WASHINGTON — If Amazon chooses Montgomery County for its second headquarters, it would add more than $17 billion to Maryland’s economy, bring in $7.7 billion in wages and deliver more than $750 million in new tax revenues, a new report from the Maryland Department of Commerce finds.

The report came out just before hearings in Maryland’s General Assembly where lawmakers started considering a $5 billion package of incentives for the tech company, which is considering 20 locations for its headquarters.

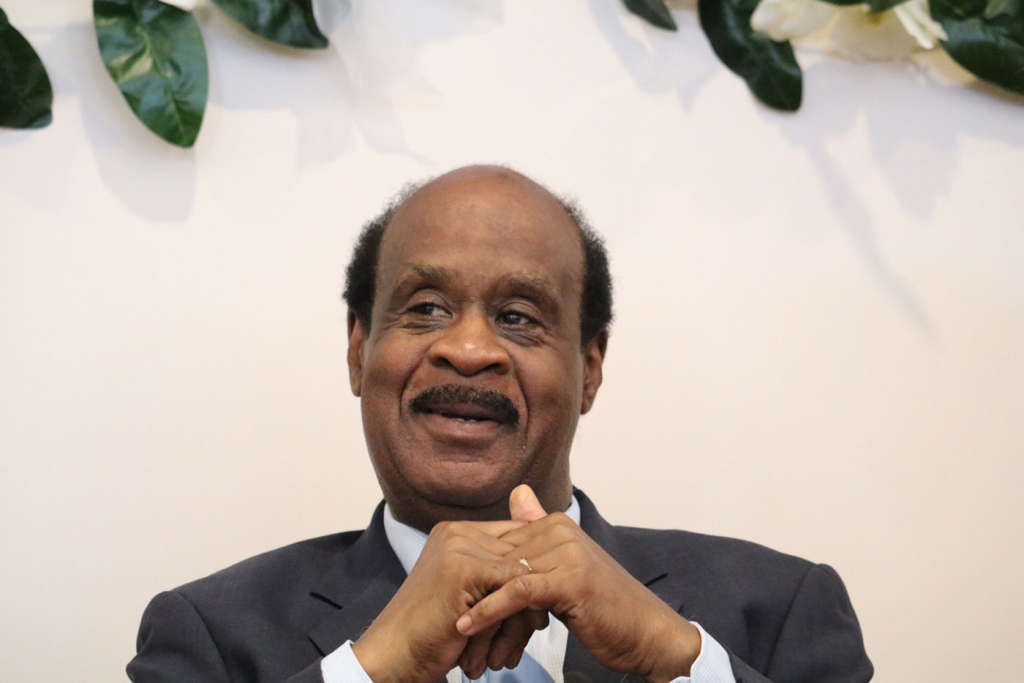

Montgomery County Executive Isiah “Ike” Leggett testified before General Assembly House and Senate committees, encouraging lawmakers to back the incentives.

“We don’t take this on lightly,” Leggett said. “This helps the entire region, and more importantly, it helps the entire state.”

Leggett was joined by Maryland Commerce Secretary Mike Gill, whose department just unveiled a report claiming the headquarters would add more than $17 billion to the state’s economy each year.

Among the economic benefits, Amazon’s headquarters would bring more than $7 billion in new annual wages, according to the report. Amazon has said the headquarters would offer 50,000 high-paying jobs.

“Total economic impact may turn out to be far larger than the estimates in this analysis suggest due to shifting economic structure,” the report states.

According to the report:

“If Amazon selects Montgomery County, it will be because of the county’s combination of astonishing institutional strength, phenomenal schools, diverse and highly educated population, and proximity to the nation’s capital. Other Maryland communities stand to be large beneficiaries, which Amazon’s presence ultimately expected to support more than 101,000 net new positions and nearly $7.7 billion in annual employee compensation in the study area. State of Maryland tax revenues will be enhanced by nearly $500 million/annum.”

“I’m tremendously enthusiastic about this possibility,” Gill said. “If Montgomery County wins, every corner of the state of Maryland wins — and wins significantly.”

Gill called the headquarters a “once in a couple of generations opportunity.”

In addition to jobs, Amazon’s presence would likely lead to more foreign visitors, fuel more international flights and potentially stimulate more exports from the state.

In January, Maryland Gov. Larry Hogan announced specific details about the state’s $5 billion incentive package.

The “Promoting ext-Raordinary Innovation in Maryland’s Economy” — or PRIME — Act provides state income tax credits equivalent to 5.75 of wages for each job created at the new Amazon headquarters. The credits would apply to jobs created within the first 17 years of the project that pay between $60,000 and $500,000.

It clears the way for more than $3 billion in tax credits for Amazon and a pledge to spend at least $2 billion more on road, transit and infrastructure upgrades.

In a statement, Hogan said the second headquarters “is the single greatest economic development opportunity in a generation, and we’re committing all of the resources we have to bring it home to Maryland.”

The legislation would technically apply to any Fortune 100 company that spends $5 billion to create a new headquarters in the state and employs at least 40,000 employees.

However, those criteria line up with what Amazon has already promised. The law’s acronym — PRIME — also mirrors the name of the popular Amazon subscription service.

Montgomery County is in competition with Northern Virginia and D.C. for the headquarters/

Other cities on the short list include Austin, Texas; Atlanta, Boston, New York City, Los Angeles, Pittsburgh and Nashville, Tennessee.

“This is a very, very competitive process,” Gill said.

The report does not look at the downsides of Amazon choosing Montgomery County, which could include the need for more housing and the need for an improved transportation network.