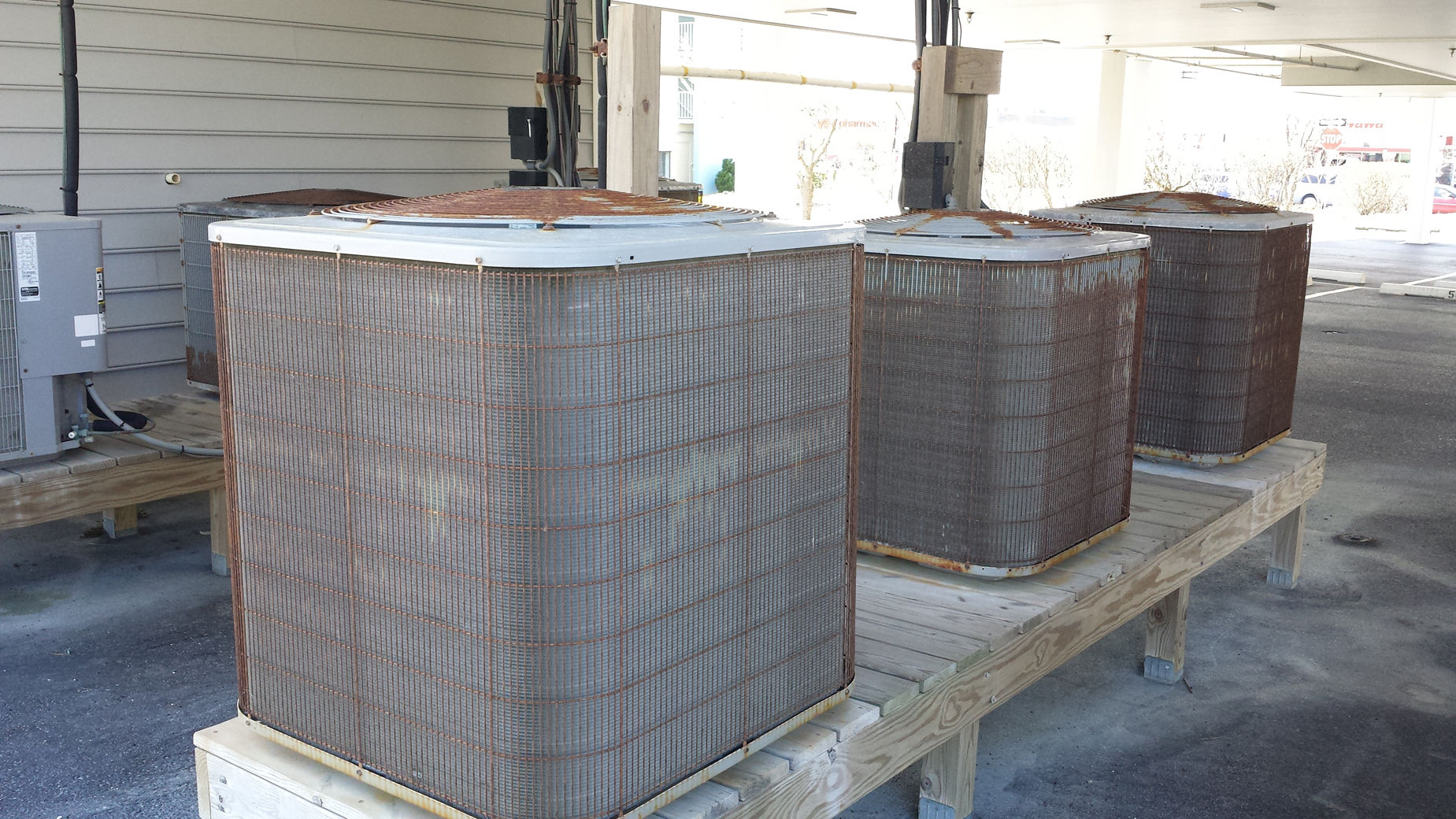

7. CHECK OUT CONDO AND CONDO DOCUMENTS

CONDO FEES

With 30,000 condominiums in Ocean City and thousands more in lower Delaware, you will likely pay a condo fee.

Know exactly what those fees cover and look at whether they are in line with fees in similar buildings, real estate agents advise.

“Condo fees aren’t necessarily a bad thing. The fees actually cover the exterior of the building. And you are really splitting the cost of the roof, railings, steps. If you were just paying for it all yourself, it would be a lot more expensive,” said Mastbrook, who owns in both states and sits on a condominium board of directors.

Condo fees, also known as dues, will be higher in buildings that have elevators, pools, clubhouses, game rooms and tennis courts. Upkeep on these items comes from that money.

“Usually, if somebody doesn’t want a pool, they don’t even want to look at a building with a pool because they’re going to be paying for an amenity that they’re not even interested in,” said Wilson.

Realize that the type of building the condominium is located in could affect whether you are able to get a conforming loan or have to look at other financing options.

Condominiums that have offices or tiki bars or other businesses on their first floors rely on the income of those businesses, and lenders take that into account.

“The way lenders look at it is if that business pulls out of that building, it’s that much money — $20,000 a year income that that building loses. So there are only certain banks that will lend on those buildings, and … it’s the local banks,” Masten said.

“To get a conforming loan on the properties is going to be a challenge. It’s not that financing isn’t available. You’re going to pay a different rate, a little bit higher rate for a shorter term,” Masten said.

CONDOMINIUM DOCUMENTS

A real estate listing will tell buyers what the condo fee is for a year, but it’s not until they are under contract that they get the details.

Condominium resale documents will include the condominium’s budget, bylaws, rules and restrictions. Agents recommend reading them closely.

“Sometimes the condo fees may seem high but the condo is probably putting money aside in a reserve fund for future expenses,” Mastbrook said. “A lot of time, people don’t realize that that is helpful in the future. That is covering you so you might not have to worry about special assessments in the future.”

Special assessments occur when condominium associations don’t have the money needed for capital projects and deferred maintenance, and have to quickly raise the money from the owners.

“The biggest thing is checking to see how much money is in their reserve account. Each building should have a reserve fund. So if there is an elevator that needs to be replaced or something like that, they’re not going to hit you with a special assessment. The money should just come out of reserves,” Wilson said.

Reserves also impact whether you get a mortgage.

“If you are going to buy in a condominium, most people think, ‘Oh, they’re just looking at me as the buyer and approving me in the mortgage process.’ Most people don’t realize they also have to approve the condominium building. They have to make sure there is enough money in the reserve account. There’s a lot of standards that revolve around approving the condominium building, in addition to the buyer,” Wilson said.

OTHER ODDITIES

The nitty-gritty information in those resale documents could make a difference on whether you back out on a sale.

Masten said buyers need to look at the condominium association’s minutes and check for any pending lawsuits. She recommends checking for restrictions and anything that would hinder how you may want to use the unit.

For example, there may be restrictions on the type and size of dog owners are allowed to have, or whether the condo can be a rental.

“If you are not happy with what those documents state, you back out of the contract,” Masten said.

RIGHT OF FIRST REFUSAL

Some association bylaws date back to the 1960s and haven’t been updated, so they may have clauses that harken back to a time when society was less inclusive.

“Probably one of the worst ones that’s down here is the right of first refusal from the building. What that means is if somebody has a property up for sale and a buyer comes in and says he wants to buy it, the rest of the condo owners may have a chance to buy that unit and stop that potential buyer from buying the property,” Mastbrook said.

ON THE RADIO

The interactive chart below, provided by Long & Foster, lets you compare home sales across Delmarva, going back to 2009.