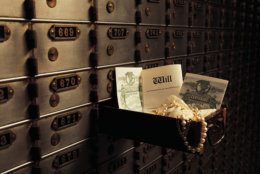

A safe deposit box is typically a well-secured storage box housed at your banking institution. Consumers lease them to store valuable objects or important paperwork.

“The main purpose of safe deposit box is to store confidential or valuable materials or documents that may be needed after your passing or that you want to keep secure and safe,” says Dawn Fabian, senior vice president and retail transformation manager at PNC.

In the age of cloud storage and digital record-keeping, a safe deposit box may seem like a relic from another era. But many consumers are responsible for certain financial papers that are difficult or expensive to replace, so having them stored somewhere safe is smart, experts say.

Considering opening a safe deposit box? Here’s what to know.

[Read: 7 Pesky Bank Fees and How to Avoid Them]

What’s a safe deposit box?

A safe deposit box is a small, secure container that’s housed at a bank. The boxes can range in size from 2 inches by 5 inches to 10 inches by 15 inches or even larger. Costumers typically rent, and prices vary according to the bank and box size. To open the box, you typically need a key. Oftentimes, the banker also has a key that is used simultaneously with yours. You’ll only be able to access your safe deposit box during bank hours.

Safe deposit boxes are a secure way to store your belongings, but they aren’t immune to major natural disasters, such as a massive flood, experts say. Plus, the contents are not FDIC-insured, Fabian says, so carrying separate insurance on your valuable belongings is a smart idea.

How much does a safe deposit box cost?

When it comes to safe deposit box costs, “it’s really a mixed bag,” says Simon Zhen, research analyst at MyBankTracker.com. Expect to pay anywhere from $40 per year for a smaller box to a few hundred dollars for larger boxes. Discounts are sometimes available for those who open a checking or savings account with the bank. For example, PNC Performance Select Checking members get a $100 annual discount on safe deposit boxes.

[Read: How to Choose a Bank]

