This article was republished with permission from WTOP’s news partner InsideNoVa.com. Sign up for InsideNoVa.com’s free email subscription today.

This article was written by WTOP’s news partner InsideNoVa.com and republished with permission. Sign up for InsideNoVa.com’s free email subscription today.

Stratford University, the for-profit college whose abrupt closure last year left hundreds of students without a clear path to a degree, officially filed for Chapter 7 bankruptcy earlier this month.

In Feb. 2 filings with the Eastern District of Virginia’s bankruptcy court in Alexandria, the defunct college claims to hold $696,241 in assets but over $8.5 million in debt. According to the filings, $2.2 million of that debt is owed to the U.S. Department of Education for loans that the department had to discharge because of the school’s closure.

Creditors have until May 12 to file proof of claims.

The university quickly shuttered last September after its accreditor, ACICS, was decertified by the U.S. Department of Education for failing to meet federal standards, and Stratford failed to find a new accrediting institution. The decertification meant that Stratford – which at the time operated campuses in Woodbridge, Alexandria and Baltimore – could no longer accept federal student loans, the main revenue source for for-profit colleges.

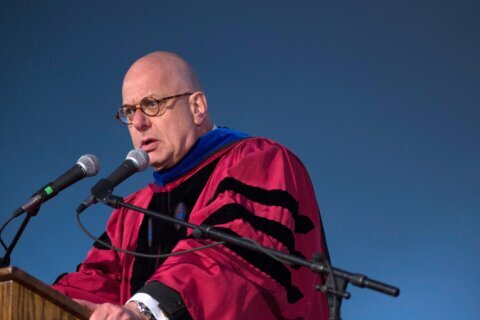

At the time, Stratford President Richard Shurtz said that without that revenue, the college could not continue to operate. The college referred its roughly 800 nursing students to other nearby for-profit colleges to transfer, but representatives for those colleges said that most of their credits would not transfer with them. As a result, students were set back years – and out thousands of dollars – in their pursuit of a nursing degree. Some told InsideNoVa that they’d given up on nursing altogether, even as the nationwide shortage of nurses persists.

The filings detail what Shurtz and Stratford’s trustees claim are the college’s remaining assets: about $475,000 spread between two checking accounts and one bond account, $174,000 in office furniture and fixtures, $36,000 debts owed to the college and $10,000 in other inventories, including what the filing calls “graduation regalia & supplies.”

The documents also list the 120 unsecured creditors the university has counted so far, with more certain to make claims before the May deadline. The college claims to owe the DOE and the U.S. Department of Treasury over $2.2 million and $621,000, respectively, for “loans.” It also lists over $1 million in unpaid rents for its two Northern Virginia locations and $375,000 for its terminated lease in Glen Allen, where the college ran a campus until 2019.

Shurtz also lists himself and his wife, Mary Ann Shurtz, as the biggest creditors, claiming that the university owes the couple – who served as president and vice president of Stratford – $2.5 million for eight promissory notes. If the court finds their claim legitimate, it could mean that Stratford’s president and vice president get the biggest sum in their own college’s liquidation.

The filings also shed light on payments to university insiders in its final year of operation. The college paid out over $30,000 in stipends to seven trustees in 2022, but the biggest financial recipients from the business were the Shurtzes. Though the filing doesn’t differentiate which expenses were Richard’s and which were Mary Ann’s, the filings for 2022 alone show over $18,000 in lease and insurance payments for the Shurtzes’ cars, over $4.7 million in loan payments and “collateral return” to EagleBank on behalf of the Shurtzes, and over $330,000 in business credit card payments. Richard and Mary Ann were paid $145,384.62 and $96,923.08, respectively, in salary for 2022.

At the same time, the college’s revenues were declining rapidly, falling from over $33 million in 2020 to $20 million in 2021 and $12.6 million last year, which was impacted by the closure with three months left in the year.

“Obviously, there’s going to be questions about things like [the money going to the Shurtzes],” Tal Franklin, an attorney representing some former Stratford students, told InsideNoVa., “where somebody … took tuition for not delivering a product. Seems to me like it it would be a better use of funds than paying for his car or whatever he was doing, to actually pay for the education or to refund that [tuition money].”

Franklin, who’s represented other students in lawsuits against for-profit colleges that closed, said he and his colleagues are considering whether to bring litigation against the university and its Board of Trustees. His firm had already begun representing students in arbitration cases brought against the college, but all civil cases are automatically stayed while the bankruptcy proceeding takes place.

It’s still unclear whether the university has insurance that would cover litigation. Franklin said he’s waiting to hear if Stratford’s attorneys think the automatic stay should extend to potential action against the trustees. If they assert that the stay does extend to trustees, Franklin said he and his co-counsel will likely challenge that assertion in court.

“We’d much rather do this in a cooperative manner and, frankly, you couldn’t find a more sympathetic group of people who are asking, I think, legitimate questions about where their funds went. And time is their enemy,” Franklin said of the college’s students.