D.C. has the highest share of one-person households in the nation, at 48.2% of all households, according to the U.S. Chamber of Commerce. That’s considerably more than the 28.6% average nationally — and those living alone pay a price for it.

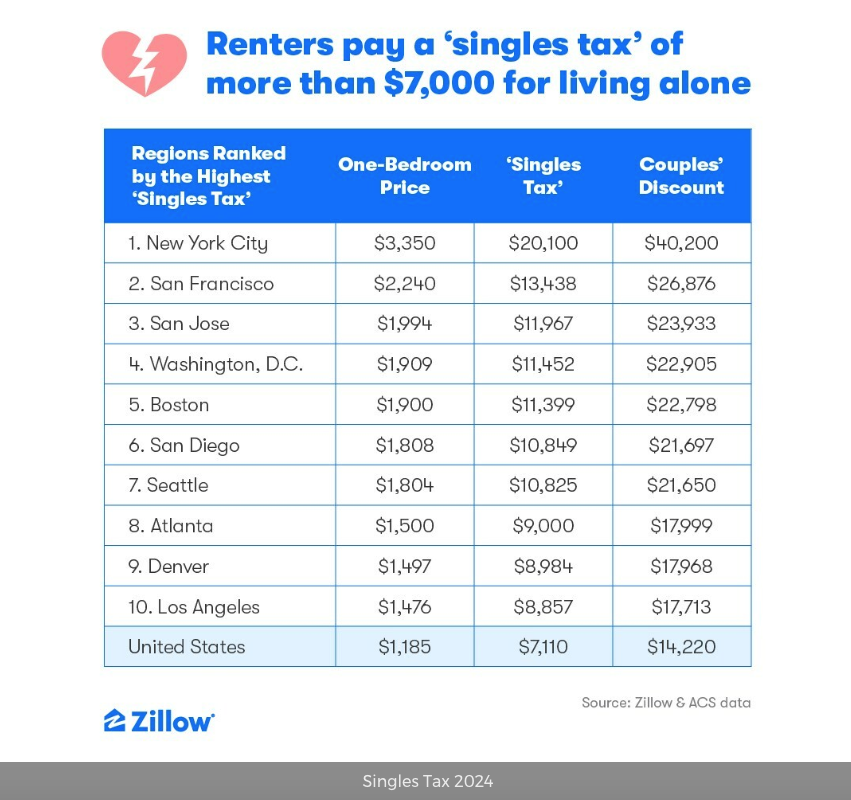

Real estate firm Zillow has calculated what it calls the “singles tax,” or the difference between housing costs for people living alone compared to those living with a spouse, partner or roommate.

In the D.C. metro area, the singles tax is an average $11,452 a year, ranked fourth-highest among metropolitan areas.

Zillow’s list is based on the average cost for renting a one-bedroom apartment — an average $1,909 a month in the D.C. area. It does not include other cost-of-living expenses that are footed by single-dweller households, such as utilities, streaming services, cable or Internet.

“Those things add up. And if you are dividing by half, then, yes, you would definitely save that money as well,” said Emily McDonald, Zillow rental trends expert.

Nationwide, the singles tax in 2024 is an average $7,110, an increase of more than $100 from last year. New York City tops the list with an average singles tax of $20,100, $600 more than a year ago.

The singles tax in San Francisco is $13,438. In San Jose, Texas, it is $11,967.

While the singles tax for single renters is among the highest in D.C., it actually hasn’t changed much from a year ago, largely because rents here have stabilized.

“It is actually down about $50 from last year, which is pretty telling about the rental market in Washington, D.C.,” McDonald said.

On the flip side, and by just reversing the math, moving in together, getting married or taking on a roommate has a “couples discount” of $22,905 combined per year in the D.C. metro, in other words, how much two people paying the rent cut their housing expense.

There are plenty of people living alone that are doing so by choice. It may not be the best financial situation, but there are trade-offs some may think are worth it.

“If you want to live alone and pay that extra price, there is definitely a benefit to it. You don’t have to worry about what you’re going to watch on TV every night. You can make your apartment exactly how you want it to be. You don’t have to worry about who is going to wash the dishes that night,” McDonald said.

Below are the singles taxes and couples discounts 10 U.S. metro areas, courtesy of Zillow:

Get breaking news and daily headlines delivered to your email inbox by signing up here.

© 2024 WTOP. All Rights Reserved. This website is not intended for users located within the European Economic Area.