Search

Showing 8791-8805 of 12954 for "taxes " Weed in D.C. -- what's legal, what's not

15 ways to save for vacation

5 Things Newlyweds Need to Know About Taxes

Md. offers health care enrollment extension

7 Ways to Take Bulk Buying Beyond Costco

The Costs and Benefits of the Blended Family

The Cheapest Place to Buy Property in the Americas

3 Ways to Save Money on Every Purchase

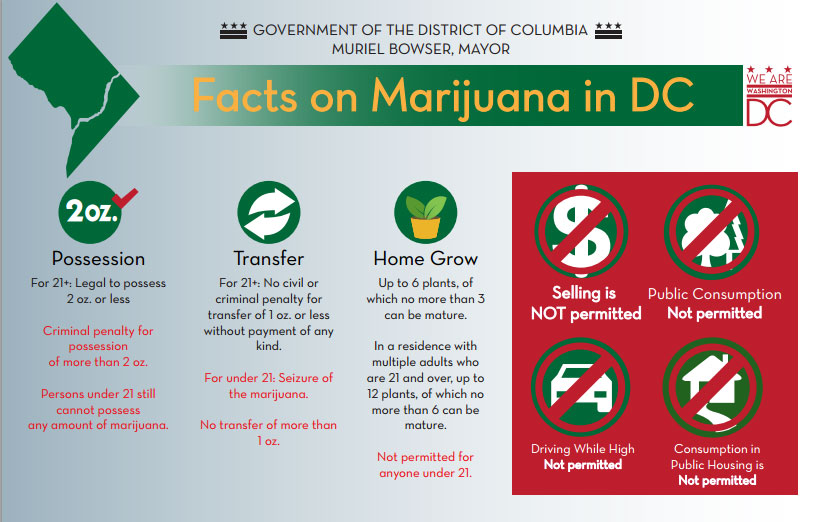

Weed in D.C. -- what's legal, what's not

15 ways to save for vacation

5 Things Newlyweds Need to Know About Taxes

Md. offers health care enrollment extension

7 Ways to Take Bulk Buying Beyond Costco

The Costs and Benefits of the Blended Family

The Cheapest Place to Buy Property in the Americas

3 Ways to Save Money on Every Purchase

Why your web surfing will get faster within weeks

Living Abroad? Expat Taxpayers Face Special Challenges

Adopting Through Foster Care: a Less Expensive Alternative

What happens if you don't pay your taxes?

In Virginia, the fight for more transportation funds

Tax data shows D.C. is the place for singles with no kids

Excited About That Big Tax Refund? Think Again.

Why your web surfing will get faster within weeks

Living Abroad? Expat Taxpayers Face Special Challenges

Adopting Through Foster Care: a Less Expensive Alternative

What happens if you don't pay your taxes?

In Virginia, the fight for more transportation funds

Tax data shows D.C. is the place for singles with no kids

Excited About That Big Tax Refund? Think Again.