WASHINGTON — Americans owe a combined $1.45 trillion in student debt. The 2016 college graduate has an average of $37,172 in debt, and only 41 percent of them know when they will have it paid off.

Most graduates believe they will never be able to pay it off. One-quarter of those with student loan debt are in default, and the sad part is that 70 percent of them would have qualified for an income-driven repayment plan. If they had evaluated their options, they could have avoided going into default and destroying their credit scores.

Several college debt repayment options are less onerous, and fit better into entry-level salaries and budgets, than the standard 10-year payback plan. Let’s put our education to work by evaluating the available repayment options and how to qualify for them.

1. Know how much college debt you have

The first step to paying back student debt is to figure out how much you borrowed and the balance including any interest. If you’re not sure what debt you have, go to the National Student Loan Data System. Once on the site, determine whether your loans are federal or private, the interest rate, and terms of each loan.

2. Use a repayment estimator

Next, go to studentloans.gov. They have a repayment estimator that will help determine what plans you qualify for and the amount of your monthly payment under each plan.

3. Know your repayment options

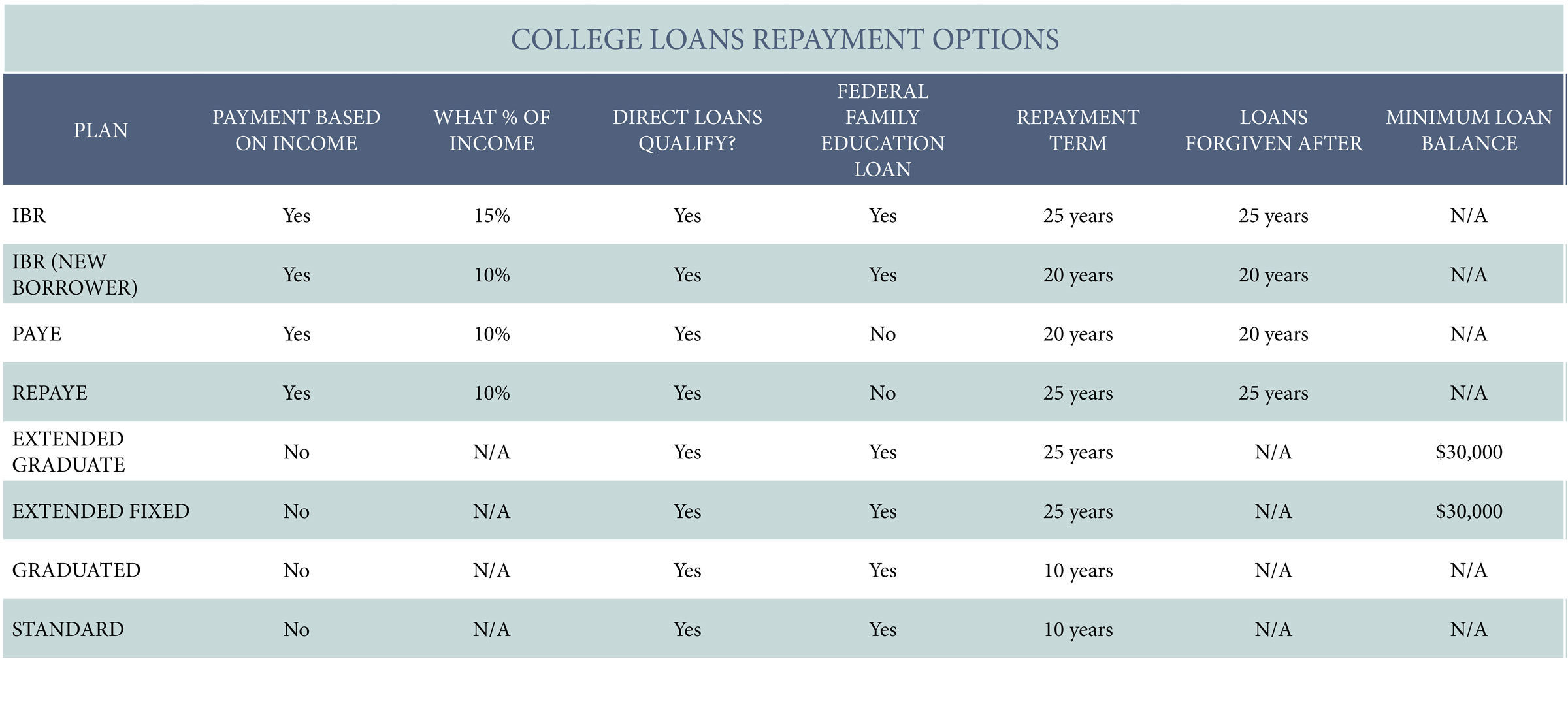

If you have federal loans, there are several repayment plans to choose from depending on your income and type of loan. These include income-driven repayment programs such as income-based repayment, pay-as-you-earn and revised-pay-as-you-earn. Other options include Public Service Loan Forgiveness, deferment and forbearance.

There are stringent qualifications to be accepted into any of these plans and important things to consider with each option. The chart below outlines the main qualifications for each repayment plan.

Note that no new loans are being made under the Federal Family Education Loan Program. All new loans are made under the Direct Loan program.

4. Choosing the right plan for you

There are benefits and drawbacks to each repayment plan option. Some of the benefits to the income-driven repayment plans include lower monthly payments and the fact that any balance of the loans at the end of the repayment term is forgiven.

It may be tempting to opt for one of these plans with the lower payments; however, you will end up paying more in interest — possibly thousands of dollars — over the life of the loan. You are also responsible for paying taxes on any loan amount that is forgiven.

Income-driven repayment plans are best for those who are having trouble paying for essentials such as rent and groceries. If you can afford the standard plan payment each month by adjusting your discretionary spending, it usually makes sense to stay on the standard plan. You will pay less in interest and won’t have the possibility of a hefty tax bill if the loan balance is forgiven. You will also pay off your loan in 10 years versus the 20 to 25 years with an income-driven repayment plan.

