WASHINGTON — It may come as a surprise that a recent Women and Money survey by Fidelity found that women are, in fact, better investors than men.

After reviewing more than 8 million client accounts, Fidelity found that women investors earned 0.4 percent more than men, and they are saving more than men too. Over time, when these small percentages are applied to increased savings and investing, it can add up to significantly more money.

While this is great news, Fidelity also found that women tend to take less risk. Given the results of the study, you would think that’s a good thing, right? But the answer is: that depends.

The better question is: Are women taking appropriate risk given their goals for their money, their need for income in retirement and their stomach for risk?

If I asked you to tell me how you weigh risk when investing your money, most people can’t answer that question or they have misconceptions about what those risks are. When it comes to understanding investment risk, many women (and men) simply don’t have a good grasp of what it is, or they associate risk with something to be avoided.

We get into trouble when we don’t really understand what those risks are or make assumptions about the amount of risk we are taking, which can lead us to inadvertently take on too much or too little risk.

Given that the notion of risk means different things to different people and risk plays an essential role in managing and growing investment portfolios over the long term, let’s look at a few common misconceptions about risk and see if we can debunk them with some facts.

If you are more of a hands-off investor and prefer to use Target Date or Index funds, be careful of these common misconceptions:

Misconception 1: All target date funds with the same retirement date have the same amount of risk

Target date funds (TDF) are popular especially in employer-based retirement plans because they offer an easy way to invest in a diversified portfolio of stocks, bonds and other investments that automatically rebalance to a more conservative portfolio the closer that they get to their target retirement date.

