The Federal Trade Commission has a new report out on who’s more likely to report being victims of financial scams — and it’s not who you’d think.

“We oftentimes hear about grandma or grandpa getting scammed by clicking on the wrong thing online, but in this case, the FTC is saying that the reports of fraud are 25% more likely to come from millennials than age groups above 40 years old,” ABC’s Rebecca Jarvis told WTOP. “I thought this was a pretty big surprise.”

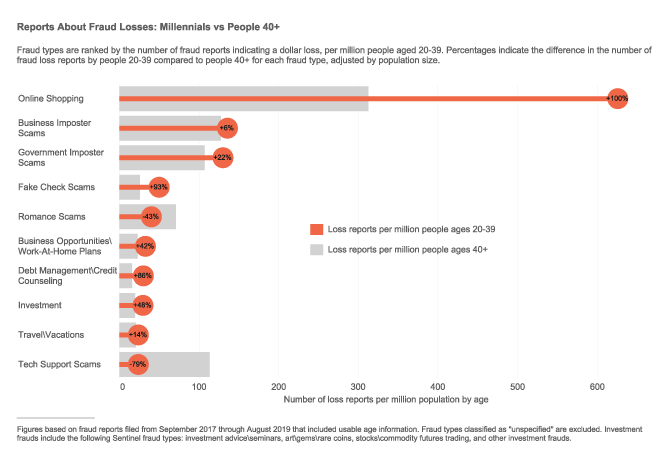

The Top Five types of fraud that affect millennials involve shopping, business impostors, government impostors, fake check scams and romance scam, according to the FTC’s report.

Millennials are twice as likely as people 40 and older to report losing money while shopping online. That includes instances of items that are never delivered or aren’t as advertised.

People in their 20s and 30s are also more likely than older people to report fraud losses on scams that promised to fix debt or promise money through jobs, investments or business opportunities. Millennials are also 93% more likely to report losing money to fake check scams.

“In 2018, consumers were duped out of $143 million because of romantic scams,” Jarvis added. “They thought they knew someone; they thought they were maybe even in love and they got scammed out of money because of that.”

According to the FTC’s report, the median individual amount millennials report losing to fraud is $400, which is a lower amount compared to what older people usually report.

“Millennials have reported losing nearly $450 million to fraud in just the past two years,” the report said. “Of that, online shopping accounted for $71 million in reported losses, and government impostor scams were close behind, with $61 million in reported losses.”

Phone calls are usually how scammers contact their victims of all ages. However, millennials report losing money to phone scams at lower rates than older people; millennials are 77% more likely to report losing money to frauds that start out as emails.

“Something that should really raise a red flag, generally, is the request for money,” Jarvis said. “Anytime you are asked for money, you should be skeptical.”

Some helpful tips to avoid scams include ceasing communication with the scammer, talking to someone you trust and researching the request.

Jarvis said asking someone you trust if what you’re dealing with sounds legitimate is a good way to gain some clarity on the situation. She added that a quick Google search can draw out results of other people that have also fallen victim to similar forms of fraud.

As for the romantic scams, Jarvis said it’s important to really know someone before giving them money.

The FTC offers tips for online shopping, how to watch out for bogus income offers and how to avoid debt and credit scams. Anyone who encounters a scam should report it to the FTC.