WASHINGTON — Your children probably do chores to earn their allowance and now, there is a new app for that.

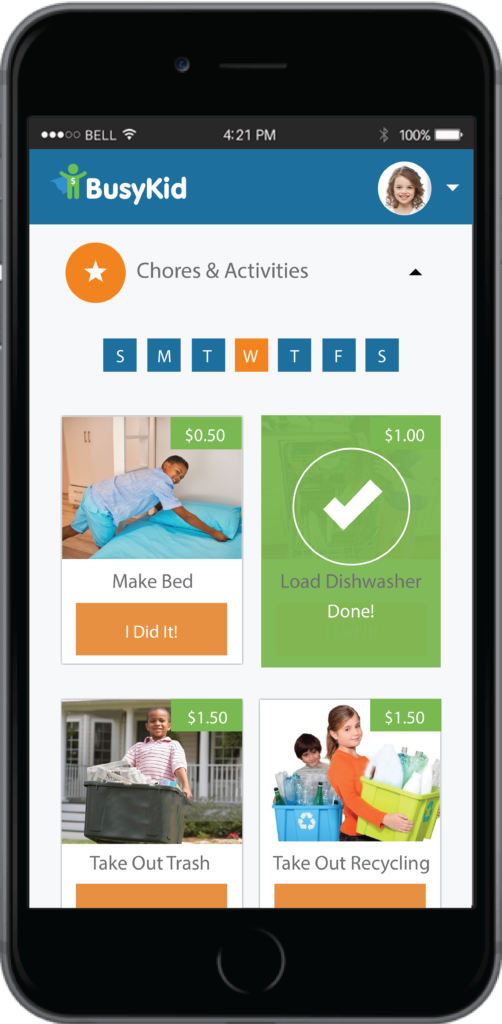

Launched some five months ago, BusyKid is like your child’s first job that has direct deposit. It is an app where parents can assign chores and children can check them off when done.

“Parents give their kids chores. They do the chores. And then, our system sends the parent a text message on a Thursday and says ‘Hey, tomorrow is Friday. It’s payday. Do you want to pay Johnny his $14 that he earned?’” founder Gregg Murset told WTOP.

“If the parent replies ‘yes,’ then we move the money directly from a linked bank account of the parent and it automatically allocates that money into three different buckets: save, share and spend,” he said.

Parents can set up their own list of chores for their children or use preset, age-appropriate chores that BusyKid lists.

BusyKid, which costs $12 a year for an unlimited number of family members but comes with a 30-day free trial, makes one of the “save” options the ability for the child to buy stocks through a custodial brokerage account.

BusyKid partnered with a company called Stockpile, which allows the children to buy into stocks on a fractional-share basis, meaning they don’t have to buy entire shares of any company to start investing.

“If a kid wants to invest $25 and invest it in Netflix, they can do that on this platform. It can teach kids at an early age about stock investing and equities and how all that stuff works,” Murset said.

At an early age, BusyKid starts enforcing two things Murset thinks are important. “One is get your work ethic on. Get off the couch and quit messing around with Instagram and earn some money. And then we made it really easy to invest that money in real stock,” he said.

Tools that introduce children to what real money is may be important at an early age because they are growing up in an age where they don’t see money. The day of the piggy bank is gone. Children are growing up in a world where money is invisible. It’s on a card or a tap of a phone, but they never see it.

“It’s super important to start teaching them in that context, so they can start making good decisions for the rest of their life,” Murset said.

Here’s a video demonstrating how BusyKid works: