WASHINGTON — Tax Day is right around the corner, and this year it falls on Tuesday, April 17, not April 15. That gives taxpayers two extra days to either file or extend their 2017 tax returns. So let’s review what you need to file on or before April 17, as well as some last-minute tax tips to consider.

What’s due April 17?

- Individual federal tax returns (Form 1040, 1040A, or 1040EZ) for the year 2017, a request for an automatic extension. (Form 4868).

- Estate income tax or trust income tax returns (Form 1041), or a request for an automatic 5½-month extension of time to file. (Form 7004).

- Individual Maryland and District of Columbia tax returns for 2017 or a request for an extension. VA tax returns/extensions are due by May 1, 2018.

- Payment of any tax owed. If you file an extension, you still have to pay the estimated taxes you owe for 2017 by the regular deadline. You can submit payment for the estimated taxes you owe with the extension form, either online or by certified mail.

- Sole proprietorship and single-member LLC returns filed on Schedule C will be filed on taxpayer’s Form 1040 and follow the extension guidelines above.

- Special Note for Other Business Types: 2017 Partnership (Form 1065), Multiple-member LLC (Form 1065) and S-Corporation (Form 1120S) returns were due March 15, 2018, unless extended to September 17, 2018. Beginning with 2016’s tax returns, the filing date for these types of business entities was changed from April 15 to March 15 to give partners a chance to receive Schedule K-1 before their personal tax return due date.

It is important to understand that filing a 2017 extension does not extend the date when your total 2017 income taxes are due. They are still due in full by April 17, 2018. As long as extensions are properly filed on a timely basis, they will be automatically granted.

Filing late could be costly

If you file your federal tax return late and owe taxes, two penalties (plus interest) may apply. The first is a failure-to-file penalty for late filing, which is normally 5 percent of the unpaid taxes for each month that a tax return is late, not to exceed 25 percent of your unpaid taxes. The second penalty is a failure-to-pay penalty for paying late, which is between a half-percent and 1 percent per month of your unpaid taxes, up to a maximum of 25 percent.

Also, the IRS accrues interest based on the federal short-term rate plus 3 percent on any unpaid tax from the due date of the return until the date of payment in full.

Penalties and interest are steep and start accruing on the day after the tax filing due date. Regardless, if you cannot pay your taxes in full, you should still file your tax return with extension on time and pay as much as you can. The IRS can work with you to help you resolve your tax debt, including setting up an installment agreement.

Estimated quarterly tax payments may be required

In addition to filing your 2017 income tax return (or extension) by April 17, some people, especially those who are self-employed and/or earn income outside of their salary, may need to file estimated tax payments for 2018. Estimated federal tax payments are due quarterly on April 17, June 15 and Sept. 15, 2018, and Jan. 15, 2019, using the 1040-ES payment vouchers.

Now that we have reviewed what you need to file by April 17, let’s discuss a few last-minute tips to consider for your 2017 tax return. First and foremost is establishing and funding your retirement plan.

Choose wisely and maximize your retirement plan

As of the end of 2017, you would have already funded your 401(k) or 403(b) employer-sponsored retirement plans, so let’s review other retirement vehicles that may make sense to fund for tax year 2017 either by April 17, 2018, or later if you file an extension.

