What is an IRS audit?

The IRS may choose to review a taxpayer’s accounts and financial information to ensure all tax laws are being followed. Even though the IRS only audited 0.3% of individual income tax returns in 2020, many taxpayers live in fear of a letter from the IRS questioning items on their return. “Taxpayers worried about the possibility of facing an IRS audit may hesitate to claim all the tax breaks they are entitled to claim,” says Kathy Pickering, chief tax officer at H&R Block. “When they do this, they are leaving their money on the table.”

The IRS generally has up to three years after the tax-filing deadline to initiate an audit, or up to six years if you omit 25% or more of your income. “If you are entitled to deductions or losses and you have adequate documentation to support these expenses, a taxpayer shouldn’t fear an audit, even though it might be stressful,” says Mitchell Freedman, a certified public accountant in Westlake Village, California. Here are some common red flags that can trigger a tax audit and what you can do to avoid problems with the IRS.

You didn’t report all of your income.

You’re not the only one to receive the W-2 forms and 1099s reporting your income; the IRS gets copies, too. If the numbers are different, expect to hear from the IRS. “It is almost automatic that the IRS will do a cross-check to make sure all of the income reported on Form 1099 is also reported on the appropriate lines of the tax return,” says Freedman. “If you haven’t reported income from the various forms, 1099s or W-2s, you will likely be audited.”

As you gather your tax records before you file, make sure you’re not missing any W-2s or 1099s — especially if you did freelance work for several employers or if you changed jobs in the middle of the year. “The surest way to get a letter from the IRS is to omit any amount of income from their return,” says Pickering. “The IRS can easily check income reported on tax returns against what employers, banks, brokers and others report. This is an honest mistake for many who have taken up second short-term, part-time jobs or side hustles.” Keep these records even longer than usual; the IRS has up to six years to initiate an audit if you’ve neglected to report 25% or more of your income.

You took the home office deduction.

Many people are afraid to take the home office deduction because they worry that the write-off will lead to an audit. This can be a valuable break to help cover the costs to set up and maintain an office in your home. However, not everyone who works from home is eligible; you can only take the home office deduction for self-employed work. To qualify, you must use part of your home “regularly and exclusively” for business. Your office doesn’t need to be in a separate room, but it has to be in an area of your home where you don’t do anything else. The space must also be your principal place of business or a place where you meet regularly with clients or patients.

You can deduct your actual expenses, including a portion of your mortgage interest, homeowners or renters insurance and utilities based on the area of your home that you use as an office. Keep records of all of those expenses. Or you can use the simplified option, where you can deduct $5 per square foot of your home office, up to 300 square feet, for a maximum deduction of $1,500. If you did freelance or self-employed work for a few months, you may be able to take a partial-year home office deduction.

You reported business losses.

You can deduct a lot of expenses when you have a business, but the IRS wants to make sure you didn’t set up a questionable business just to benefit from the deductions. In some years, your business can have more expenses than income, especially when you’re getting started, but the IRS gets suspicious if it never makes a profit. An audit red flag is businesses with net losses year after year, or businesses that appear to barely break even, says Timothy Stiles, chief operating officer of KPMG Spark, which is accounting firm KPMG’s online tax and accounting bookkeeping service.

If your business has a profit in three of the past five years, then the IRS considers it to be a business rather than a hobby. Otherwise, you need to take extra steps to prove that it’s actually a business. “Just because a business doesn’t meet the three-of-five-year profit doesn’t mean that a taxpayer can’t continue to deduct losses on business, but the taxpayer must be able to prove … that there is a profit motive,” says Freedman.

Keep detailed records not only of your expenses but also of your business plans. “If someone has a side hustle business and claims deductions, it needs to be a business,” says Annette Nellen, CPA, professor and director of the Masters of Science in Taxation program at San Jose State University. “There must be a profit motive ideally supported by a business plan. There must be appropriate records of revenue and expenses. For a loss over one or two years, the taxpayer needs to have a plan for how to avoid that in the future. The taxpayer needs to show they are knowledgeable about their business, such as by keeping up to date with industry trends.”

You had unusually large business expenses.

You may hear from the IRS if your business expenses are much larger than other businesses like yours. “The IRS compares deductions taken by taxpayers in the same income bracket or business type to find inconsistencies,” says Pickering.

Keep detailed records of your business expenses for at least three years after the tax-filing deadline — at least six years if you’re receiving income from a variety of sources — especially for years when you have large expenses. Take steps to separate your business and personal expenses. “Maintain a separate bank account if you are self-employed and make sure all income is deposited and expenses are paid through the business account,” says Pickering. “That way, you have a clear financial record. Keep records such as logs and calendars documenting the work you’ve done as well as receipts, so you can show the business purpose of your expenses. If you pay expenses through a credit card, it’s a good idea to have a separate card for your business.”

Another audit red flag is claiming 100% for business use of your car rather than allocating between business and personal use, says Freedman. Keep a mileage log so you can calculate the portion of the time you use the car for business, and to help defend your case if you’re audited.

You didn’t report all of your stock trades.

Stock trades are taxable when you sell the shares, unless the investments are in a tax-deferred retirement account. The brokerage firm sends a copy of Form 1099-B to you and the IRS, and you need to report the capital gains and losses on Schedule D when you file your income tax return. Investments held for less than one year are short-term capital gains and are taxed at your income tax rate. Investments held for longer than a year are generally taxed at the lower capital gains tax rate, which is currently 0%, 15% or 20% depending on your bracket. Forgetting to report information from the 1099-B or any big change in your capital gains income could lead to an audit.

