This article is part of WTOP’s monthlong series, “Money Matters,” where we explore tips for saving, budgeting and making your money work for you. Check for new articles every Tuesday and Thursday, right here on WTOP.com.

This video is no longer available.

The cost of everything is going up, and there are widespread concerns that the D.C. area could fall into a recession. Often times, what would be considered a middle class income in most parts of the country won’t cut it in the D.C. region, and it’s only getting harder.

Whether you own your own home or rent, getting by is becoming a struggle for many families, leaving them to wonder if it’s time to move someplace else.

Leaving their Bowie, Maryland, home and moving to another state is something Daniel and Monica Gardner figured was going to happen once they hit retirement age. Now, they might not wait at all. In fact, they’re eying up jobs in other parts of the country, with their situation made even more dire by Daniels’ recent layoff from the federal government.

Cost of living at ‘California levels’

“It’s far from family, it’s far from everyone,” Daniel admitted. “But we’re almost California-level of cost of living here.”

The couple has made attempts at cutting back spending; he does maintenance projects himself and the combined age of their cars is over 40. But they have two sons, both of whom are autistic, and whether it’s utilities, insurance, taxes, or yes, groceries, everything keeps getting more expensive.

“I’ve noticed the grocery bill had pretty much doubled about three years ago,” Monica said. “It would cost about $120 for a week’s worth of groceries for us. And the last couple of years, I’ve been spending about $240-$250 for groceries for one week, generally buying the same stuff.”

That’s even after splitting their grocery strips to different stores around Bowie, taking advantage of lower costs for certain goods and coupons at other stores.

“You really notice how fast the money is going, and how you have to make cuts,” Daniel said.

It’s an anxious feeling, shared by families all over the D.C.-area. Even those that do everything right still might struggle. But no matter what your income is, oftentimes, families don’t have the best plan in play.

Make and track your budget

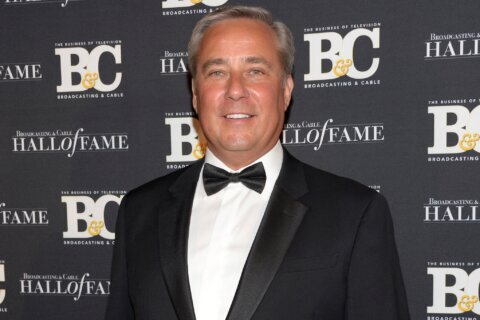

“Most people don’t have budgets,” said John Bell, the owner and lead financial planner at Free State Financial Planning in Maryland.

Closely track your budget, and “at least then you know where your money’s going, and you have a chance to then redirect it or use it in the way that you want to use it. Clarity helps a lot, because if you understand where your money’s going, you can then be intentional about making changes to it,” Bell said.

Most planners will recommend what’s called the 50-30-20 rule — a simplistic way of dividing your income, though one that’s a little trickier in high cost of living places, like this one.

“The idea is you spend about 50% on your needs, which is housing, electricity, food, student loans — things that are for lack of better word, nondiscretionary,” Bell said. “You have to spend them to survive.”

“Then you use the other 30% for wants. And those 30% wants could be things like vacation, eating out, sports, activities, whatever it might be,” he added. “Then the last 20% is in savings.”

With housing and utilities having soared in recent years, he concedes 50-30-20 might not work well for everyone.

“Where housing is more expensive than other areas in the country, you might spend more than the recommended amount,” Bell said. “Maybe it’s 70% that you need to do for your needs … and then you maybe say, ‘Well, only 10% is wants, or maybe all I can do is put together, put in 10% into my savings accounts.'”

Apps can help track spending

Bell said there are mobile apps that can help you effectively track your spending, designed to encourage you to make the right, and sometimes, difficult choices.

Someone who is good with spreadsheets can set their own tracking plan up and see where they might need to adjust their spending. And in severe cases, some financial planners like Bell will offer their work at a discount or even pro bono to help get someone going.

“If you start very small with measurable steps, then you can make progress,” said Bell.

Get breaking news and daily headlines delivered to your email inbox by signing up here.

© 2025 WTOP. All Rights Reserved. This website is not intended for users located within the European Economic Area.