Also, remember that you are not stuck with the plan you choose, and can change from one plan to another at any time if you meet the qualifications for that repayment plan.

5. Private loan repayment plans

With private loans, you are limited to the repayment options allowed by the lender. Don’t be afraid to ask whether they have different options: Some may offer graduated or extended repayment plans. In a graduated repayment plan, your payments start out lower and increase over time. In an extended repayment plan, you have lower payments for the life of the loan, but the loan period is longer so you end up paying more in interest.

Read: Smart Saving Strategies for Millennials

6. Set up automatic payments

Once you’ve decided which plan is right for you and you’ve been approved, set up automatic payments. With any of these plans, if you miss even one payment, then you are no longer eligible for the loan forgiveness which could cost you tens of thousands of dollars.

7. Recertify every year

If you choose one of the income-driven repayment plans, you must recertify every year around the same time you entered the plan the previous year. Your monthly payments are based on your income and family information, which may change throughout the year, so you are required to resubmit every year, even when nothing has changed.

When it’s time to recertify, you can do that online at StudentLoans.gov. You’ll need to have your most recent tax return and family information handy. Even though loan servicers should remind you to do this, it’s best to set a reminder yourself to avoid any increase in payments should you forget.

8. Watch out for taxes on forgiven loans

It is rarely talked about, but if you do have student loan debt forgiven under any of the above plans (except for Public Service Loan Forgiveness and Student Loan Forgiveness for Teachers), then the amount that is forgiven is considered taxable income! Depending on what tax bracket you’re in when the loans are forgiven, you could be liable for thousands of dollars in taxes.

9. Marriage and monthly payments

If you’re planning to get married, find out how your new status will affect your loan repayment and eligibility. You may have qualified as a single individual, but getting married and filing taxes jointly can increase your income, and therefore your payments, or even make you ineligible for the programs because your combined income is too high. Check with your accountant or financial adviser to see how this may impact you and your future spouse.

Choosing the best repayment plan can help you save money (not to mention your credit rating) in the long run. By choosing a plan with a monthly repayment amount that you can live with, you won’t have to sacrifice other goals such as saving for a house, putting aside some money for retirement, or taking a well-deserved vacation.

Megan Tutt, CFP, is a wealth adviser at Bridgewater Wealth, in Bethesda, Maryland, and a founding member of Her Wealth®.