The big and unexpected jump in used vehicle prices in the last two years, prompted in part by the shortage of new vehicles, is having an impact on the leased vehicle market — and those currently leasing the vehicle they drive would probably benefit from buying it when the lease is up, or sooner.

According to Edmunds data, the difference between a 2019 leased vehicle’s trade-in value and that vehicle’s residual value is an average 33%. The residual value is what is assigned to a vehicle at the beginning of the lease, and is the predetermined price for what the person leasing the vehicle can buy it for at the end of the lease, typically three years.

“Residual is a forecast. Little did they know there would be a global pandemic and that new car buyers would have to resort to shopping in the used car market,” said Ivan Drury, senior manager of insights at Edmunds. “So because of that, their expectations for what a vehicle’s value was going to be has been off by quite a bit.”

One option is to buy the vehicle outright at the residual value, continue driving it knowing it’s a great deal, and avoid the hassle of trying to buy another vehicle in the current market.

Another option is to profit from it, which would not be difficult.

“Buy out the vehicle and then sell it, either to an online retailer or someplace like CarMax or to a dealership, somebody who is going to want to buy that vehicle from you. And right now, with used vehicles being so hot, there are going to be a lot of people who want their car,” Drury said.

A third option is to use the vehicle’s value as leverage on a trade-in for another vehicle.

Drury said unless the vehicle has an exorbitant number of miles or has excessive wear and tear, just about anyone driving a two or three-year-old leased vehicle right now is guaranteed to see an increase in value.

One caveat to factor into Edmunds’ math: To buy the vehicle outright at the end of the lease means either coming up with the full amount in cash — say writing a check for $30,000 — or financing the purchase. But even with a typical down payment on an auto loan, most leasers would still come out ahead.

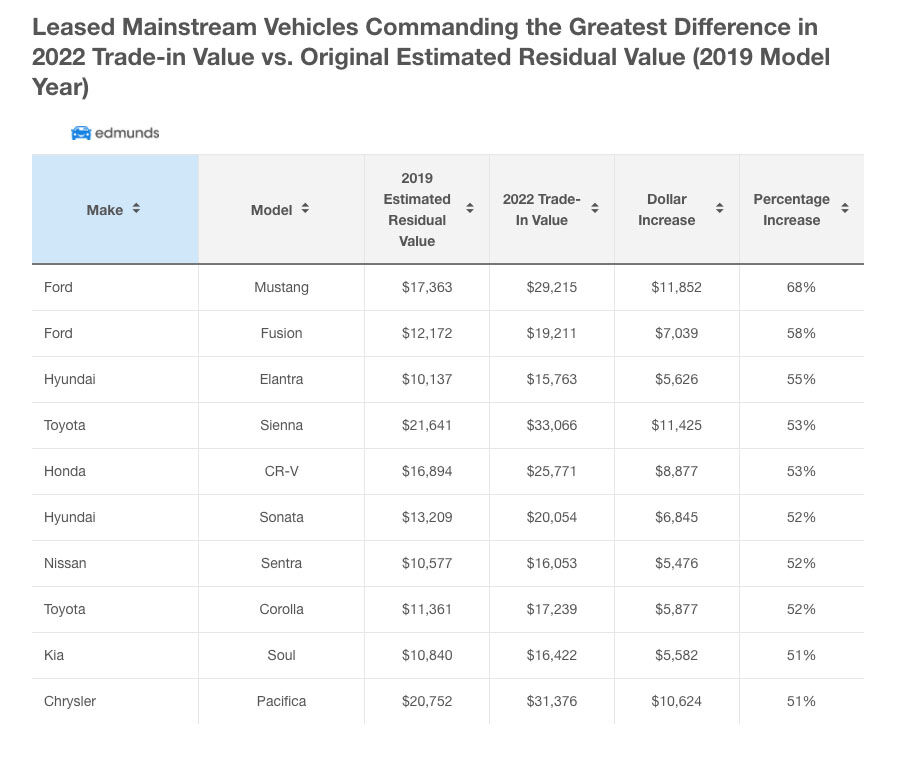

The Ford Mustang yields the highest percentage increase, generating an average 68% more than its original estimated residual value, or almost $12,000.

Among luxury vehicles, a leased 2019 Lexus IS300 has the biggest residual-to-trade-in percentage difference, at 46%, or almost $10,000.

Edmunds has a free online instant appraisal tool to see the current value of vehicles.

Here are the 10 2019 luxury vehicles with the greatest difference between trade-in value and residual value:

Here are the top 10 2019 mainstream vehicles with the greatest difference between trade-in value and residual value: