WASHINGTON — Virginia should raise a variety of taxes and dedicate that new money to keeping up or expanding transit systems across the state, according to the final report of a panel tasked with figuring out a solution to the commonwealth’s transit capital funding issues.

The Transit Capital Project Revenue Advisory Board report, dated last week but due to be presented to the Commonwealth Transportation Board Tuesday, suggests a combination of new taxes that gradually ramp up over coming years to help address $1.3 billion in needs over the next decade that are not funded today.

Even more money could be required to keep Metro from deteriorating further, since Metro now aims to complete more than $6 billion in capital projects over the next six years, rather than the $5 billion that had been factored into the revenue board’s analysis.

Even the most limited maintenance plans would lead to a $500 million gap statewide over the next decade while cutting bus and rail services, which the report finds would add to traffic on Virginia’s roads. A more expansive plan, one that would allow for maintenance and some additional contingencies and service expansion, would leave an estimated $2 billion statewide gap over 10 years.

The seven-member advisory board, representing statewide transit interests and local government leaders, believes most of the new money they are recommending to close at least the $1.3 billion gap (about $130 million per year) should be raised and prioritized statewide, with some additional region-specific taxes allowed in areas such as Northern Virginia. The board had signaled over the last few months that it would recommend tax increases.

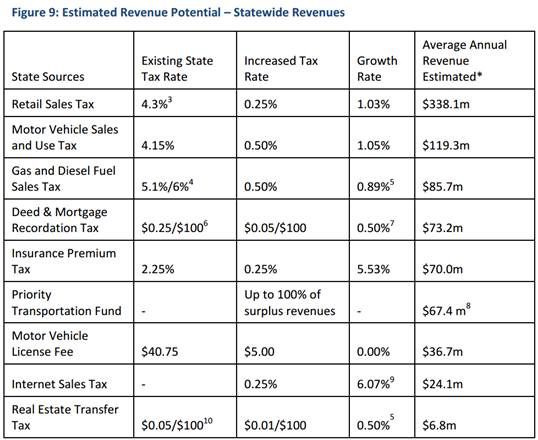

Statewide proposals include raising the retail sales tax rate 0.25 percent to an effective 5.55 percent in most of the state or 6.25 percent in Northern Virginia and Hampton Roads, raising the sales tax rate on cars 0.50 percent to 4.65 percent, raising the statewide gas tax rate 0.50 percent to 5.6 percent, raising the deed and mortgage recordation tax by five cents per $100 to 30 cents per $100 of assessed value, raising the insurance premium tax 0.25 percent to 2.25 percent, using a possible future surplus in the Priority Transportation Fund, adding $5 to a driver’s license fee, using a future 0.25 percent sales tax on online purchases if approved by Congress, and adding one cent per $100 to the real estate transfer tax.

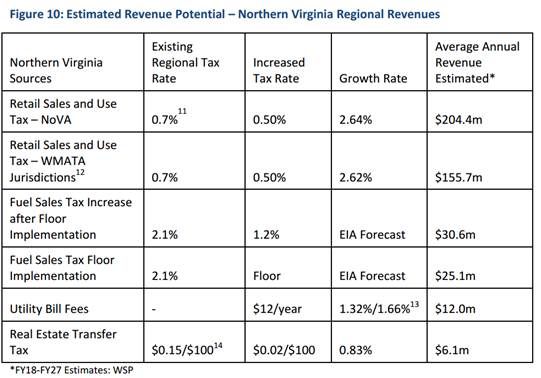

In Northern Virginia, the panel suggests looking at raising the additional regional sales tax rate from 0.7 percent on top of the statewide rate to 1.2 percent across the area or just in jurisdictions served by Metro, implementing a floor on the regional gas tax and possibly raising the regional gas tax from 2.1 percent to 3.3 percent, adding $12 per year to utility bills, and adding two cents per $100 to the real estate transfer tax. Similar taxes are suggested for consideration in the Hampton Roads area.

The various proposals would be combined to raise an estimated $130 million to $140 million in additional revenue each year statewide.

In Northern Virginia, the local money could largely be dedicated to Metro if a regional agreement is reached. If current formulas are followed, the recommended half-percent increase in the retail sales tax combined with raising the regional gas tax could provide Virginia’s share. Other transit agencies like Virginia Railway Express and bus systems that provide local and commuter bus services have significant needs as well.

Under the advisory panel’s proposals, at least 80 percent of all transit capital funding in the state should be directed only to maintaining a state of good repair for or minor enhancements of transit systems, while the other 20 percent could be used for major expansions when warranted. The state funding typically requires that additional money be put up by local governments for things like new vehicles or maintenance projects.

Statewide, the board notes the number of transit trips rose 33 percent between 2005 and 2015, to more than 200 million total trips each year across Virginia’s 44 public transit agencies.