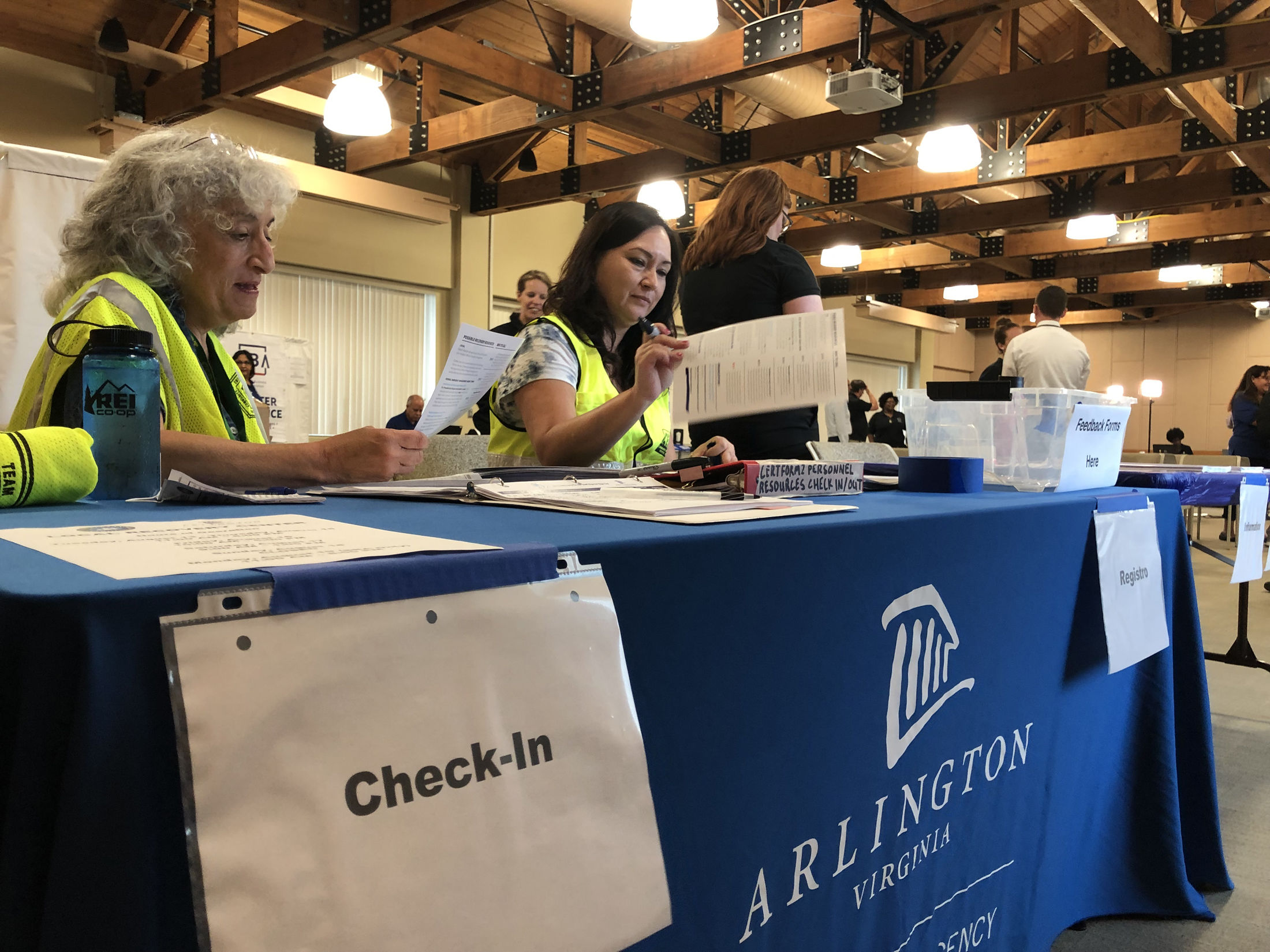

The flooding that swept through the D.C. area on July 8 left so much damage that the federal government is offering low-interest disaster relief loans. Homeowners, renters and businesses can apply for help and seek county services at one of three recovery centers across the region.

Businesses of all sizes and nonprofit organizations can borrow up to $2 million for physical damages, with interest rates that can be as low as 4%.

“And businesses may be able to qualify for [loans to cover] up to $2 million worth of economic loss,” said Aaron Miller, director of Arlington County’s Department of Public Safety Communications and Emergency Management.

Personal property disaster relief of up to $40,000 can apply to things such as vehicles, clothing and furniture. Homeowners are eligible for up to $200,000 for repairs at interest rates as low as 1.938 percent.

“Our goal is: There’s no wrong door, and we want to help however we can,” Arlington County’s Hannah Winant said. “Here we have everything from immediate crisis assistance — you may qualify for financial help with things like food or rent in the immediate response to the July 8 severe storms.”

Flood victims also can get advice on repairs, permits, zoning and human services needs, such as mental health or other social services.

Recovery centers are closed Sunday, but otherwise open through Monday, Aug. 19, in Fairfax County and Arlington County, and through Wednesday, Aug. 21, in Montgomery County, where visitors will need to present a government-issued photo ID and go through security.

To be eligible to apply for federal disaster loans, people must live in D.C.; Arlington, Fairfax or Montgomery counties, or in the cities of Alexandria or Falls Church.

Editor’s note: This report has been corrected to include the residence requirements.