Apartment rents in the D.C. metro plunged in 2020 and vacancy rates soared as many renters financially impacted by the pandemic moved home, doubled or tripled up with roommates or downsized. Now the opposite is happening.

Commercial real estate research firm Delta Associates reports average rents for all apartment classes in the third quarter in the D.C. metro were up 7.6% from a year earlier. For Class A apartment properties, or higher-end, amenity-rich buildings, average rents are up 9.1%. Many of those Class A properties are all the new buildings that have come on the market in recent years.

Well-paid renters want and can afford those amenities, but Delta Associates says demand may have to do with the pandemic.

“The idea of moving into a brand new apartment that no one has lived in before, has its appeal for people looking to relocate during the pandemic,” said Will Rich, president at Delta Associates.

The D.C. region’s hottest apartment markets based on demand, and how quickly apartment buildings lease up, tend to be where that new construction has been.

“In the Washington area, the areas near the Capitol Riverfront and Southwest Waterfront, that part of the city, as well as the NoMa H Street corridor. And in Northern Virginia the Rosslyn Ballston corridor is pretty hot,” Rich said.

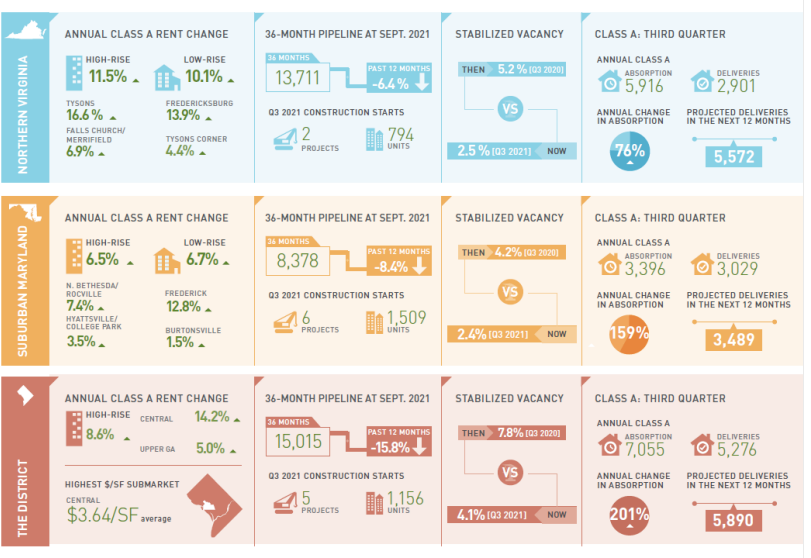

The hottest market in Northern Virginia right now is Tysons, where Class A rents in the third quarter were up 16.6% from a year ago.

Class A absorption continues to set record breaking numbers with 16,367 Class A apartment units leased between the third quarter of 2020 and the third quarter of 2021, according to Delta Associates. Another 19,355 Class B units were leased.

The growth in rental activity in the D.C. metro is also pushing vacancies lower, at 2.6% in the third quarter.

Developers continue to add residential projects. Over the next 36 months, more than 37,000 apartment units are expected to deliver, although that is a smaller pipeline than one year ago.