Potential homebuyers have a potent opponent in the buying market, and they’re not other families competing for the same home.

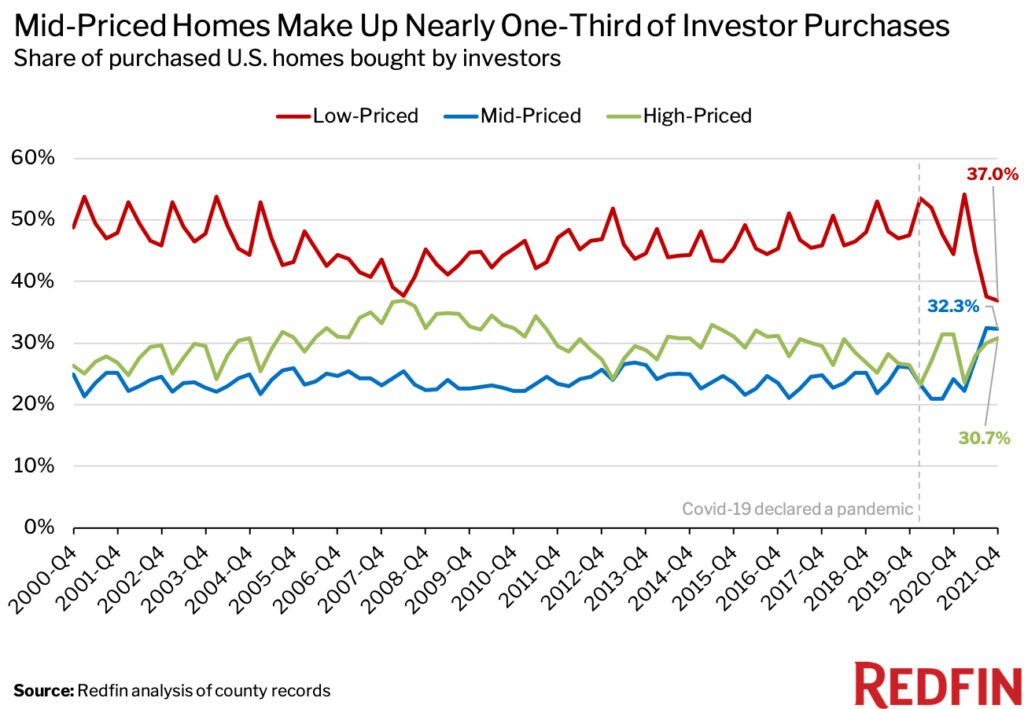

Investors bought a record 18.4% of all homes in the U.S. that were sold in the fourth quarter. That was roughly 80,000 properties, worth a total of $50 billion, according to real estate firm Redfin, which analyzed the 50 most populous metro areas.

But in the D.C. metro, investors accounted for just 7.8% of all sales in the fourth quarter, the second-lowest share in the nation, behind Providence, Rhode Island.

“It may just have to do with the profitability that investors are focused on a lot. Investors are focused on lower price points, and there aren’t a lot of affordable homes for sale in D.C.,” said Daryl Fairweather, chief economist at Redfin.

Metros with the fewest sales to investors:

- Providence, Rhode Island — 6%

- Washington, D.C. — 7.8%

- Warren, Michigan — 8.2%

- Virginia Beach, Virginia — 8.6%

- Montgomery County, Pennsylvania — 8.6%

Even so, investor buyers in the D.C. region snapped up almost $952 million in homes last quarter, at a median price of $425,000, among the highest paid per property when compared to the top 50 metros.

Investors often have the advantage of cash, and they are buying properties for several reasons. One is to chase rising rental rates. They prefer single-family homes, and that is a category of rentals that has been rising sharply.

Another reason they are buying is to cash in on the surge in vacation rentals, such as Airbnb and VRBO. And these investors aren’t all big institutions.

Owning such a property and renting it out at high weekly rates can be more lucrative than a yearly lease with one family. But it can be a headache, even with a management company doing some of the heavy lifting, such as bookings, bookkeeping and guest relations.

“Anybody who is thinking about becoming an investor, I would advise them to really research how many hours it will take to manage a property, what things can go wrong, and if you have tenants rotating regularly, I think you should expect a little more wear and tear, and those costs could add up,” Fairweather said.

Among the cities seeing the biggest increase in investor purchases is Baltimore, which saw an 83% increase in investor buys in the last year. The median price of a property bought in Baltimore was $150,000.

Investor buyers also are flocking to Sunbelt states.

According to Redfin, investor buyers in the Florida cities of Jacksonville, Miami and Fort Lauderdale made up 29.8%, 27.5% and 21%, respectively, of all home sales in the fourth quarter. Investor purchases in Jacksonville last quarter were up 157% from a year earlier.

Redfin’s full report on fourth quarter investment buyer report is online.