Students are digging deep into financial literacy courses offered after school and during lunch in Montgomery County, Maryland.

Whitney Ramirez, with Diapers 2 Deposits, is the program director for the “Cash Out” sessions, which are offered at four middle schools and five high schools in Montgomery County.

Students sign up for the free sessions through Excel Beyond the Bell, a department of recreation program.

Ramirez told WTOP, upon entering the one-semester program, many students know how to transfer money on their phones using apps, but that, “They don’t know how to necessarily open up an account, they don’t know much about budgeting.”

The sessions teach the fundamentals of personal finance, with a focus on what students tell instructors they are most interested in learning.

The middle school students jump feet first into the investing module.

“Believe it or not, the middle school students have the most questions when it comes to what companies they should invest in and then honing in on what companies they believe are going to be around for years to come,” said Ramirez.

Students are offered $10,000 of imaginary money to invest. The money is virtual, but the intensity of buy-in from the students is real, said Ramirez.

At the very next session after making their investments, Ramirez said students had a single question: Could they check their portfolios?

“So, we had to stop in the middle of class and let everyone check their portfolios,” she said.

High school students get a slightly different emphasis in their financial literacy journey. Ramirez said they’re taught, “what does a budget look like, how to draft up a budget after college, and then it’s really heavy on proper credit card usage.”

Ramirez explained understanding credit is vital for students, especially as they consider future purchases such as buying cars and paying for college. Ramirez said many students have their first experience with credit when they are offered cards on a college campus.

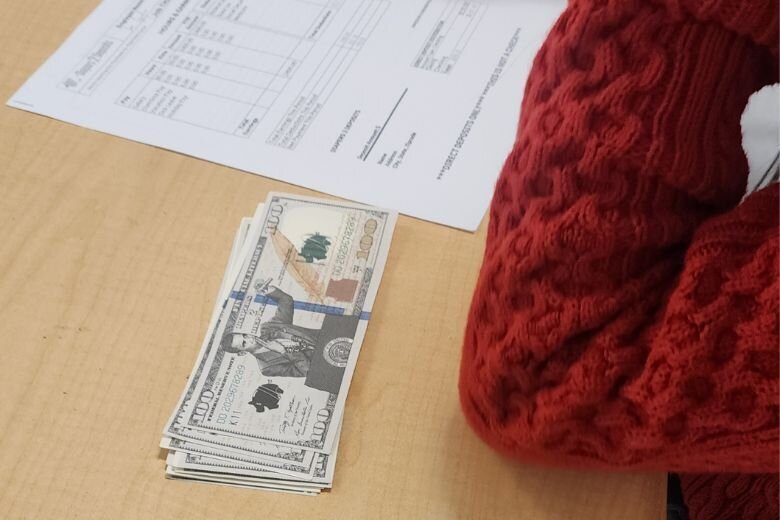

One of the exercises starts with the offer of a virtual $10,000. The students are told they can have it, and spend it, over a period of a year. The excitement is palpable as kids dream of ways they would spend their windfall.

But then it’s explained to them that they have to pay it back — with interest.

In this scenario, that comes out to be $13,000. Ramirez said that’s when the students hand the money right back.

“And we’re like, ‘What’s the problem, you’re not taking my offer?’ and the students often reply, ‘No, we’re not taking that offer, that sounds crazy,'” Ramirez said.

Ramirez said the CashOut program is currently being piloted, but she’d like to expand it. And she wants the financial literacy programs to start younger, by fourth or fifth grade.

Feedback from the students has been positive, Ramirez said, with one high school student telling her, “Miss R, you should have caught us before we got our first paycheck.”

Get breaking news and daily headlines delivered to your email inbox by signing up here.

© 2024 WTOP. All Rights Reserved. This website is not intended for users located within the European Economic Area.