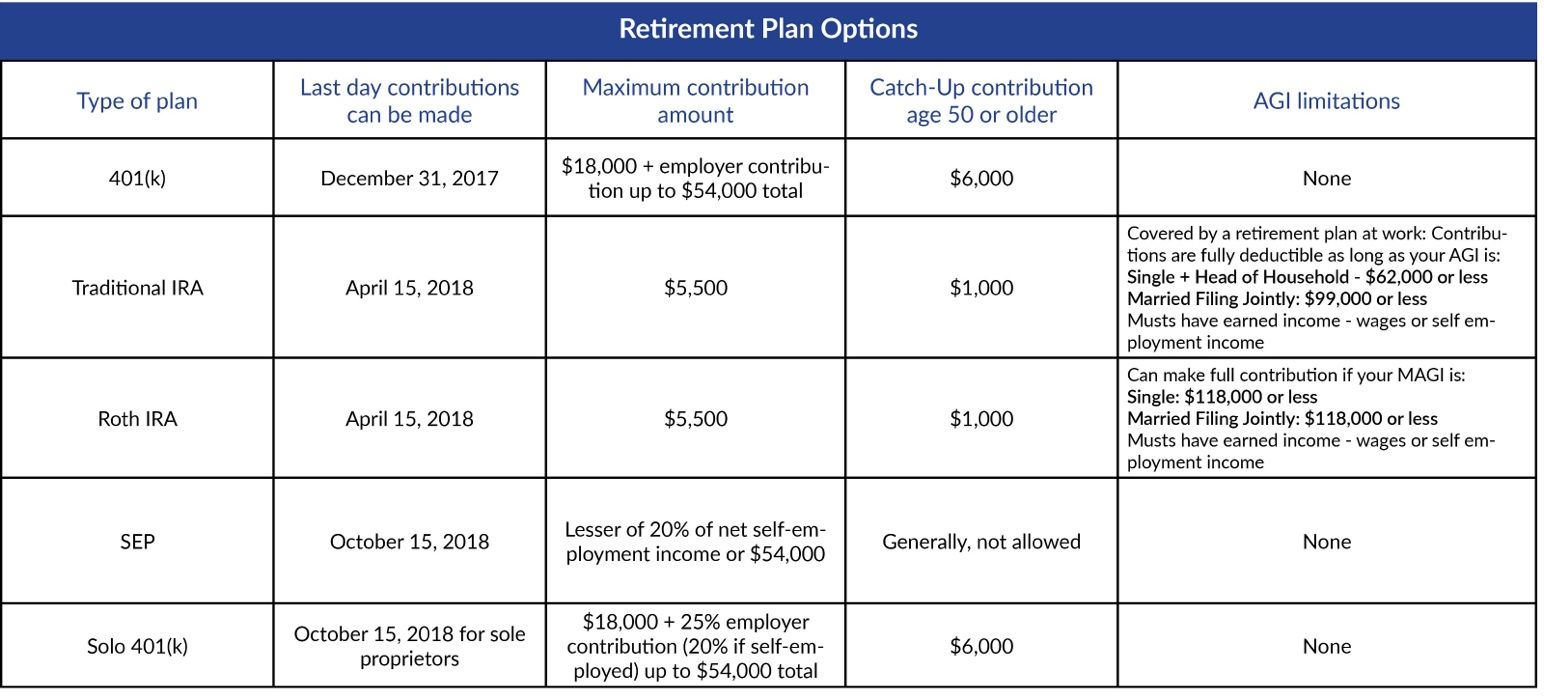

This chart serves as a helpful guide for other types of retirement plans based on adjusted gross income (AGI) limitations, maximum contribution and catch-up contributions, if you are 50 and older. Click it to expand it:

The deadline for making tax year 2017 IRA or Roth IRA contributions is April 17. If you choose to put money aside in a SEP IRA or Solo 401(k) for 2017, you can fund these as late as Oct. 15, 2018, if you have filed an extension.

SEP IRAs and Solo 401(k)s can be very attractive retirement plans for self-employed people. They allow a maximum tax-deductible contribution of $54,000 to $60,000 for tax year 2017, depending on your age and net income. Specifically, a sole proprietor is allowed to fund 20 percent of their net income (not to exceed $270,000), for a maximum retirement contribution of $54,000. A Solo 401(k) allows an additional $6,000 contribution if you are 50 or older.

Keep in mind that you would have had to establish your Solo 401(k) by Dec. 31, 2017, in order for your contributions to be eligible for 2017. A SEP IRA can be established up until your 2017 extension deadline in 2018. If you are a sole proprietor who had a successful year in 2017 and have not yet established a retirement plan, you may want to consider opening a SEP IRA to maximize your tax-deductible contribution before filing your 2017 tax return in 2018.

