The Federal Housing Finance Agency has set conforming loan limits for 2022, or the maximum amount of a mortgage Fannie Mae and Freddie Mac are allowed to purchase.

For high-cost housing markets including much of the D.C. area, it will be $970,800.

High-cost areas are determined by local home values where 115% of the local median home value exceeds the baseline limit. In 2021, the high-cost area limit was $822,375.

The baseline limit for 2022 will be $647,200, up significantly from the 2021 conforming loan limit of $548,250.

FHFA resets conforming loan limits annually, based on the year-over-year change in median home values between the third quarter of 2020 and the third quarter of 2021.

In the D.C. region, the high-cost limit applies to D.C., as well as Calvert, Charles, Frederick, Montgomery, and Prince George’s Counties in Maryland, and Arlington, Clarke, Culpepper, Fairfax, Fauquier, Loudoun, Prince William, Rappahannock, Spotsylvania, Stafford, Warren, counties in Virginia. It also includes the Virginia cities of Fairfax City, Falls Church City, Fredericksburg City, Manassas City, and Manassas Park City.

The high-cost limits apply to dozens of counties across the country. It also applies to all of Alaska, Hawaii, Guam and the U.S. Virgin Islands that, at minimum, are 50% above the country’s baseline limit.

About 95% of U.S. counties have been assigned the baseline limit for 2022.

FHFA also sets conforming loan limits for two, three, and four-unit multi-housing dwellings as well, all of which will rise next year.

The new conforming loan limits for Fannie Mae and Freddie Mac are effective Jan. 1, 2022.

While home values have seen periods of annual declines, by statute, FHFA’s baseline loan limits do not decrease. They remain the same until a recovery in home values has made up for the decline. That last happened in 2006, and conforming rates remained the same until 2017, the first increase in several years.

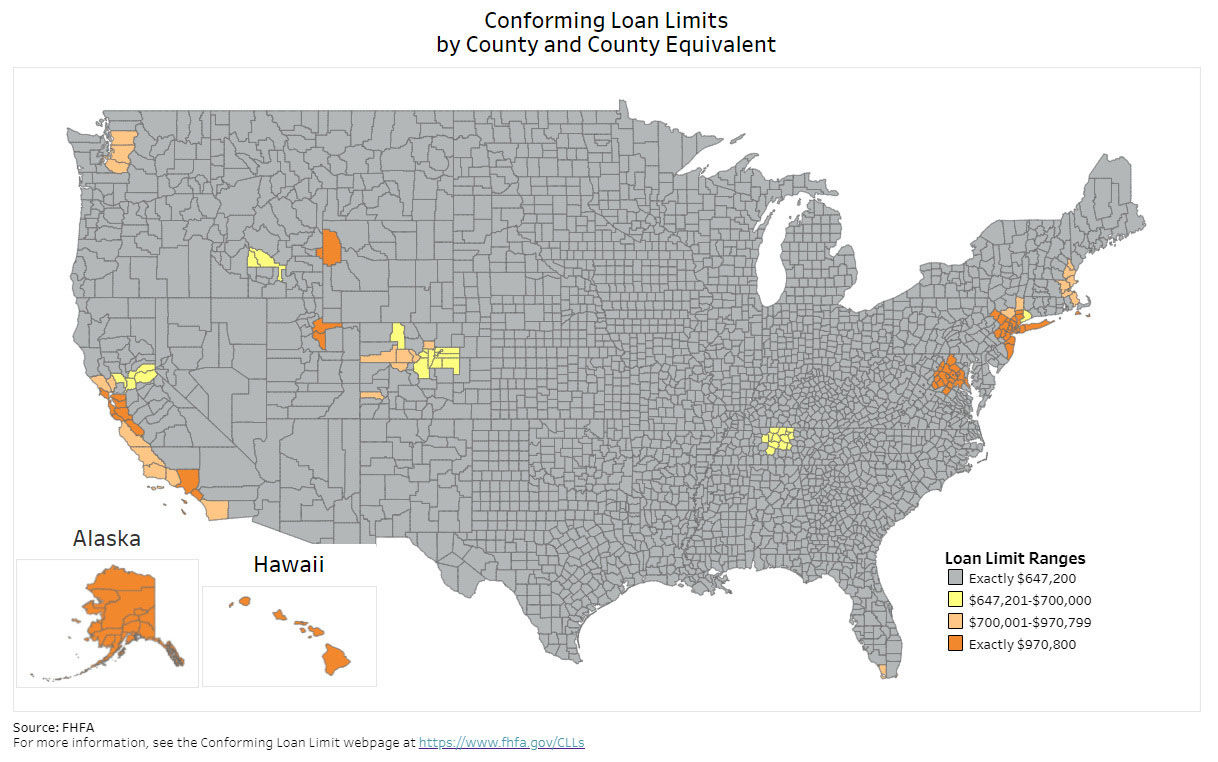

Below is a map of counties where baseline conforming loan limits are in place for 2022, and where incrementally-increased conforming loan limits are in place, courtesy the Federal Housing Finance Agency: