WASHINGTON — Mortgage rates have been holding steady or moving lower for eight straight weeks now, and 30-year rates hit a nine-month low this week.

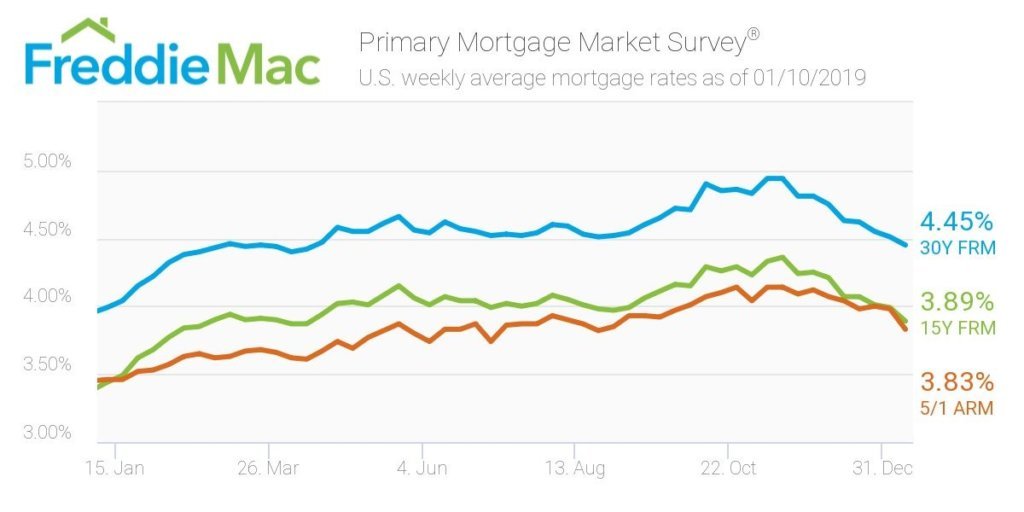

Freddie Mac says the average rate on a 30-year fixed-rate mortgage this week was 4.45 percent, down from 4.51 percent last week. Two months ago, 30-year rates were flirting with 5 percent.

“Mortgage rates fell to the lowest level in nine months, and in response, mortgage applications jumped more than 20 percent,” said Freddie Mac chief economist Sam Khater.

“Lower mortgage rates combined with continued income growth and lower energy prices are all positive indicators for consumers that should lead to a firming of home sales.”

Mortgage rates are still higher than they were a year ago, but the gap continues to close. Thirty-year rates averaged 3.99 percent a year ago at this time.

Lower rates, prompted by falling 10-year treasury yields, may further a recovery momentum in sales in the Washington area.

In December, the number of contracts signed to buy a home in the Washington metro was up 1.4 percent from a year ago, the first year-over-year increase in pending sales in five months, according to listing service Bright MLS.

The median price of a home that sold in the D.C.-area in December was $445,000, up 5.9 percent from a year earlier, and the highest December median price in a decade.