This is the second article in our series, Money Matters.

The last year has seen interest rates rise for consumers on loans of all types, including mortgages and car loans. And as home prices and car prices have also gone up, high interest rates sting more.

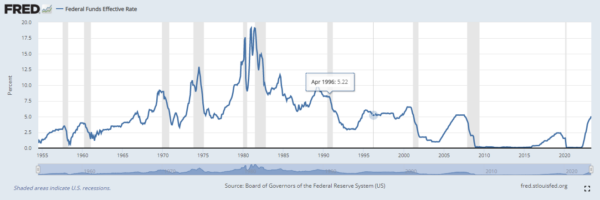

For about a decade, interest rates were unusually low — until early 2022 — and “we got used that,” says Jeff Bentley, president and CEO of Northwest Federal Credit Union.

The Federal Reserve has been raising rates in the wake of the COVID-19 pandemic “to slow down the economy so that they have an impact, a negative impact, on reducing inflation,” Bentley explained. And, he added, the Fed may not be done raising the rate.

But credit unions like Northwest Federal may be able to help customers manage their banking loan needs despite the elevated interest rates, he said.

“Credit unions are more focused on helping and less focused on profit,” Bentley said. “Because we don’t have the same targets from a profitability perspective, we can take those profits or potential profits and put them back into our loan products.”

What that means is that credit unions are often able to offer lower auto loan rates, lower mortgage rates and higher savings and deposit rates than other lenders, he said.

Despite the sting, current rates remain historically low

Although interest rates are higher now than in the recent past, the May 2023 rate of 5% to 5.25% remains far below the rates seen during 1970s and 1980s. Bentley recalled when former Fed Chairman Paul Volker pushed interest rates toward 20% in June of 1981.

In the last few years, low housing inventory has kept home prices high. Bentley pointed to the chip shortage that resulted in low car inventory on dealer lots for the bump in car prices. The combination of pricing inflation paired with the elevated interest rates of the past year make the recent rates more painful for people, he acknowledged.

As for what the future will bring, nobody has a crystal ball, but Bentley said interest rates could go slightly higher. His advice: “If you’re waiting for rates to come back down, it’s probably not going to happen anytime in the near, near term. So, go ahead and pull the trigger.”

The lending requirements for a credit union are essentially the same as those of banks. Bentley said that although “it’s not always all about the rate,” Northwest Federal’s rate is quite competitive.

And the same applies to mortgage loans. Many organizations will quote a rate and then a buyer can negotiate that rate down. But beware: That lower rate often requires a large upfront payment going in, Bentley said.

“With our focus on helping people,” he said Northwest Federal offers a 100% loan finance option. “We [also] have a 97% loan finance option with varying rates. We have a jumbo product. We have a 30-year fixed and a 15-year fixed.”

He cautioned against paying large upfront fees for processing or other services, because those fees can add up quickly and affect the overall purchase price of a home or car.

“Even though you might get an eighth point better rate, in the long run, you’re going to be paying a lot more because you ended up paying fees you didn’t really need to.”

To read more articles and listen to the full discussions in the WTOP Money Matters series, click here.

Northwest Federal Credit Union is federally insured by NCUA and an Equal Housing Lender. Visit nwfcu.org/loans/mortgages for details about pricing, fees, terms and payments.”