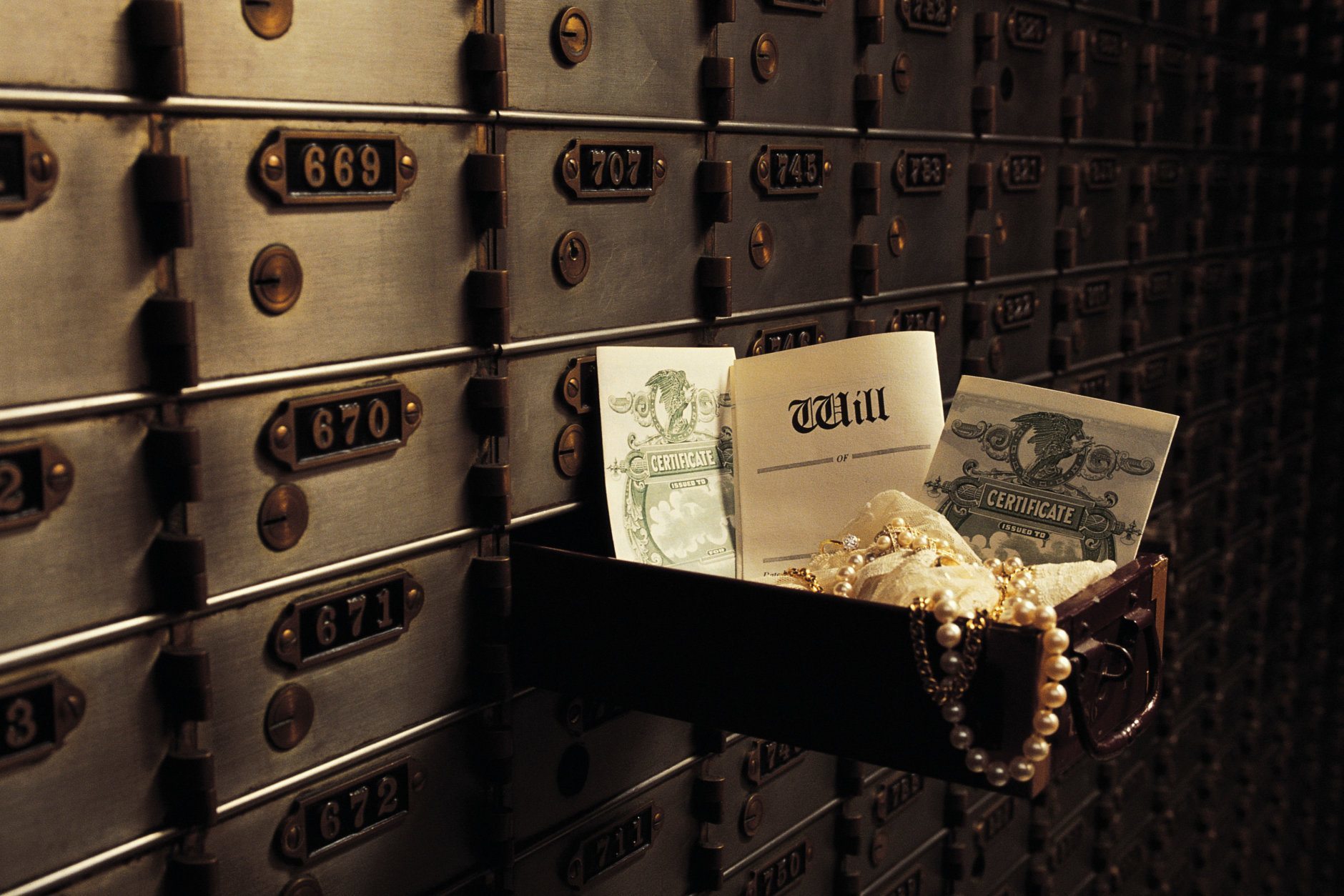

What should I keep in a safe deposit box?

You may also want to keep valuable jewelry or a coin collection in the box. But don’t forget to make sure they’re insured by your homeowners insurance or a separate rider since they won’t have FDIC insurance.

Additionally, make sure that your spouse, heirs or financial team know about the existence of the safe deposit box and what it contains, so they can make plans to access it after your death.

What shouldn’t I keep in a safe deposit box?

First, you don’t want to store documents that you may need unexpectedly, such as your passport or Social Security card. The risk is that, at the moment you need one of these documents, the bank won’t be open, and you’ll have to wait until the next morning or the start of the next week to get access.

When it comes to estate-planning documents, such as your will, the decision to keep them in a safe deposit box is a bit more complex. “We do not recommend to clients to keep wills in safe deposit boxes,” wrote Gerry Joyce, managing director and national head of trusts and estates at Fiduciary Trust Company International in New York City, in an email. Doing so may cause a “chicken and egg” scenario in which the safe deposit box can only be opened by the executor, but the executor can’t be appointed by a probate court without the original will, Joyce says. “We often prefer to see the client leave the original will with their attorney or in a fire-proof safe at home,” Joyce says.

State law determines how banks provide safe deposit box access to heirs or executors, says Jennifer Guimond-Quigley, an attorney in Chicago. “As long as the process is followed, the bank is supposed to remove the will and file it with the court,” she says. It’s worth it to check with your bank or estate-planning attorney to verify that your heirs will be able to find and access your will if it’s in a safe deposit box. She agrees that keeping a will in a sturdy safe at home, or even at your attorney’s office, may make accessing it more simple for your heirs.

The same logic applies to documents your family may need if you fall seriously ill. Living wills and medical powers of attorney should be stored in a secure place to which your family has ready access.

[See: 10 Ways to Save More in 2019.]

What are alternatives to a safe deposit box?

If a safe deposit box is too expensive or old-school for your taste, consider using an alternative. A fireproof and waterproof safe can protect your documents from a disaster or a nosy houseguest. These are available for as little as $50. Experts note, however, that unless it’s bolted to strong surface, a thief could run off with your safe and figure out how to open it off-site.

There are also ways back up the documents stored in a safe deposit box or home safe. Consider storing copies of your original documents on a safe online storage platform. Take a photo of the contents of your safe deposit box, so you or your heirs can easily reference what’s stored within, Fabian says.

The bottom line is that your heirs should be aware of — and know how to access — whichever secure method you use to store your important documents and paperwork.

More from U.S. News

8 Big Budgeting Blunders — and How to Fix Them

9 Secrets to Save Money on a Shoestring Budget

12 Useless Fees Draining Your Budget

What Should I Keep in a Safe Deposit Box? originally appeared on usnews.com