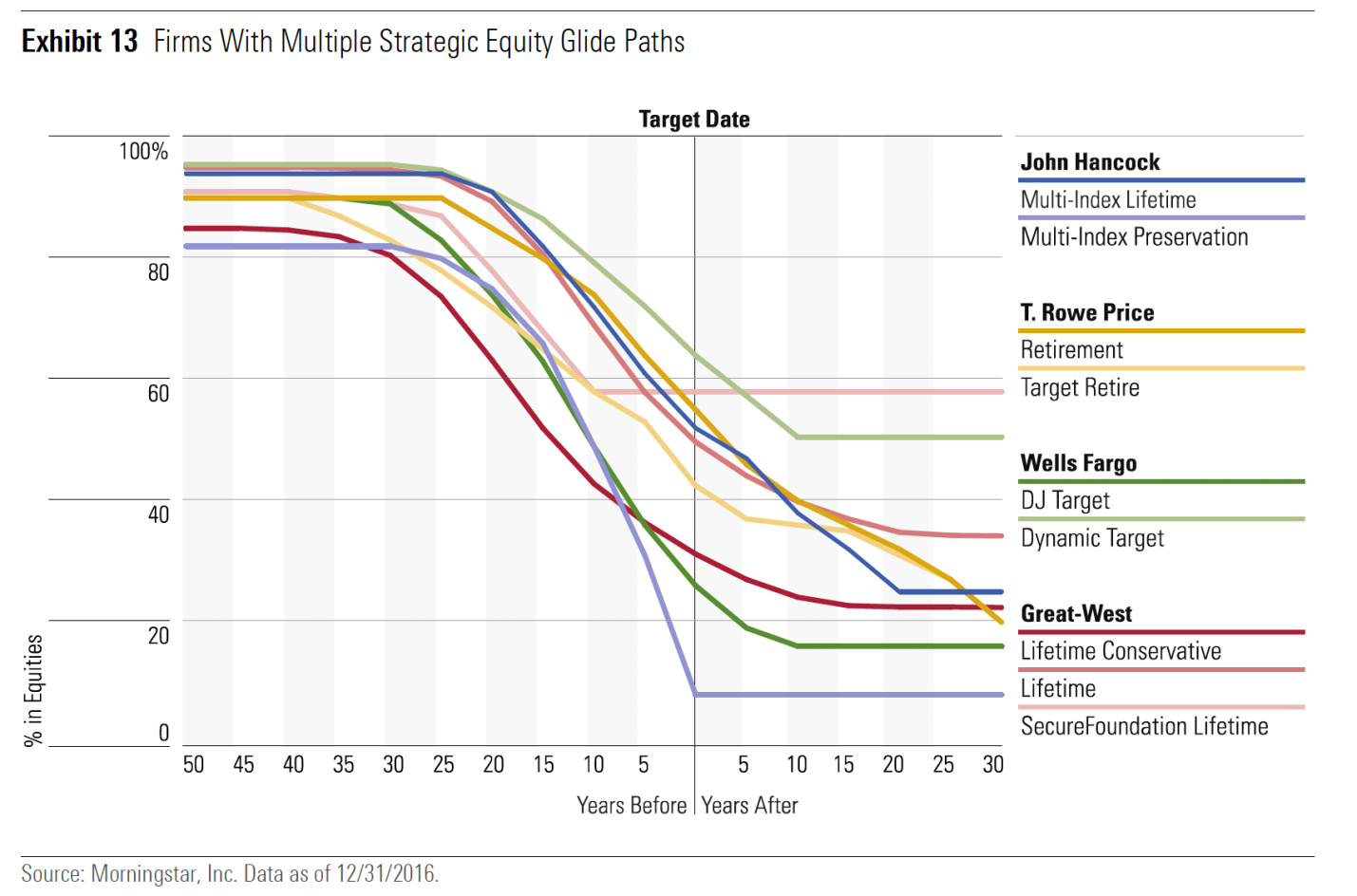

Sounds great, right? The problem is that not all target date funds with the same retirement dates transition to more conservative investments in the same way or at the same time. This transition, known as the “glide path” can vary greatly from fund to fund with the same retirement target date.

To better illustrate this point, Morningstar compared several of the glide paths for target date funds. The difference in the percent of equities in each fund varied from 10 percent to almost 65 percent at the retirement date. Some reached their target equity allocation at their target date, while others did not reach their final equity allocation until years later.

While target date funds can be a good choice for those who don’t want to have to make investment decisions, it’s important to pick your retirement date carefully. Rather than going with a target date fund based on your projected retirement date, look closely at each funds’ glide path and choose one with a date that best matches your tolerance for risk, volatility and retirement goals.

If you have other sources of income, like a pension and can tolerate more risk, you may want to consider choosing a fund with a date beyond your retirement date. Or, you may discover that the date closest to your retirement date has too much exposure to equities for your liking. In that case, you may want to choose a fund with a closer retirement date. In the end, it’s not your retirement date that’s the determining factor, but all of the dimensions of your wealth that affect your financial decision-making.

Misconception 2: If you’re investing in Index funds, you can set-it-and-forget-it

Taking a long-term approach and investing in a well-diversified portfolio is the strategy we recommend and employ in our clients’ portfolios. A well-diversified portfolio creates a more consistent pattern of performance with lower volatility and helps defend against the equity market meltdowns of 2008 or 2000-2002 that we have witnessed this century.

But, there are several reasons that you should sit down and take a close look at your investment game plan at least once a year.

Those reasons include changes in your life such as getting married or divorced, losing a spouse, having a child, losing a job or receiving a windfall of cash from the sale of a company or an inheritance. All affect how you choose to invest your money and must be considered along with your goals and tolerance for risk.

For instance, if you’re in your 30s and inherit an IRA from your 85-year-old grandmother, her allocation will likely be too conservative because her goal was to preserve her money and your goal will probably be more growth-focused. If you have a longer time horizon, you may want to increase the allocation to equities and the potential for greater returns.

Another phenomenon that happens in a portfolio is that investments that have done well over time will start to grow more rapidly than others causing them to make up more of your portfolio than you originally intended. Say that you allocated 60 percent of your investments to U.S. stocks, and because the market has done very well, it now makes up 80 percent of your allocation. Many investors have been lulled into complacency by low volatility and years of gains.

Those investing through cap-weighted index funds hold more risk then they realize because the five FAAMG stocks (Facebook, Amazon, Apple, Microsoft and Google/Alphabet) have a combined weighting of 13 percent in the S&P 500 and account for approximately 40 percent of the market’s return this year.

Indexing to market-weighted benchmarks is a momentum-driven strategy that does exceptionally well as long as the winners keep winning. Over time, leading stocks get more expensive and take up an increasingly larger share of the index. Passive investors wind up with portfolios that are more concentrated and riskier than they realize. Asset classes go through cycles and the United States’ bull market, which has been growing for more than eight years, will not last forever.

For the hands-off investor, it’s important to take a look at your total asset allocation and rebalance your portfolio closer to your target allocations by selling investments that have done well and buying investments that have lagged behind. This includes trimming some of your U.S. equity allocation and adding other types of equities like international, emerging markets and long/short strategies along with some more defensive positions.

Rebalancing is really just a sell high/buy low strategy that locks in some of your gains and safeguards your portfolio from becoming overly dependent on the success of one asset class. All markets go through cycles, and no one knows when a correction will happen.

Although we don’t recommend that you look at your investments every day, it is a good idea to review them periodically so that your money is working for you as you intend it to.

In my next article, I’ll look at the investment risks of the conservative investor and what affect those risks and our behavior have on their overall return.

Nina Mitchell is a Senior Wealth Advisor at Bridgewater Wealth and Co-Founder of Her Wealth.