A quick word about traditional IRAs and Roth IRAs: The total amount an individual can contribute to either an IRA or Roth IRA (or split between them) is $5,500 below age 50 or $6,500 at age 50 or older. There are specific AGI limitations for both types of IRAs, and you must have earned income from a salary, self-employment income or alimony to be eligible to contribute. Passive income from investments does not qualify as earned income.

In addition, a nonworking spouse can make an IRA or Roth IRA contribution for the same 2017 limits, as long as the couple files a joint tax return and the working spouse has earned income that covers the sum of both the working and nonworking spouse’s IRA contributions, but does not exceed the maximum AGI limits. For married couples, the earned income requirement can be fulfilled entirely by one spouse.

Contributions to a traditional IRA are generally tax-deductible, with taxes being paid when withdrawn in retirement. Conversely, contributions to a Roth IRA are not tax-deductible, but qualifying withdrawals are 100 percent tax-free.

Lastly, no matter which retirement plan you choose to establish and fund, don’t wait until the very last minute to make your contribution.

Maximize your deductions

Based on the 2018 tax law changes, 2017 will be the final year to deduct miscellaneous itemized deductions in excess of 2 percent of your AGI on your Schedule A. Make sure to fully deduct expenses such as tax preparation and investment management fees, as well as unreimbursed employee business expenses, on your 2017 tax return.

Unreimbursed employee expenses can cover a wide variety of ordinary and necessary business expenses, such as professional and union dues, work-related education and training, a home office, subscriptions to professional journals, required uniforms not suitable for everyday use, travel, meals and entertainment relating to work. You should check the specific IRS requirements for these categories before deducting these expenses. These expenses will no longer be deductible as an itemized deduction for years 2018 thru 2025.

Ordinary and necessary business expenses paid as part of your self-employment business and reported on Schedule C are still deductible for 2018 and future years.

To the extent you have any carryforward capital losses from the prior year, make sure they are correctly reported on your Schedule D to offset capital gains from the current year.

If you acquired rental property during 2017, don’t forget to take depreciation and any other expenses that you may be entitled to. It is also worth noting that the $10,000 aggregate limitation rules for state and property taxes starting in 2018 do not apply to taxes paid with carrying on a trade or business such as rental property. Therefore, taxes paid for an individual’s bona fide rental property remain fully deductible, and not subject to the $10,000 limitation for the 2018 tax year and beyond.

Alternative minimum tax: 2017 vs. 2018

2017 may be the final year that many taxpayers will be subject to the dreaded Alternative Minimum Tax (AMT), at least through year 2025. The original intent of the AMT was to ensure that people pay a minimum amount of tax, regardless of the amount of deductions taken on their return. The AMT is a parallel tax system that required filers to calculate their tax bill twice — based on regular tax code rules and under AMT rules — and pay whichever tax is higher.

Inclusive of tax year 2017, many taxpayers have been subject to the AMT due to the addback of certain itemized deductions, such as state and property taxes, and miscellaneous itemized deductions.

Starting in 2018, the number of tax filers hit by the AMT may drop by more than 95 percent. According to the Tax Policy Center, only about 200,000 tax filers are expected to owe AMT for the 2018 tax year, versus the 5.25 million who likely would have under the old (2017) tax law.

The new 2018 tax law made three major changes to AMT calculations that dramatically cuts who will owe AMT going forward. These changes include eliminating the addbacks of miscellaneous itemized deductions and capping state and property taxes at $10,000; increasing the amount of income automatically exempt from AMT to $109,400 for joint filers and $70,300 for individual filers, and lastly, dramatically increasing the exemption phaseout level to $1 million for joint filers and $500,000 for individual filers.

Starting in 2018, most households making between $200,000 and $1 million will be able to take full advantage of the exemption levels and no longer be subject to the AMT.

One final word: Too often, many women who rely on their spouse or partner to prepare or manage the preparation and filing of their joint tax return do not take the time to review the return before signing it. If this sounds like you, we urge you to read: Never Sign a Tax Return You Haven’t Read, and then make sure to review your 2017 and future tax returns! You’ll be glad that you did.

Nina Mitchell is a principal and senior wealth adviser at The Colony Group, and co-founder of Her Wealth®.