“If, for example, the taxpayer’s capital gain income is typically 40% of total income, and it drops to 5% in one year, that may be a red flag to the tax auditor,” says Stiles

You didn’t report cryptocurrency payments.

The IRS wants to know about cryptocurrency transactions. This question sits near the top of 1040 Form: “At any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency?”

“Cryptocurrency is a hot-button issue,” says Roy Goldberg, a CPA in Rancho Palos Verdes, California. If you receive cryptocurrency as income or if you have a profit or loss from selling cryptocurrency, you usually need to report it.

For federal income tax purposes, virtual currency is taxed like any other sort of property, meaning the tax principles that apply to assets like stocks and bonds also generally apply to Bitcoin, Ethereum and other cryptocurrencies. And if you sell cryptocurrency, you must recognize any capital gain or loss.

Expect to hear from the IRS if you didn’t report any cryptocurrency payments they know about. “If a taxpayer has cryptocurrency transactions of $20,000 or more, he or she will receive either a form 1099-K or 1099-B. If such a form is received, the IRS will know about it,” says Freedman. “Having and maintaining a crypto wallet or a crypto tracker will enable a taxpayer to keep track of his or her transactions and provide protection from hacking, which is a big risk with cryptocurrencies.”

You made large charitable contributions.

Charitable contributions can be tax-deductible if you itemize (and in 2021, even taxpayers who take the standard deduction can still get a tax benefit for cash contributions).

But especially for itemizers, it’s important to keep good records when you donate. “If someone donated cash or noncash items to a charity in the amount of $250 or more and itemizes deductions, they can only claim that deduction if they have the required contemporaneous written documentation from the charity,” says Nellen. “It is the donor’s responsibility to get the proper letter.”

That means you can’t just get a letter from the charity years later if you’re audited; you need to have the documentation by the time you file your income tax return claiming the deduction. There are additional record-keeping requirements to substantiate large noncash donations, such as clothing, household supplies or vehicles, says Pickering. For example, you must have a qualified appraisal for noncash contributions over $5,000, in addition to the written acknowledgment from the charity.

You earned a lot of money.

The more you earn, the more likely you are to be audited. In 2019, people earning $200,000 to $1 million had an audit rate of less than 1%, but the audit rate rose to 2.4% for taxpayers earning $1 million or more. It pays to be extra careful when reporting your income and substantiating your expenses and other deductions at higher income levels. It’s a good idea to work with a CPA or enrolled agent who knows the rules and record-keeping requirements, can help if you are audited and can also do tax planning to help minimize your tax liability in the future.

You made errors.

The IRS also audits returns with basic mistakes — such as incorrect Social Security numbers and math errors. You may face extra scrutiny if you rounded the numbers for your expenses rather than using the specific dollar amounts. “Numbers entered on the return which appear to be estimates, rather than actual numbers, such as amounts entered to the nearest $100 or $1,000 appear to be pulled out of the air,” says Freedman. Check your work before you hand in your return.

What happens if you’re audited?

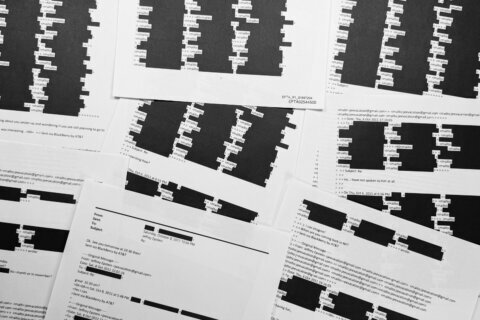

“Many audits start with a simple notification letter sent to the taxpayer,” says Stiles. “This may be automatically generated by the tax authorities, for example, when a 1099 was reported by a payer, such as a bank, but the individual doesn’t show any income from the bank on a tax return. Another example is a large transaction reported in a single year, perhaps from the sale of a home or business. The IRS typically identifies the issue and asks for a response.”

As soon as you get the letter, gather your records to make your case. “A good recommendation is to send clear, concise documentation with a simple explanation in response,” says Stiles. In many cases, that may be all you need to do.

Pickering adds that most audits are conducted by mail and resolved by sending supporting documents with an explanation. “If a face-to-face meeting is required, having a tax professional represent them could make some taxpayers feel more comfortable, prepared and knowledgeable about what to expect.”

If you worked with an enrolled agent or CPA, let them know about the audit — they should be able to help and can represent you in front of the IRS. If you filed your tax return through a tax preparer or software service, they may be able to help, too. For example, you can sign up for TurboTax’s audit defense program when you file your taxes for an extra fee.

Tax audit triggers:

— You didn’t report all of your income.

— You took the home office deduction.

— You reported several years of business losses.

— You had unusually large business expenses.

— You didn’t report all of your stock trades.

— You didn’t report cryptocurrency payments.

— You made large charitable contributions.

— You earned a lot of money.

— You made errors.

More from U.S. News

Smart Ways to Spend Your Tax Refund

Things to Do When You’re Deep in Debt

Money Moves You Will Be Thankful For

9 Red Flags That Could Trigger a Tax Audit originally appeared on usnews.com

Update 02/15/22: This story was published at an earlier date and has been updated with new information.