If you find yourself making sacrifices to ensure your housing costs are covered, you’re not alone: a new Redfin study found that roughly half of Americans are struggling along with you.

According to the study, a whopping 49.9% of homeowners and renters “sometimes, regularly or greatly struggle to afford their housing payments.”

Efforts to make sure the bills are paid sometimes entail sacrifices.

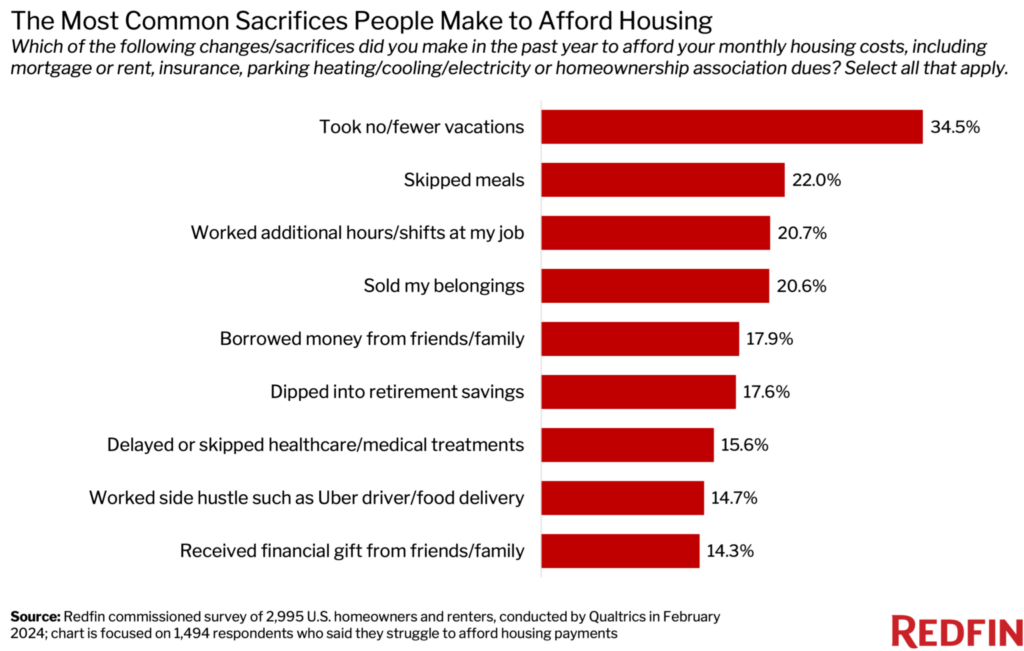

More than a third (34.5%) of those who are struggling said they skipped vacations within the last year.

For some, the sacrifices have been more significant: 22% skipped meals, 20.7% worked extra hours at their job and 20.6% sold belongings.

Some (17.9%) have had to borrow from family and friends; 17.6% have dipped into retirement savings (including 14% of Millennials); and 15.6% have either put off or skipped medical treatments.

“Housing has become so financially burdensome in America that some families can no longer afford other essentials, including food and medical care, and have been forced to make major sacrifices, work overtime and ask others for money so they can cover their monthly costs,” Redfin Economics Research Lead Chen Zhao said in the report.

“Fortunately, the country’s leaders are starting to pay attention, and homebuyers may get a reprieve in June if the Federal Reserve cuts interest rates, which would bring down the cost of getting a mortgage.”

Redfin commissioned the study, which was conducted by Qualtrics in February 2024; 2,995 U.S. homeowners and renters were surveyed. Redfin said the study focused primarily on the “1,494 respondents who indicated that they sometimes, regularly or greatly struggle to afford regular rent or mortgage payments.”

Read the full report online.

Get breaking news and daily headlines delivered to your email inbox by signing up here.

© 2024 WTOP. All Rights Reserved. This website is not intended for users located within the European Economic Area.